Here’s a simple truth about modern politics: it’s full of hypocrites.

Here’s a simple truth about modern politics: it’s full of hypocrites.

Also, it’s eating the British economy alive from the inside out.

Whether or not there’s an incoming party out there courageous enough to radically decrease the size of the state leaves to be seen.

But it’s clear that the public sector is rapidly running out of control.

Over the past decade, Britain’s public sector has ballooned to a size politicians insist doesn’t exist.

According to the ONS, public sector employment hit 6.18 million in September 2025, with central government at a record 4.05 million. The NHS employs more than 2 million people, while the civil service alone now numbers roughly 554,000, up from about 416,000 in 2016.

That’s a 21% increase since 2019, delivered during an era supposedly defined by “smaller government”.

The state has grown faster, more expensive, and more complex, even as politicians talk endlessly about restraint.

And yet, as the public sector bloats under the watchful eye of politicians, something fascinating happens when the phone rings from Silicon Valley.

Suddenly, the virtues of the public sector give way to the riches of private industry.

Suddenly, private enterprise and big tech are no longer existential threats to society; they are “world-changing” opportunities for humanity.

Suddenly stock options carry more weight than the voice of constituents.

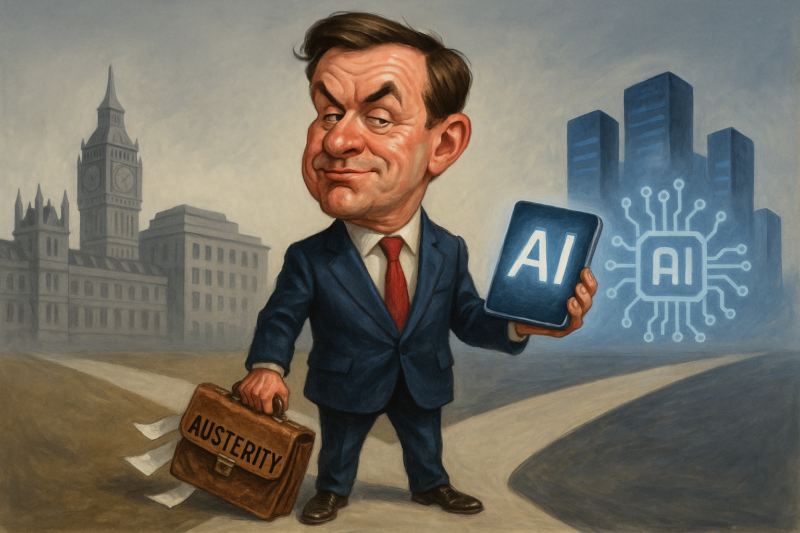

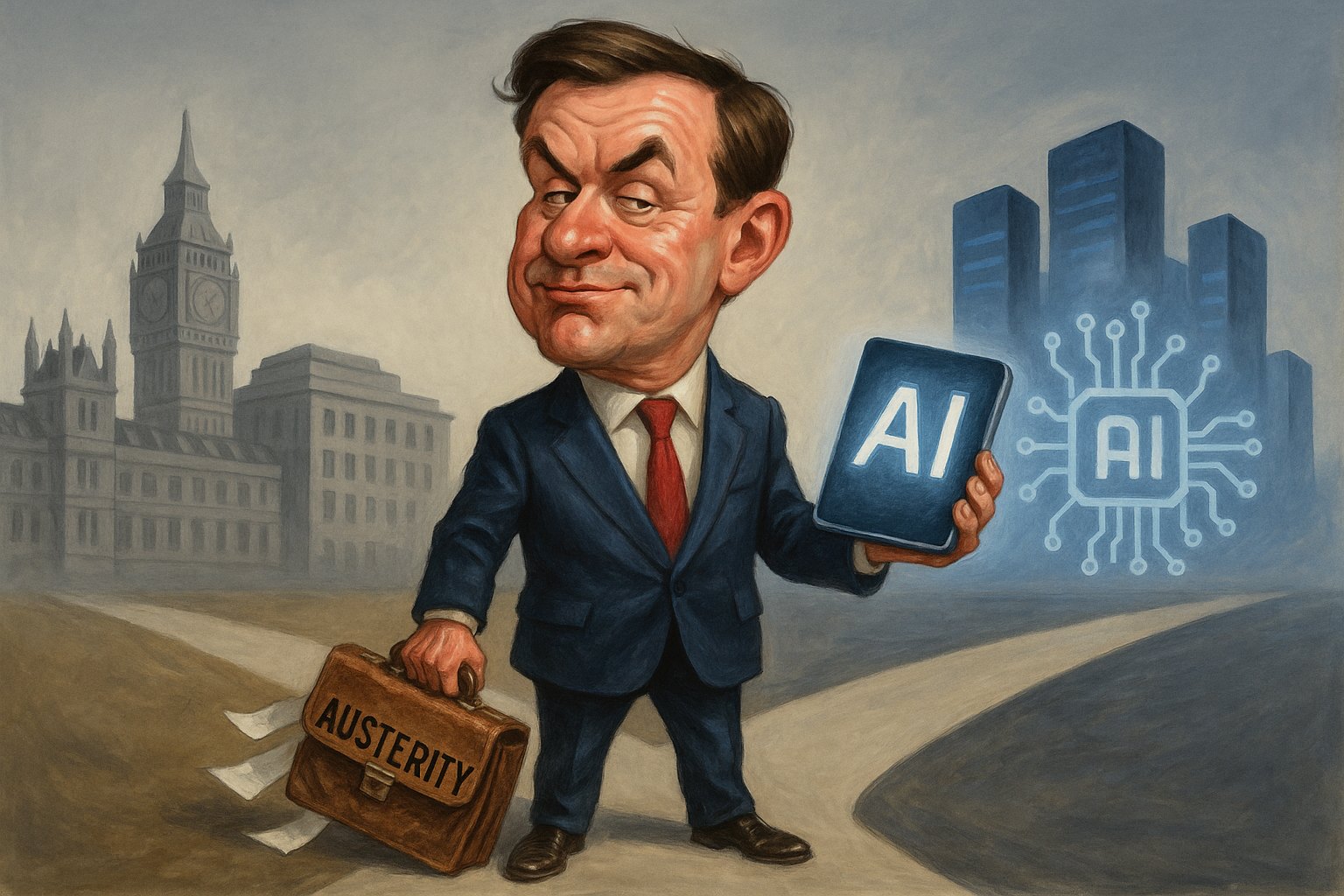

Who did it better? Clegg or Osborne?

Nick Clegg once styled himself as the conscience of British politics. As Deputy Prime Minister, he spoke passionately about accountability, fairness, and the need to rein in the way in which people’s data was stored and used by government and technology companies.

And then after the 2015 election, he resigned and had a high ranking position at Facebook inside of three years.

In October 2018, Clegg was Vice President of Global Affairs, effectively the public face and chief defender of one of the most powerful corporations in history.

If you want to talk about abuses of data, you should probably start with Facebook.

Public virtue, it turns out, travels well when paired with equity incentives.

And we got another reminder of that this week as George Osborne dropped some “personal news” online.

As Chancellor, Osborne preached austerity and fiscal discipline. But since politics, he’s chaired newspapers, banked fees at Evercore, advised BlackRock for around 650K a year, and hosted a podcast dissecting the state of the nation, “Political Currency”.

If there’s ever been a politician who was just biding time in office, knowing full and well he’d be making bank on the outside, it’s Osborne.

This week, he took the final step in his transformation from public office to the riches of private enterprise.

Osborne announced he is joining OpenAI as Managing Director and Head of “OpenAI for Countries”, based in London. His remit is to help OpenAI work with governments outside the United States to deploy national-scale AI infrastructure.

Osborne said in his 2015 Budget speech that his budget was, “…one more big step on the road from austerity to prosperity.”

How did that work out?

