I wouldn’t say the Bank of England has the investing chops when it comes to market warnings.

I wouldn’t say the Bank of England has the investing chops when it comes to market warnings.

But at its October Financial Policy Committee (FPC) meeting, the rhetoric from the BoE was quite straightforward about the markets…

AI stocks look to be in a bubble.

The FPC specifically said,

On a number of measures, equity market valuations appear stretched, particularly for technology companies focused on Artificial Intelligence (AI).

They went on to say,

Equity valuations appeared stretched, particularly in backward-looking metrics in the US. For example, the earnings yield implied by the Cyclically-Adjusted Price-to-Earnings (CAPE) ratio was close to the lowest level in 25 years – comparable to the peak of the dot com bubble.

Yes, that’s them calling a bubble.

The headlines soon followed…

The Guardian piled on, pointing to OpenAI’s valuation exploding from $157 billion to $500 billion in a year, Anthropic’s tripling to $170 billion, and 95% of companies getting no financial return from generative-AI projects.

I can only imagine how many times “Pets.com” was mentioned in the editorial offices.

But this isn’t 1999.

It’s something bigger, and a lot more real.

Mega-deals reshaping the foundations of the future

Let’s start with the sheer scale of what’s happening. Then you can decide if you think we’re in a bubble.

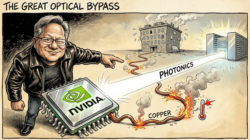

In September, Nvidia and OpenAI signed a letter of intent to deploy 10 gigawatts of Nvidia systems (millions of GPUs) across next-gen AI “factories.”

Nvidia will invest up to $100 billion in OpenAI as each gigawatt goes live, the first arriving in late 2026.

Two weeks later, OpenAI inked a deal with AMD for six gigawatts of Instinct GPUs, plus warrants for up to 160 million AMD shares, tied to rollout milestones.

That’s another 10 GW of compute capacity locked in, the power output of five nuclear plants.

Then there’s the Stargate programme.

That includes OpenAI, Oracle and SoftBank building five new U.S. data centres worth $400 billion, scaling to $500 billion by end-2025. Oracle alone is shouldering more than $300 billion in buildouts.

Meta’s capital spending for 2025? Up to $72 billion, rising sharply again in 2026.

Elon Musk’s xAI is spending $18 billion more on 300,000 Nvidia chips for its Colossus 2 centre.

These aren’t fancy pitch decks and an investor’s roadshow. These are infrastructure projects on a scale we haven’t seen since the early days of the electrical grid.

Now, critics say much of this looks like financial round-tripping.

Nvidia invests in OpenAI… OpenAI buys Nvidia chips… Oracle spends on Nvidia chips, and Oracle deals with OpenAI.

It’s a fair point.

Deals this self-referential do have a whiff of 1999.

But Jensen Huang isn’t Enron (as far as we know). He argues the capital isn’t circular it’s forward-funding a global AI grid that will soon stand on its own feet.

Sam Altman agrees. And while he says parts of this are bubble-like, what we’re seeing isn’t speculation, it’s construction of a very important future.

The truth sits somewhere in between.

Yes, parts of the market are overheated. I can reel off a number of stocks involved in nuclear to quantum computing to rare-earth miners that look way overvalued.

But unlike the dot-com bubble, there are billions being spent on digging foundations you can see, touch and plug into, real infrastructure, tangible plant and equipment, and critical services.

In the late 1800s, railroads looked like a bubble too. Investors overbuilt, speculators piled in, and plenty of fortunes vanished. But the rails stayed, and they built the modern economy.

The dot-com bubble also may have seen plenty of boom and bust, but the underlying technology of the internet, the infrastructure of it remained, and delivered some of the most life-changing games in investment history.

Today’s AI expansion has that same smell of over-exuberance mixed with inevitability.

And while investors do like to chase shiny AI app names, or pumped-up meme-stock darlings, the real money for the next 20, 30, 40 years is going to the builders.

A company like Vertiv’s (NYSE:VRT) cooling systems are now (very literally) the plumbing of the AI era. Its stock might be up 4x since the start of 2024, but they’re delivering important, critical services and infrastructure to AI datacentres.

Micron, another that’s on an absolute tear is up 133% year to date. But this isn’t a stock with a fancy website and great corporate speak. Dare I say their website stinks? But they’re delivering arguably the most important technology via high-bandwidth memory to AI datacentres to enable a high-tech AI everywhere future. Again, they’re infrastructure, tangible goods and services, not vapourware.

These are but two examples of companies that are flying but are also fundamentally infrastructure companies. You could almost even call them utilities.

Bubble or backbone?

There’s still plenty of ridiculous valuations out there too.

Any company slapping “AI” on a press release can see its stock double in a day. We saw the same with “dotcom” in 1999 and “blockchain” in 2017.

But the best investors learn to separate the infrastructure from the interfaces.

Infrastructure, chips, power, cooling, fibre, will underpin the economy for decades. Hype-driven applications will fade as quickly as they appear or be superseded by AI built competitors that are leaner, smarter, faster and efficient.

So, when the Bank of England warns of an AI bubble, they’re right to worry about valuation shocks, and they’d be blind if they didn’t see it.

But they’re missing the deeper point. What’s being built now won’t vanish in a crash. If anything, a pullback might clear the rubble for another decade of growth.

I suggest that in markets like this, you should be riding the momentum, but also taking profits, and recycle gains into the builders of AI infrastructure.

When a stock doubles, sell half. Lock in the win. Let the rest run. That discipline turned D-Wave’s quantum computing ambitions into an 889 % gain in eight weeks in our True Alpha UK options service.

These are the kinds of wins that are happening in the market right now.

So, you can love or hate the AI boom, you can listen to the BoE and tremble on the sidelines just waiting for the crash (that may not come for a long time yet).

But you can’t deny the impact that underlying AI infrastructure is having. It’s shaping power markets, reshaping chip supply chains, and forcing governments to think in gigawatts, not gigabytes.

We may see a correction. Some paper unicorns will vanish. But what remains will be tangible steel, silicon, and servers humming with intelligence. The only thing is these critical AI companies may still double or triple before they have a 20% or 30% pullback.

Again, not the kind of position you want to be missing out on waiting for fear to kick in that never arrives.

Until next time,

Sam Volkering

Contributing Editor, Investor’s Daily

P.S. The Bank of England may be right about the AI bubble—but wrong about what it means for investors. A market shakeout could be the very thing that clears space for the next phase of growth. That’s exactly the kind of shift we call a Wealth Window—when most people are looking the wrong way, and a quieter opportunity begins to open. It’s already happening in the UK. You just have to know where to look.