“Ponzi”

“Snake oil”

“Dotcom on steroids”

In 2017, a lot of words were thrown at the crypto market, at us. It was during a market boom with “initial coin offerings” or ICOs at the heart of the investor hype cycle, playing out and winding people up.

A lot of money was made, and in the inevitability of the crash, a lot of money was left on the table.

The “ICO boom” of 2017 was a phenomenon global markets had never really seen before. But it was also detrimental to the crypto markets because all this took place in an unregulated, unsupervised, unprofessional way that left a lot of people, a lot of investors exposed, not really giving proper consideration to the risks involved.

And after the 2017 ICO boom, many sceptics proclaimed that crypto, and the ICO, was dead.

Well, crypto clearly wasn’t, but for several years, thanks to ‘enforce first, ask questions later’ regulators, the ICO was dead. It was a shunned form of capital raising in crypto markets.

But that’s now all changing.

And that change is the clearest indicator yet that the biggest piece of market legislation is about to land and unlock a flood of capital, innovation and certainty the digital assets market has been craving for the better part of a decade.

The ICO Returns, But This Time It’s… Civilised

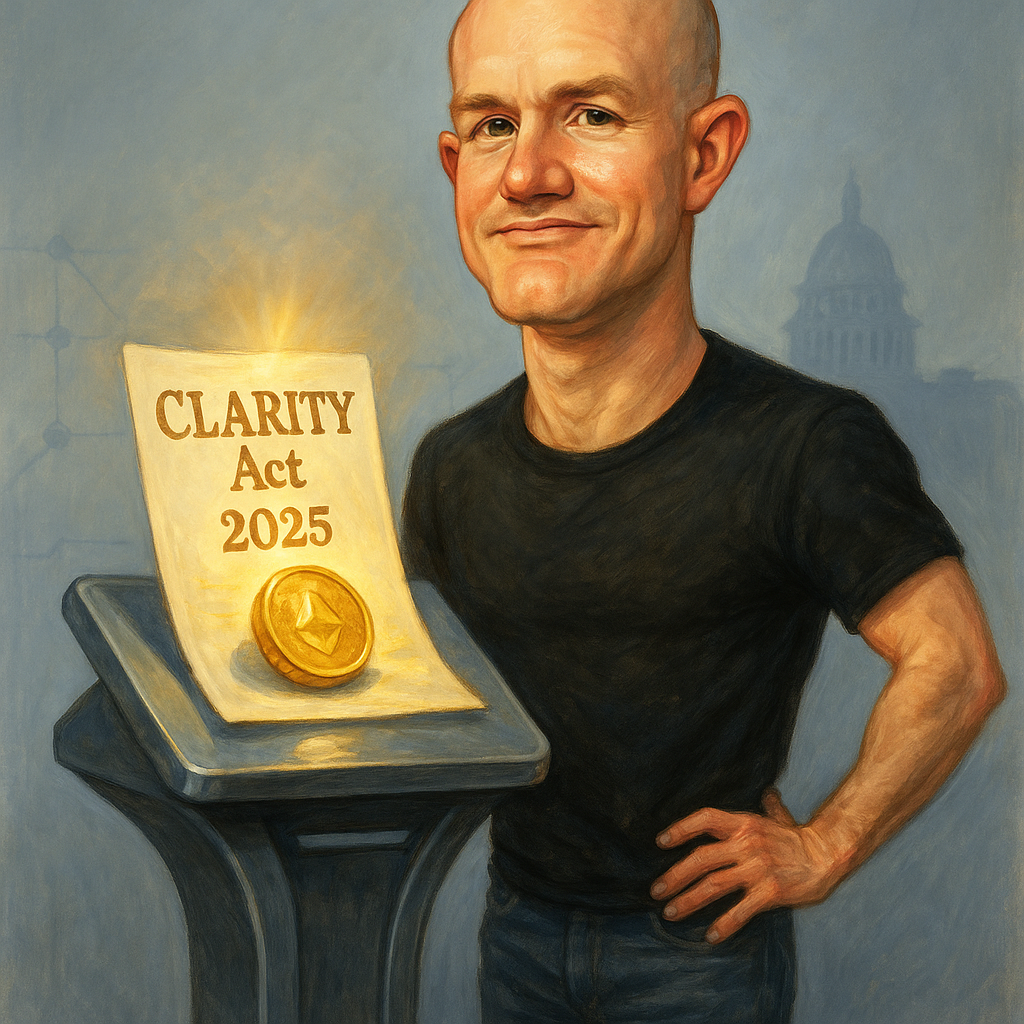

Coinbase, the most regulated, most politically connected, most globally accepted crypto company in the world, has just rolled out something nobody thought we’d ever see.

