- The Supreme Court saved Trump. But will the Fed?

- Bitcoin will sniff out the coming rescue package

- Chairman Powell’s chance for revenge

For ten years, President Trump has faced a barrage of “lawfare” from Democrats. Countless injunctions, lawsuits, and challenges filtered up through the courts.

This is mighty ironic given rumours about how Trump uses lawfare in his own business practices…

And he certainly earned some of the cases and decisions against him…

But thanks to exceptionally well-timed retirements at the Supreme Court, Trump was able to appoint three Supreme Court Justices during his first term.

Given all roads of appeal lead to the Supreme Court, this has proven to be a bit of a get-out-of-jail-free card.

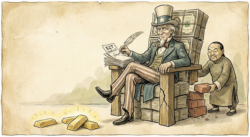

The Democrats can sue as much as they like and where they like. In the end, Trump comes up trumps due to his majority on the bench that reigns supreme. He just needs to keep appealing to the higher court until he gets to the judges he appointed. Jurists call this “court packing”.

All this is a fairly intuitive state of affairs to understand. But, for some reason, investors fail to extend the same concept to the Federal Reserve…

And yet, I believe appointments to the Fed’s board will determine the fate of both Trump’s presidency and asset markets over the next six months.

So, let’s take a closer look…

Majority [of appointees] rules

Trump needs looser monetary policy to goose the stock market, keep government borrowing cheap, and spur on the economy.

But will he get it?

That depends on who votes for monetary policy at the Fed in coming months.

The Federal Reserve’s version of the monetary policy committee is a complex beast. It has permanent appointments and rotating ones. Trying to predict what they’ll do is a bit like trying to pat your head and rub your tummy at the same time.

There are seven permanent members who vote all the time. They are the Fed’s Board of Governors. The President picks them, subject to Senate approval. They serve 14-year terms, which is supposed to insulate them from political pressure.

Heh…

Thanks to some more convenient timing, Trump appointed three of the seven. And he also appointed the Fed Chair Jerome Powell, although that relationship went terribly sour since.

There are also five voting seats for regional Federal Reserve Bank Presidents. Four of these rotate each year among the 11 regional Federal Reserve Banks.

The New York Fed President is regional, but gets a vote every time, because they actually implement the monetary policy in the bond market.

The regional Federal Reserve Bank Presidents are chosen by their respective boards. Who are, in turn, chosen by a bizarre and complex system designed to bore you into submission.

That’s not a joke. The Fed was designed to hide who influences it. But that’s a whole other book.

The point is that US monetary policy is a question of who is in the hot seats. And the US president has a substantial influence on that.

It’s actually a bit like the European Union, but let’s not go there…

Trump’s loose goose will replace a hawkish Powell

Trump’s appointees may dominate the Supreme Court. But when it comes to “court-packing” the Fed, things are a bit more uncertain.

Voters at the Fed can be classified into hawks and doves. Not just because they are all bird brains, but because each of them tends to consistently favour tighter or looser monetary policy than the average of their peers.

Trump wants doves to replace hawks.

In January, the four regional voters will change. So far, analysis suggests hawks will be replaced by more hawks. Although there is great debate about this. Different voters place different emphasis on different data sets.

But Trump has an ace to play.

In May, the president will nominate a new Chair to lead the Fed. This means that a sort of leadership contest is underway right now.

Fed board members are trying to get on Trump’s good side in the hope they’ll be chosen as the next Dear Leader to conduct the US’ economic central planning.

I was expecting Trump to announce the new Fed Chair last month. The idea was to goose the stock market higher by announcing a dove will replace hawkish Powell.

But Trump’s continuing delay in announcing who will lead the Fed seems to be an effort to manipulate more voters to be more dovish in the hope of being appointed Chair. So far, one typically hawkish Fed voter has turned doveish in her attempt to become the next chair.

Still, whenever Trump does nominate a loose goose to Fed Chair, markets should soar in response.

But there’s a problem. May is far away.

How unpopular is Trump at the Fed?

Right now, the big question is how far the current Chair Jerome Powell will allow markets to crash under President Trump.

If Powell wants to discredit the President ahead of the mid-terms as the Bank of England did to Liz Truss, now’s his time. All Powell has to do is disappoint the market with a small rescue package for the recent market chaos.

Next year, the President’s yes-men will be running US monetary policy. So time is running out for the hawks.

Of course, the market will price in the coming shift in advance. When does the transition occur?

Bank of America strategist Michael Hartnett has highlighted that bitcoin “will be the first to sniff out the Fed coming to the rescue.” So a rising bitcoin price will be your signal to do this.

Until next time,

Nick Hubble

Editor at Large

P.S. After laying out how Trump’s fate — and the market’s — now hinges on a handful of Fed voters, here’s the part I didn’t have room to include above: if Powell does drag this out, and if markets wobble before Trump can install his doves, the biggest opportunities won’t appear in the headlines… they’ll emerge in the chaos.

That’s exactly why James Altucher has just released his new briefing. He explains how this political–monetary tug-of-war could open a rare wealth window, one we may not see again for decades, and reveals the strategies he believes could benefit most if the Fed is forced into a rescue.

If you haven’t watched it yet, I strongly suggest you do so now.