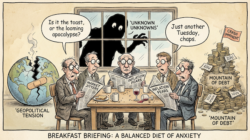

Wall Street’s bull run is roaring ahead. The S&P 500 and Nasdaq are skating at or above all-time highs, and even Treasury yields spiked after the Fed decided on Wednesday to cut rates for the first time since Trump took office for the second time.

Wall Street’s bull run is roaring ahead. The S&P 500 and Nasdaq are skating at or above all-time highs, and even Treasury yields spiked after the Fed decided on Wednesday to cut rates for the first time since Trump took office for the second time.

And the market loved it!

The era of low rates is back, pump that stock market baby, flood us with cheap, cheap money.

And with the Fed likely to do it again soon, if you thought these all-time highs in the market were good, wait till the next round…

You know what, it feels a lot like 2021 all over again.

Except this time, we’re not swimming in authoritarian government control…hmmm.

Anyway, it is different in that we haven’t been locked inside for two years, and we didn’t have an AI fuelled market boom back then.

Also, there’s a different playing field this time around which wasn’t present before. All leading to what very well could be a “melt-up” in equities the likes I’m not sure most investors are ready for.

And there’s a little twist to this marketing pumping story too, this time around (a-la 2021) special purpose acquisition companies (SPACs) are surfacing as a barometer of tech-driven capital flows…

Yes, the easy-path-to-market, blank-check offerings which were once the poster child of 2021 mania are back in a big way, but again, a little different to before.

Compared to 2021, the surge of 2025 SPACs are more nuanced and driven by regulatory reform far greater scrutiny than before.

Actually to throw one more little twist in with this story, the infamous CEO of Nikola motors (Trevor Milton) arguably the poster company of 2021 SPAC mania, who was then also convicted of securities and wire fraud after Nikola was proven to be a fraud in 2022 was pardoned by the Trump administration in April and just this week the SEC has moved to dismiss the case against him.

Anyway, back to the main thing you should be thinking about… if this is SPAC season 2.0 is it a playground you want to play on, or should you steer well clear in anticipation it will all come crumbling down like it did in 2022?

Four new SPACs getting deals done

New SEC rules (adopted in 2023 because of the shambles of 2022) require tougher disclosures on sponsor fees and conflicts, and institutional investors are returning with higher standards.

In other words, today’s SPACs are being underwritten, scrutinised and PIPE-backed like traditional IPOs, making them more reputable. But they’re still retaining that speed and ease to market.

That alone says something about the process to IPO and publicly list, but we’ll keep that discussion for another day about tokenisation of capital markets…

The thing is with global interest rates coming down and equity benchmarks rallying, and the momentum of investor sentiment plus market just willing things higher, SPAC season 2.0 is a great place to hunt for and find some great profit opportunities.

In short, SPAC season is no longer a mindless bubble but a regulated vehicle for big bets particularly on AI, crypto, quantum and robotics.

Take a look at some of the newer SPAC deals and launches in recent weeks,

- FutureCrest Acquisition Corp (FCRSU) – This is a brand-new SPAC by Fundstrat’s Tom Lee and investor Eric Semler. They say they’ll be looking at opportunities in line with the management’s experience, and also, “AI, fintech and digital innovation” deals. In all honesty if this doesn’t end up as a crypto token treasury company or some kind of crypto exchange, I’ll be shocked.

- Boost Run LLC (NASDAQ: BRUN) – This one (also new as of this week) is a GPU-cloud AI infrastructure startup has done a deal and will go public via merger with Willow Lane Acquisition Corp. The combined company will be valued at about $614 million, with $112M in Willow Lane’s trust funding its expansion. Boost Run offers on-demand Nvidia-powered servers to accelerate AI development. Lots of buzz words there, but also, AI infrastructure. There’s a big market with room for a company like this to thrive.

- Ares Acquisition Corp II (AACT) – This SPAC has announced a deal with Kodiak Robotics to list the autonomous vehicle company on the market at some point this year. Trucks, cars… tanks, Kodiak is looking to roll out their SensorPods into all kinds of vehicle solutions. Backers include big names like Soros Fund Management and ARK Invest. Autonomous vehicles and robotics are clearly in focus here – as Ares CEO notes, deploying self-driving tech at scale could slash costs amid today’s driver shortages.

- Churchill Capital Corp X (CCCX) – This SPAC is set to do a deal with Infleqtion quantum computing. This quantum computing hardware startup is now looking at a post-SPAC valuation of $1.8 billion and is expected to inject $540+ million of cash (including from institutional PIPE investors). Infleqtion builds superconducting quantum chips and sensors – technologies that CEO Matthew Kinsella says will drive breakthroughs in AI, defence and space. It plans to trade on Nasdaq under INFQ. Notably, pretty much every other listed quantum stock (IonQ, Rigetti, D-Wave) also went public via SPACs in 2021.

These blank-check deals highlight sectors where investors truly believe major shifts are occurring, AI infrastructure, blockchain/crypto, quantum computation, robotics and new-tech defence.

Importantly, this SPAC season 2.0 comes with a more structured and scrutinised market.

So, is this another irrational market blow-off top, or a sustainable leg higher into 2026?

I’d say it’s more the latter… with a minor caveat.

The Fed is easing, liquidity is abundant and looking for a home, and the global economy has so far stood up and said it’s ready.

That suggests stocks (and SPACs) can keep powering upward. Still, sharp rallies do breed volatility.

When everyone piles in, it’s wise to lock in some gains.

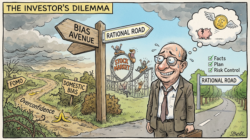

In practice, that means lean in on tomorrow’s winners, and ride something like SPAC season 2.0 hard, but don’t go in blind to the risks.

In this fevered market, continue building positions in AI, crypto/Bitcoin, quantum hardware and robotics, where many of these SPACs are playing.

But take smart profits as you run it up.

With equity benchmarks at new highs and interest rates sliding, the market feels optimistic. I don’t think we’re at full hype-train and FOMO yet, which is a good thing. But that will come and so will corrections.

So, enjoy it, invest in it, and be sure to take those profits from it to minimise downside risks when you can.

Until next time,

Sam Volkering

Contributing Editor, Investor’s Daily

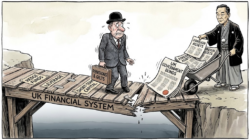

P.S. Most people missed the dot-com boom. They missed crypto. And now they’re too distracted by recession headlines to see what’s coming next. Don’t miss the “Wealth Window” opening in Britain right now. Here’s what they’re overlooking.