Now we know how all the “crypto bros” felt.

Now we know how all the “crypto bros” felt.

Being a crypto sceptic — arguably, a crypto ignoramus — your editor enjoyed no financial benefit from the great crypto boom.

We didn’t invest when it was $10. Nor when it was $100 although we did tell readers to consider doing so.

We didn’t buy at $1,000, $10,000, or even $100,000.

The best we can say is that, at some point in the past five years, we threw a few thousand dollars at it — more out of curiosity than conviction — and it’s worth about the same today.

It’s such a small amount that if it went to zero tomorrow, we’d shrug. There’s no emotional attachment because there was never any belief behind it.

We clearly did something wrong. But if we’re honest, we don’t really care.

Our heart was never in crypto and that’s the difference. You can’t profit from an asset you don’t believe in. Those who made fortunes in crypto didn’t just buy coins; they bought a story, a revolution, an identity.

That’s the thing about every speculative mania, from tulips to tech stocks. The early believers always think they’re buying freedom; only later do they realise they were buying liquidity.

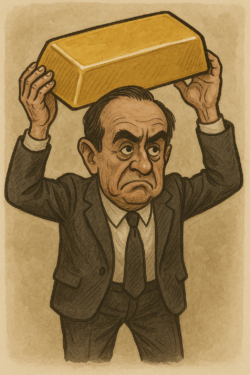

Gold, on the other hand, is a completely different story.

We didn’t buy at the so-called “Brown Bottom” lows… but we built our position mostly between US$900 and US$1,500 — and we’ve topped up along the way.

Today, it trades around US$4,337 and looks set to go higher. Granted, it’s not a “10,000% moonshot” like the crypto headlines promised, but we’ll take a fourfold increase in something real, enduring, and universally recognised.

Gold isn’t about adrenaline; it’s about assurance.

It doesn’t promise you’ll get rich quick, it promises you won’t go poor slowly.

That’s why, to us, gold feels less like an investment and more like an anchor.

You can hold it, test its weight, and know that — no matter what the screens say — it’s worth something everywhere, to everyone, in every language.

That can’t be said for Bitcoin, NFTs, or whatever new token is trending this week. Those assets rely on electricity, networks, and belief. Gold requires none of that. It existed before banks and will exist long after them.

The only reason — as far as we’re concerned — why gold would fall meaningfully is if every government suddenly decided to give up its centuries-long obsession with debt, deficit spending, and war.

Do you see that happening?

Neither do we.

That’s why gold remains a cornerstone of wealth preservation, no matter what era you live in.

Of course, that’s not to say gold can’t get ahead of itself. Like any asset, it moves in cycles. That’s why we encourage investors to build positions gradually — to buy little and often.

If you can, buy physical gold. Nothing beats holding it in your hand. But it’s perfectly fine to use exchange-traded funds (ETFs) for simplicity and liquidity. With brokerage costs now so low, there’s no reason not to add small amounts regularly.

Because while the world chases whatever digital dream is flashing across their screens, we’d rather keep stacking something that doesn’t need a password and has been trusted for 5,000 years.

It may not make us “crypto rich.” But when the next bubble bursts, and there’s always another one, we’ll still be standing on solid ground.

Cheers,

Kris Sayce

Editor & Publisher, Investor’s Daily

P.S. We missed the crypto rocket and we’re fine with that. Because we’d rather anchor our portfolio in something real than gamble on belief. In The Wealth Window, James Altucher isn’t chasing hype. He’s identifying real assets, real cash flows, and real conviction, especially in the places everyone else has forgotten to look. If you’re a UK investor who wants something stronger than storylines and speculation…start here. Get the details.

What you may have missed…

Golden Patterns

There’s a corruption cycle too…roughly corresponding to the shift away from the ‘rule of law’ to the ‘rule of men.’ This appears to be a part of the life cycle of democracy. Read more here…

Only a recession can save Starmer now

Prepare for the “bad news is good news” paradigm. Investors hoping for another high from the stock market need a recession to give them a shot in the arm. Read more here…

Bigger than chips. Bigger than AI energy. This is the next AI gold rush

When people talk about the “arms race” in AI, they usually mean GPUs, the “AI superchips” powering the revolution. And here at Investor’s Daily over the years I’ve also written to you about the importance of compute memory. Read more here…

The man behind the Boriswave

Bad ideas cost money…at best. Sometimes they kill millions of people. And not always deliberately. What’s astonishing is that such ideas don’t go away when they fail. We seem to be stuck with them. Read more here…

The LSE’s tariff dodger boom begins

Trump’s tariffs are back in the news with a bang. On Friday, they triggered a market meltdown. By Monday, it was all just a storm in a teacup after all… Read more here…