A full-blown ICO platform.

Yes, the ICO is back. But this time it’s got a direct line to the White House.

And here’s the part that I think everyone has missed…

Coinbase would never launch this unless they knew for certain something about Washington that the public doesn’t.

For me, this move only happens now because Coinbase knows the Digital Asset Market Clarity Act of 2025 (the long-awaited CLARITY Act) isn’t just likely to pass… it’s imminent.

And once it lands, the tokenisation floodgates will open.

Off the back of the wild action in 2017, U.S. regulators at the SEC, particularly under Chair Gary Gensler forced the 1946 Howey Test onto the bulk of the market. The SEC and CFTC fought turf wars over who had controlling rights. And by the end of 2018, the U.S. retail investor was effectively banned from ICOs.

You’d see a token sale launch, and in the terms and conditions was the banning of anyone from America.

Fast-forward to this week.

Coinbase announced a new, curated token-sale platform with:

- Monthly public offerings

- Circle’s USD Coin (USDC) is the settlement stablecoin

- Transparent tokenomics and insider-ownership disclosures

- Six-month lockups for insiders

- An algorithm that prioritises smaller buyers over whales

- No bot sniping, no gas wars, no chaos

- No fees

- More advanced allocation tools on the way

This is not a revival of 2017. This is a regulated platform, a key piece of market structure, for token launches.

They are building infrastructure… for a world where the CLARITY Act is law.

Think through this logically.

If you’re Coinbase and you believe the CLARITY Act is not passing imminently… you absolutely do not launch an ICO platform in the United States open to U.S. investors.

Yet Coinbase did exactly that.

The exchange is effectively front running the regulatory shift. You can’t tell me someone hasn’t given them the inside line on CLARITY passing…

And I don’t see this as Coinbase guessing or hoping. Coinbase is preparing, acting with certainty. And that tells me CLARITY is coming.

Why This Is the Catalyst for the Next Big Cycle

If CLARITY lands (and I believe Coinbase’s timing tells us it will), then three things ignite at once.

1. U.S. retail finally gets access to new token launches again.

For years, Americans have been sidelined while Asia carried the speculative torch. That ends the moment the first Coinbase token sale goes live. Suddenly, U.S money is back in the game.

2. Vetted token offerings become a mainstream asset class.

No scammy Discord channel chaos or weird Telegram chat groups. Not shady offshore deals. Just regulated, transparent, broadly distributed digital assets to investors, where appropriate protections and measures are put in place.

3. Tokenisation moves from theory to practice.

If Coinbase can run compliant public sales, then:

- Tokenised treasuries

- Tokenised equities

- Tokenised funds

- Tokenised commodities

- Tokenised real-world assets

…all start flowing through properly regulated U.S. hubs… through Coinbase.

And remember… tokenisation needs regulatory clarity to scale. It cannot go mainstream until the securities vs commodities debate is settled.

CLARITY settles it.

This is why the Coinbase announcement matters more than just the first token sale they’re launching. This infrastructure they’re putting in place is the first real piece of major market infrastructure for a world of “tokenised everything” and a big step towards capital markets moving onchain.

Of course, no law is guaranteed. The Senate may tinker with the language. The SEC may drag its heels. The politics could get messy, as politics tends to do.

And even regulated token sales are still speculative. Projects can fail. Valuations can unravel. Liquidity is never guaranteed. Prices could plummet, leaving retail investors holding worthless bags.

But that’s not really the point.

The point is that the U.S. is positioning crypto as a major strategic domestic growth industry. And Coinbase is showing us right now that the era of operating in regulatory fog is coming to an end.

Sling words and comments at crypto, at the White House, at all of us, as you will if you still are sceptical.

But there’s a massive fundamental shift in how global capital markets are being restructured. How global money flow is being rerouted. How the world transacts and interacts with wealth.

Money and investments, as we have known them, are moving onchain. And it is the U.S. that’s leading the way here. I don’t care if crypto “bought the White House” because the certainty and structures that are getting put into place now is far greater than anything that’s been put in place up until now.

That means we are moving onchain.

For investors, it’s the infrastructure layers of crypto that will underpin all of this change. And that infrastructure crypto, I believe, are the ones where the biggest long-term opportunities to make generational wealth exist, right now.

Until next time,

Sam Volkering

Contributing Editor, Investor’s Daily