- Who cares about Japan?

- A “supermajority” to do what exactly?

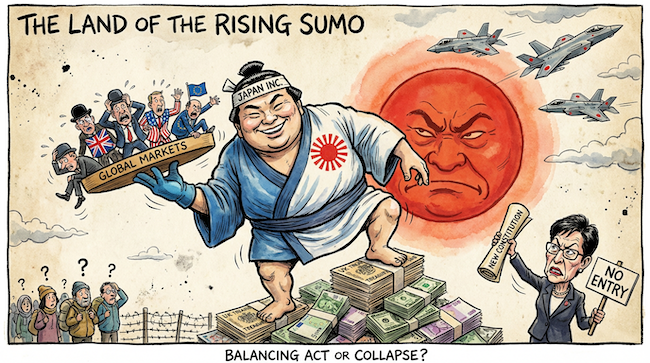

- Takaichi will sell you out cold to pay Japan’s bills

Ten years ago, I didn’t know “konnichiwa.” Now I live in Japan with my Japanese wife and three kids.

Soon, the country could commandeer your life, your money, and your retirement much the same way as it does mine. And nobody sees it coming. It’s a bit like sub-prime mortgages and gain-of-function research. Who cares, until…

Japan matters to all investors in two important ways.

The first is its Net International Investment Position (NIIP).

Japanese investors own vast amounts of foreign assets. About £2.6 trillion more than foreigners own Japanese assets. This makes Japanese investors a crucial source of funding, especially for many European governments. In October last year, Japanese investors bought almost £2 billion of UK government bonds.

This isn’t because Japanese people consciously decided to invest overseas. They’re not that stupid. They just didn’t have a choice. It’s a consequence of Japan’s trade surplus.

When Japan sends us cars, they earn foreign currency. But Japanese people don’t like buying foreign (read: inferior) goods. So they invest the money in foreign stocks and bonds instead.

Over time, these steady trade surpluses have led to a vast accumulation of foreign assets.

The trouble is, at some point, they could decide to sell out of those holdings…

If you’ve ever wondered why the Japanese government can borrow so much money, now you know. The country has enough foreign assets to offset the debt…

Long before the Japanese bond market truly crashes, other government bond markets will melt down as Japanese investors sell out and bring their money home.

That’s how Japan’s problems become everyone else’s.

The second key issue is the yen carry trade. This one takes a bit of explaining.

Yen carried out on a stretcher

In Japan, the cost of living used to get cheaper every year. The price of a litre of beer at the pub last night was £4.67, for example.

That may sound odd, but consider this: Japanese workers used to accept periodic pay cuts to adjust for deflation.

The Bank of Japan tried to ignite inflation for decades. The country has been on the quantitative easing and 0% interest-rate bandwagon for much of that time.

This had another unintended consequence that could cause chaos in your life.

Traders borrow Japanese yen cheaply and use the money to buy overseas assets with higher yields. They pocket the difference as their profit margin. This is known as the yen carry trade.

The trouble is that the yen carry trade can unwind.

If the yen’s value spikes unexpectedly, or Japanese interest rates rise, the yen carry trade opportunity evaporates.

That might not sound like a crisis. But it’s a rug pull for all the assets that traders used to buy with their borrowed yen… including UK government bonds.

The point is that Japan is a source of demand for many of the asset markets in the world. A little trouble in Japan could be big trouble for those investing in the same things.

Well, sure enough, trouble may have arrived…

What just happened in Japan?

Japan held its election on Sunday. It featured a controversial new party leader at the head of the long-standing incumbent party. She faced off against a rabble of odd smaller parties that I can’t quite get a grip of.

But they don’t matter anymore. Japan’s iron lady grew her party’s control of the lower house of parliament into a supermajority.

In other words, her party won so many seats that it ran out of politicians to take them all up!

Fourteen seats were ceded to other parties as a result of the shortfall.

The supermajority matters. It allows the ruling party to override the upper house of parliament and to propose amendments to the post-war constitution, which has never been amended.

