- Silver miners can’t keep up with silver prices

- Gold’s verdict on silver’s comeback

- Conspiracy theorists were right, wrong and missed the point

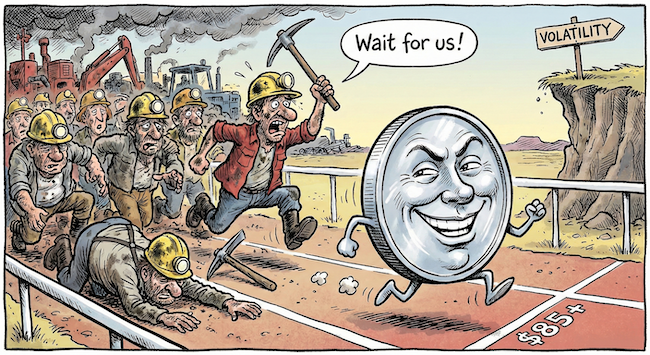

Mining stocks are supposed to leverage gains in the commodities they produce. Since early December, that relationship has broken down for silver.

Not only are silver miners failing to keep up, the precious metal has risen at roughly twice the pace of its miners.

What does this mean?

We can’t be certain. But there are several plausible explanations worth considering.

The familiar suspects

The first explanation is that stocks are pricing in an imminent correction in silver. Investors in mining stocks don’t believe the silver price will hold up.

Mining stocks are priced on the long-term future of their earnings. A short-term commodity price spike is good news. But it only has a small effect on the overall value of the company’s long-term projects if it will eventually reverse.

We saw this play out with gold stocks a few times in the past. The gold price outperformed gold stocks dramatically during and after the pandemic, for example.

Supply chain chaos and rising energy prices meant that gold miners couldn’t turn those higher prices into higher profits. I remember whinging about it, back then. We were right about the metal’s surge, but failed to profit much.

Of course, the gold price didn’t end up dropping back down. It just kept on going up. And so gold stocks have made up for this disappointing period. They’ve outpaced gold, as they should.

That’s because a $1 rise in the price of gold is a small percentage increase in the value of gold, but a far larger percentage increase in the profit margin of the companies that mine it.

Perhaps the same is coming for silver stocks? Perhaps mining investors are too bearish and they will catch up to silver in even more spectacular fashion?

Before you rush off to liquidate your silver to buy stocks, there’s another more concerning theory for the divergence…

Geopolitical chaos is good for silver

This explanation is less conventional, but it has historical precedent.

But my Australian colleague Charlie Ormond claims that there’s a very long history of silver spikes signalling the end of monetary systems.

The theory goes something like this…

Gold is too scarce and valuable for ordinary people to diversify into when they expect geopolitical or monetary chaos. So they buy silver to protect themselves. It is “poor man’s gold.” But it is close enough to do the job of protecting your wealth during chaos.

Silver has no counterparty risk and you can own it directly in your own possession. That makes it superior to most investments during geopolitical upheaval.

There’s no shortage of geopolitical chaos to worry about right now. If the monetary system is under real strain, it would make sense for silver miners to lag the underlying metal. Many operate in dodgy jurisdictions in South America, where Trump has been busy. Higher political risk means cheaper stock prices.

Another theory is that silver’s price reflects short-term logistical issues rather than a true long-term supply-and-demand equilibrium.

It’s a bit like the spike we saw in the gold market during Trump’s tariff chaos in April. Back then, the Bank of England struggled to meet demand for physical gold with its limited logistical resources. And gold refineries struggled to recast gold fast enough to meet stringent trading standards. That imbalance caused a sharp, temporary price spike.

The exact logistical bottlenecks in silver are less clear. But they’ve struck a long list of commodities in recent years.

One for the conspiracy theorists

Last and least is a long-run conspiracy theory about the nature of silver markets. One I last looked into about a decade ago. So please forgive me if this is an unfair characterisation…

The silver price is currently set in the futures market. But there is very little physical silver actually involved in this derivative “paper” trading. This can open the price up to manipulation by traders who wouldn’t know a silver bar if it hit them in the face.

For years, regulators and the financial press dismissed these claims. But fines and even convictions have since occurred. So the conspiracy theorists were right…to an extent.

However, the confirmed cases of silver price manipulation did not establish long-term suppression of the silver price. That’s what the more extreme version of the conspiracy theory alleges.

They also claim that vast amounts of silver futures relative to actual physical silver supply suppresses the price in and of itself. The evidence for this is weak. For every person short in the futures market, someone must be long. Every buyer must have a seller. The net effect should be zero.

A more interesting version of the same theory is that China has called out the Western commodity markets’ lack of physical commodities.

When all else fails, blame China

A fairly new commodity exchange in Shanghai was set up to reflect actual metal supply and demand.

If prices between Shanghai and London diverge, this can drain the Western markets dry of its small amount of physical supply. A bit like New York drained London dry of gold during the gold tariff shenanigans.

This is like calling someone’s bluff in poker. They have to play their hand. And there might not be enough silver on hand for futures traders to cobble together to meet obligations. Not without bidding up the price of silver elsewhere.

Remember, there is always enough silver to meet demand. You just have to bid enough to coax it out of investor’s vaults. It is only ever a matter of price.

Digging up your back yard takes a lot of effort. Even if you can remember where you buried you stash. So silver investors tend to demand a very high price.

In other words, the physical supply and demand for silver has begun to control the price instead of financial contracts that rarely involve the real metal.

The general point is that we can’t quite tell why the silver price is spiking. So it’s tough to tease out why silver miners are not.

But it certainly is a warning. Either the silver price is due for a correction. Or we are on the cusp of something else going terribly wrong.

What happens next?

The silver price spike is highly likely to end in tears. How high it goes in the meantime is a very tough question because of how difficult it is to identify the cause of the spike in the first place.

The big question is where silver prices settle after the current surge. Will it leave silver miners dramatically more profitable than they were? Or will there be a crash to match the boom?

Either way, volatility is likely to rise. And that brings me to an important point.

Not all asset classes are harmed by volatility. Some actually benefit.

That’s why, today, we are launching a project to help investors like you prepare for market instability.

It doesn’t matter what form that instability takes. Nor which markets trend up or down.

We’ll show you how to turn volatility itself to your advantage.

Until next time,

Nick Hubble

Editor at Large, Investor’s Daily

P.S. Most investors try to predict direction. The smarter ones get paid for volatility itself. In the briefing we’re releasing next, we show how to position before markets break, not after — using the same principles professionals use to turn chaos into opportunity. If you want to act while others react, make sure you’ve seen it.