- The counterfeiters of London, Frankfurt and New York are terrified

- He may have discovered gravity, but forgot it applies to stocks

- If only Sir Isaac Newton had been an Austrian

Sir Isaac Newton once frequented taverns in the seedier parts of London. Not for any lecherous activities. At least, not that I know of. He was looking for something even less credible. You might call it the second-oldest profession: counterfeiters.

Sir Isaac had been appointed Master of the Mint. You can check out what’s left of his office in the Tower of London today. It’s quite strange to stand in the dingy room where Newton once did.

The Yeoman Warder who gave me a tour of the Tower was a bit annoyed that I found the Mint more interesting than his story about personally guarding the Nazi prisoner Rudolf Hess…

Anyway, during his time working at the Tower’s Mint Office, Newton tried to restore the coin of the realm. He standardised the currency into one coherent unit. And fiddled with the metallic standard used, thereby putting the Kingdom on a de facto gold standard.

Yes, it can be done.

Although some say it happened by mistake. Newton wasn’t very good at economics, as we’ll get to in a moment.

Sir Isaac also became obsessed with personally hunting down coin clippers and other debasers who undermined his currency reforms. He took their crimes personally. By all accounts, he took everything personally.

Newton’s adventures included frequenting crime infested alleys undercover and in deep disguise, looking to entrap his sworn enemies.

Can you imagine Bank of England governor Andrew Bailey doing that?

No, because he’s the one doing the counterfeiting these days. Printing money willy-nilly without the gold or silver to back it.

Newton would’ve been horrified. And Bailey would’ve been accused of high treason – a capital offense, punishable by death. If convicted, Bailey would’ve been hanged, drawn, and quartered.

But economics has moved on since Newton’s day…

Isaac forgot about gravity

Here’s what makes all this incredibly ironic. While restoring confidence in the coin of the Realm successfully, Sir Isaac Newton also got caught out in the South Sea stock market bubble.

Things started well. First, Newton made a fortune in the stock market. But he sold too early. The price kept going up. Far and away past what Isaac Newton considered sensible.

Like so many since, Newton was unable to resist temptation. He got sucked back into the market by the rocketing share price.

In the end, even the man who discovered gravity forgot that what goes up must come down.

The Master of the Mint, entrusted with restoring the nation’s money, lost his fortune as the South Sea Company’s share price crashed…

He wasn’t happy about it either. According to a famous quote, he could “calculate the motions of the heavenly bodies, but not the madness of people”.

If only he’d been aware of something called the Austrian Business Cycle Theory…

Bubbles are as old as stock markets

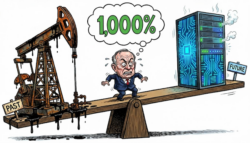

Asset prices have a habit of booming and crashing. Especially when the government gets involved. As it did in the South Sea Bubble, the Mississippi Bubble, the Housing Bubble of 2008, the Japan Bubble and now the AI Bubble.

For an economy to make a mistake as big as a bubble, it needs an external influence to put it off kilter. Excessively loose monetary policy, subsidies or regulations are the usual culprits. Blaming “animal spirits” or “the madness of people” is just a lazy excuse.

Given that central banks and governments dominate our economies and financial markets, investors must be willing to accept that investing is now about a boom-and-bust cycle. But they are really just speculators in a series of booms and busts engineered by governments.

The last few years have proven the point. If you missed out on the AI stocks, your investments have likely gone nowhere adjusted for inflation and taxes. Only the AI bubble boomed. Even Buffett underperformed.

What few investors realise is that the money supply is at the heart of the boom-and-bust cycle. Newton’s role as Master of the Mint and investor in the South Sea Bubble are part of the same story.

Something called the Austrian Business Cycle Theory explains how the story goes. But it hadn’t been invented during Newton’s time. So, let’s explain the sequence…

Newton’s currency reforms restored confidence in the money but also constricted the money supply. Without access to funny money to finance the War of Spanish Succession, the government was forced to come up with more creative means. The con job that was the South Sea Company is what it came up with.

Sir Isaac Newton losing his fortune in the South Sea Company would be like Andrew Bailey’s pension blowing up as a result of the LDI bond crisis, which undermined Liz Truss. Bailey announced QT the day before the mini budget, remember.

But it was Truss, not Bailey, who got ousted and branded a moron.

What if the counterfeiters won?

In the end, Sir Isaac was successful in restoring the value of and trust in British money. For a while…

These days, things are looking a lot more iffy.

Investment bubbles rattle through the global economy in an endless cycle. Inflation is so high you’d think the coin clippers are back. The pound is hardly trusted or revered around the world. And its value relative to gold and silver has plummeted.

During Newton’s time as Master of the Mint, a pound could buy you 8 grams of gold. Today, you’d need more than £100 to buy a single gram…

These days, it’s the government itself that’s printing the unbacked currency. Something that’d probably horrify Newton.

But it’s nothing compared to what comes next.

The new money has arrived

We are on the cusp of the next great bubble. Central bankers and governments are as busy as ever, trying to find a sector of the economy to goose into a boom.

Trump is trying to get the energy and resources sector to “drill baby drill.”

The Europeans want a defence industry.

The Japanese are reviving heavy industry.

The Chinese are trying to outcompete in everything.

The UK government is…well, I’m not sure to be honest.

But it’s bubbles galore. The question is which one will pop next. And which one will replace it.

I believe this emerging bubble is the next big thing.

Until next time,

Nick Hubble

Editor at Large