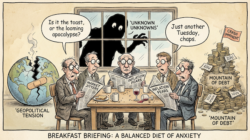

Volatility was the name of the game last week and it sent the markets into a headspin.

And yet we are.

Gold is back above $5,000 an ounce. Silver is trading north of $80. Tech stocks are posting double-digit bounces. Even Bitcoin looks like it’s shaken the fear off its back.

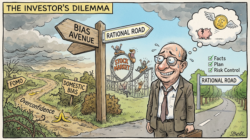

The big question everyone is asking is…why?

Can we pin down this volatility to one catalyst? Or is it a result of pressure building on pressure — one shock layered on top of another — pushing markets into full chaos mode?

And even then, should we expect this volatility to continue?

Should you be worried? Pulling risk? Sitting on your hands and waiting it out?Or is this a generational opportunity to buy into oversold positions, to load up on commodities and metals to ride out a massive bull run?

Well, that’s exactly what we’re digging into in today’s video.

Nick Hubble breaks down what’s going on in the commodities markets, and where he believes the next major move is heading.

Sam Volkering takes aim at the big tech sell-off, examining whether the pain is over… or whether this is the kind of reset that sets up the next powerful leg higher.

If you’re a Southbank Research subscriber, you’ll get exclusive access to the specific pockets of opportunity Nick sees in commodities and Sam sees in tech — the areas we believe matter most as we look toward 2026.

If of course you’re not one of our subscribers, then perhaps you might want to take a look at Jim Rickards’ latest briefing here.

As Jim puts it, “there’s a new era dawning in the United States. The federal government is finally tapping into a secret “trust fund” that’s been untouchable for 163 years. And by joining me and my team of world-renowned experts, you have a chance to tap this estimated $150 trillion “American birthright”.

If Jim’s macro lens isn’t your cup of tea — and you’re more interested in tech, innovation, and hyper-growth — then you’ll want to hear what James Altucher is saying about Elon Musk’s impending “SuperIPO”… and how investors may be able to position before the largest IPO in history goes public in the coming months.

Enjoy the video,

Elizabeth Cox

Associate Publisher, Southbank Research