British regulators are hellbent on tightening crypto rules… issuing warnings… making noise.

British regulators are hellbent on tightening crypto rules… issuing warnings… making noise.

Meanwhile, about 6.7 million people bought crypto anyway.

They’re not waiting for permission. They’re allocating capital into a space that’s still misunderstood by traditional finance.

That’s about to shift.

If U.S. President Donald Trump signs the pending crypto framework into law, it could radically reshape the global financial system. I break that down in more detail in this special briefing (registration required).

Bitcoin Dropped. But That’s Not the Story.

Bitcoin recently dipped below $90,000. The headlines pointed to Fed uncertainty, a weak macro outlook, and routine profit-taking.

But here’s the thing. This isn’t the time to panic.

Because something important is happening beneath the surface. And most investors are missing it.

Crypto sell-offs like this aren’t signs of collapse. Often, they’re signs of a system doing exactly what it’s supposed to do.

Crypto Isn’t Just Surviving. It’s Evolving.

Crypto represents one of the most asymmetric bets of our lifetime. The potential upside still dwarfs the downside. Not because it’s speculative. Because it’s foundational.

In less than 15 years, crypto has rebuilt what took traditional finance a century to develop. Markets, money, derivatives, settlement systems — all reimagined on-chain.

But crypto evolves differently. Wall Street relied on committees and regulators. Crypto evolves in public, through code, feedback, and iteration.

When something breaks, it doesn’t disappear into court filings. It’s open-source. Developers review the damage, test fixes, and push updates within days.

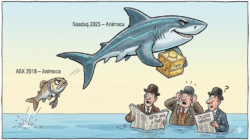

Two Flash Crashes. Two Very Different Outcomes.

The flash crash on October 10 wasn’t so different from what happened on October 19, 1987, when stocks fell 22% in a single day.

In both cases, algorithms accelerated the panic. But the response? Couldn’t be more different.

In 1987, the Fed stepped in. And financial markets got used to rescue plans. Liquidity backstops. Confidence as a product of policy.

Every crash since – 2000, 2008, 2020 – has come with bigger bailouts.

Crypto doesn’t work that way. There are no meetings. No press conferences. No taxpayer-funded safety net.

When the system breaks, it clears. Liquidations happen. Leverage gets wiped. And the code keeps running.

DeFi Gets Stronger by Failing

It’s painful. But effective. And it avoids the kind of slow, hidden contagion that traditional finance often amplifies.

DeFi, by design, is transparent. Collateral-first. And antifragile.

Flash crashes in crypto don’t just test resilience. They reveal it.

That’s why my team and I study what survives. What adapts. And what actually holds value when sentiment turns sour.

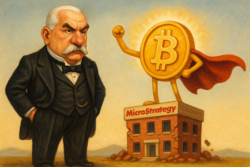

The Policy Trigger No One Is Pricing In

Even in the current slump, we see a catalyst ahead.

Trump is likely to approve a sweeping crypto framework. If it passes, it will trigger the next big shift: tokenization of real-world assets.

Think real estate. Bonds. Equities. All moving on-chain.

That’s where the number comes in. One quadrillion dollars in potential assets.

Not a typo. Not hyperbole. Just a reflection of what happens when regulatory clarity meets digital infrastructure.

And that’s why this matters to UK investors too. Because once the rails are laid, capital moves faster than regulation can keep up. The opportunity won’t be isolated to one country.

Crashes Filter Out the Noise

Here’s what to take from this:

Market crashes don’t eliminate strong projects. They expose them.

When fear spikes, everything sells off. The bad stuff gets punished. The good stuff gets discounted.

But in the moment, it’s hard to tell which is which.

So protect yourself. Don’t invest more than you can afford to lose. If a 40% drop keeps you up at night, you’re overexposed. Diversify. Not because you’re pessimistic, but because you want to survive.

And don’t take your cues from Twitter threads or WhatsApp chats. Panic isn’t insight.

Five Projects. One Briefing. Real Signals.

We break all this down, plus five projects we’re watching closely, inside our research event, The Quadrillion Dollar Mega-Boom.

This is free, but to ensure you understand the risks associated with this market, you must go through a quick registration process. Those aren’t my rules! You can register here… it takes 2 minutes.

Regards,

James Altucher

Contributing Editor, Investor’s Daily

Editor, Early-Stage Crypto

P.S. Crypto is volatile. That’s not a warning. That’s the nature of the asset. Understand the risks before you invest. But don’t ignore the signal hiding in the fear.