- Why the FTSE100 got left behind

- UK stocks are cheap enough to buy

- But are they actually better too?

In the Phantom of the Opera musical, two nouveau riche business owners purchase the opera. This is especially scandalous because they made their fortunes selling “junk.” Or, as the owners prefer to put it, “scrap metal.”

The point is that even junk can be bought and sold at a profit,i pay a cheap enough price.

For about a decade, the UK stock market has underperformed its global peers. The FTSE 100 WAS left for dead. It became “junk.”

But is it junk worth buying?

Is it cheap enough to give you good returns in the future?

Could you one day afford to buy the opera if you buy UK stocks now?

To find out, let’s first consider what went wrong…

Not everything is Labour’s fault

Stock market indices across countries are not directly comparable. It’s a case of apples and oranges.

The Australian index is full of mining companies. The US has lots of tech stocks. Japan has a lot of industrials.

Our FTSE100 index is full of companies in industries that happen to be struggling lately. That’s not a reflection on the UK. It’s a reflection on which industries happen to like the UK stock market.

Fossil fuel energy is top of the list. We are home to major oil companies like BP. Over the past decade, these got slogged with a cheap oil price, the anticipated phaseout of their primary good, and disastrous green energy investments.

Indeed, green energy stocks and projects are also in abundance in our FTSE100. Their value has crashed slowly since 2021, undermining our index’s performance.

We also have a lot of pharmaceutical companies. But they’ve been unpopular since COVID subsided. And the new US administration targeted the sector too.

Financials are still struggling to recover from a rough 20 years. The 2008 crisis, the European Sovereign Debt Crisis, below-zero real interest rates, high inflation, interest rate instability, and poor housing affordability.

The point is that financials, pharmaceuticals and fossil fuel energy stocks in most countries performed poorly. It’s just that we happen to have a lot of them in the FTSE100. So our index lagged more.

Of course we are to blame for some of the underperformance. We had high inflation relative to the rest of the world. Which undermined UK stocks’ values.

The pound strengthened sharply against many currencies, which cut the profits for our exporting companies. The FTSE100 is full of those too.

But what investors really want to know is whether the UK is a buy now.

You might think this depends on the UK’s outlook. Or the outlook for fossil fuels, pharma and financials.

But what if that’s the wrong question? You should be asking…

Is the UK cheap enough?

The answer certainly appears to be “yes.”

By some measures, the FTSE100 is undervalued. Meaning it is cheap.

Let’s look at one such measure.

The price to earnings ratio (P/E) of a stock measures how many pounds you are paying when you buy their shares per pound of profits the company makes.

A small business will usually sell for a P/E of around 5. Meaning the value of the business is five times its profits. Or, put differently, it’ll take you five years’ profits to recoup the money spent buying it.

A business with a low P/E ratio is cheap. You pay less per pound of profits the business is earning. It takes less years to recoup your initial investment.

Publicly listed companies typically trade at much higher P/E ratios.

And we can use the same measure for stock market indices as a group.

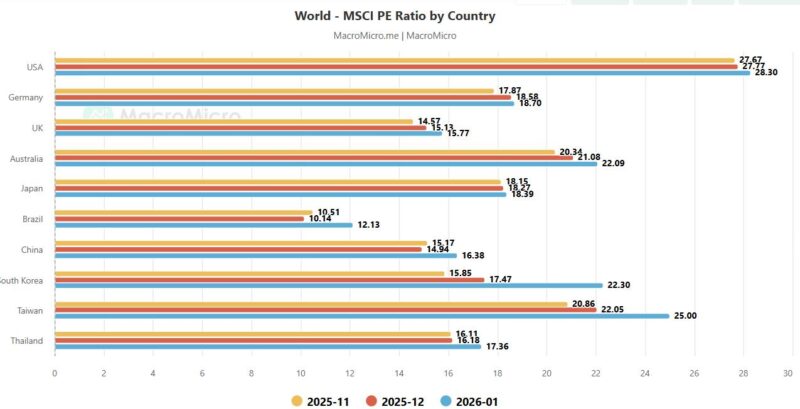

This chart from MacroMicro shows the P/E ratio for a few major stock market indices around the world over the past few months.

UK investors are paying £15.77 per pound of profits from FTSE100 companies. It’d take you 16 years to recoup your money if every pound of profits were paid out to shareholders.

Investors are paying far more, $28.30 per dollar of profits, in the US stock market.

Currently, the UK stock market is the second cheapest from the list that MacroMicro happens to have collated. Only Brazil is cheaper.

That looks like an epic opportunity to buy up UK stocks on the cheap.

Now, there are many things to consider here. Lots of factors to adjust for.

Stock markets with high profit growth in coming years are more expensive for a good reason. Their earnings will grow to bring their P/E ratio back to normal levels.

And there are many ways to define profits when you do the maths for P/E ratios. Past, future and present, for example.

But the point is that our stocks in the UK are cheap.

Why?

Because they haven’t gone up as much as other countries’.

Underperformance is what has created the opportunity. They aren’t necessarily better. Just cheaper.

But are they actually better too?

Two weeks ago, I introduced you to investing’s law of relativity. The idea that relative prices oscillate because valuations can’t get too far out of whack.

This applies to stock market indices too. The UK can only underperform other markets for so long. Eventually, purely by virtue of it being cheap, it must begin to catch up.

Even scrap metal can be worth buying if it is cheap enough relative to virgin steel.

But today I want to argue that investing’s law of relativity also applies to the industries that held the FTSE100 back.

The oil price is cheap relative to many commodities. It is likely to catch up.

Technological advances and Trump’s attempt to make Europe pay market prices for pharmaceuticals signal a comeback for the sector.

Housing policy can only be absurd for so long. At some point, a political party will pick the low hanging fruit and focus on affordability.

That already happened in New Zealand and Canada. It was mentioned by Trump at Davos. A housing affordability revival will be good for financials which lend to home buyers.

Just as the UK was dragged down by the cyclicality of the industries its stock market index is full of, they will soon drag it back up.

It’s time to buy UK stocks once more. Let the search for the best opportunities begin!

Until next time,

Nick Hubble

Editor at Large, Investor’s Daily

P.S. Situations like this don’t come from optimism. They come from neglect. When an entire market is written off for a decade, value doesn’t disappear — it piles up quietly. That’s why I’m paying close attention to this briefing that looks at how long-ignored structures can suddenly re-price when conditions change. It’s not about politics or predictions. It’s about understanding where value has been quietly accumulating — and how ordinary investors can position before it’s obvious. If this idea of “junk worth buying” resonates, you’ll want to see the full case laid out here.