It’s easy to promise the world, never deliver, bail, and then cash in with big tech private industry to leverage those years in Westminster.

The timing here is also interesting. It lands just days after the Trump administration paused the UK–US Tech Prosperity Deal, citing frustration with Britain’s Online Safety Act, digital services taxes, and general animosity toward U.S. tech firms.

That deal had promised tens of billions in American investment into UK AI, quantum, and advanced technology. Instead, it stalled over concerns that UK regulation could materially harm U.S. tech companies.

And then the former Chancellor gets a prime position at OpenAI…

Rachel Reeves must be seeing her future riches in her dreams.

But, for all the hypocrisy of politicians (on all sides) and their clear self-interests aside, there’s actually an optimistic thread here from Osborne’s big sell-out.

OpenAI’s “for Countries” initiative is about building sovereign AI capacity outside the U.S.

Nvidia’s Jensen Huang estimates $3–4 trillion will be spent on AI infrastructure by the end of the decade. AMD believes the data-centre chip market alone hits $1 trillion by 2030. Broadcom sees $60–90 billion in annual custom-chip revenue within just a few years.

Recent deals back it up. Microsoft and Nvidia committing billions to Anthropic. Oracle signing cloud agreements reportedly worth hundreds of billions. Nvidia deepening its relationship with OpenAI while selling the hardware that powers it all.

That capital ends up somewhere, and if it all ended up in the U.S., that would be a catastrophic outcome for the UK.

In fact, the only way in which that capital finds its way over to the UK is if people like Osborne do fill these positions.

We don’t have to like it, but at the same time they’re almost necessary to ensure the future prosperity of the UK. Maybe Osborne’s lofty goals to go from austerity to prosperity were never possible in government, and its only outside of it that he can be of any use to Britain?

Who wins from the Osborne’s OpenAI?

If OpenAI is keen on using this new employee to genuinely scale outside the U.S., that’s ultimately a good thing for investors.

Scale means more… of everything.

AI compute, memory, storage, infrastructure, cooling, energy, connectivity… Nvidia, AMD, Broadcom, Micron, the data-centre builders underpinning AI are where the real opportunities lie.

The growth they currently display will accelerate and the profits each quarter will continue to blow away expectations.

There is no AI bubble when you see the speed of growth.

Of course, prepare for volatility. This AI build-out won’t be smooth. But if you believe AI is the next industrial revolution, any pullbacks are opportunities, not an “end of days” scenario.

Yes, the hypocrisy is glaring when politicians leave the country in a worse state than when they started, only to go search for riches in the private sector.

But then again, maybe that was always their plan?

And markets don’t care for the moral outrage. They only want to know where the money flows and the profits are made.

Maybe this Osborne appointment as cringeworthy as it might be sends a big chunk of that change the way of Britain, and maybe there is a pathway to prosperity.

Cheers,

Sam Volkering

Contributing Editor, Investor’s Daily