The Allies imposed that constitution on Japan. It was designed to keep Japan bottled up and pacifist. So the prospect of amendments to the constitution offer a major shift in Japanese policy. One that hasn’t been on the table in a generation.

Whatever political desires have been lurking in Japanese minds are about to be unleashed. The country has the opportunity to govern itself again. It can get rid of arbitrary constraints.

Sounds like Brexit!

Which begs the question…

What does Sanae Takaichi have planned for you?

Japanese politics communicates between the lines. So predicting policy – let alone constitutional change – is difficult. change.

Getting rid of Japan’s pacifism is definitely on the table though. Japanese defence stocks are surging.

We live near an air force base facing North Korea. Japan’s F-35 fighter jets arrived last year. They make a terrible din. But the local schools got air conditioning in return.

Markets approve too.

The Nikkei 225 jumped 5% on Monday.

But here’s the most interesting shift. Conveniently, it’s one that’ll make you sit up and listen too. Because the same topic is dominating UK politics right now (not to mention most other Western-style democracies)…

Japan is in the midst of an anti-immigration outburst. Unlike in the UK, the ruling party actually shifted its policy to reflect this. That’s how it won the supermajority.

While immigrants remain a small part of the population in Japan, that understates the challenge.

Immigrants in Japan stand out more. It’s a lot harder to assimilate. Being Japanese is very difficult. So difficult, I’ve long since given up trying.

I don’t think anyone has a problem with immigrants that do assimilate. But there seems to be some sort of a threshold where immigrants cease to do so. They begin to form communities distinct from the general population.

That’s happened in Japan to a greater extent than most other countries because the country struggles to integrate immigrants. They need to memorise 5,000 different letters. And even then you could mistake the word “Japan” for “daybook.”

Immigration is also uneven. At a recent coming-of-age ceremony in Tokyo, half the attendees were foreign-born.

Across Japan, almost 10% of people in their 20s are foreign. That’s triple the overall percentage across all age groups. And it signals what the country would look like in a few decades if current immigration rates persist.

That 10% is also a rapid increase compared to a decade ago. So Japan had a taste of importing foreign workers and decided it doesn’t much like the consequences.

Takaichi has a mandate to crack down on immigration. She believes cultural cohesion is more important than GDP growth. That suggests Japan is attempting to fight off the challenges of demographic decline independently. It’s trailblazing the way out of the demographic crisis, just as it led the world into one. We need to watch how this unfolds.

Japan may still have the cultural cohesion needed to deal with demographic decline. Japanese people love to suffer burdens quietly.

Japan also has a lot of foreign assets it could sell to pay for policies that combat demographic decline… as I highlighted earlier.

The country that never seems to change could be on the cusp of a serious upheaval. Investors exposed to assets that Japanese capital supports may be the ones who pay. UK government bonds are near the top of that list.

Of course, Japan isn’t the only country that has already embarked on such a shift. In the US, President Donald Trump is trying to reset the American economy’s relationship with the world too.

Part of his plan is to unleash the vast natural resources that environmentalism has kept locked up for decades. I’m betting the same is coming to Japan soon too.

For now, investors have the chance to profit from Trump’s promised birthright. We are even revealing one stock positioned to capture the potential gains. Best of all, the Japanese economy relies on its output.

Until next time,

Nick Hubble

Editor at Large, Investor’s Daily

PS Japan is a reminder that real market risks don’t announce themselves politely. Capital moves quietly, policies shift slowly, and by the time the consequences are obvious, prices have already adjusted. That’s why I’m paying close attention to where governments still have room to act without triggering chaos elsewhere. Right now, one of the clearest examples isn’t in bonds or currencies at all, but in America’s vast, under-recognised physical wealth. A recent legal shift is unlocking access to assets Washington has sat on for generations — land, minerals, and resources that don’t depend on financial confidence holding together. To see how some investors are positioning for that shift, read more here.