I’ve been around the markets long enough to know one thing is 100% for certain…

I’ve been around the markets long enough to know one thing is 100% for certain…

Short term there is no such thing as “up only”.

Markets do not just go up, stocks do not just go up. Long term, if you look at indexes, it might appear all they do is go up, but there’s a bit of a caveat to that.

Indexes change over time. Stocks crash lower and aren’t as big, so they fall out of the index, they are replaced by growing stocks that get bigger and jump into the index.

Hence by pure design of an index, with a long enough rope, they will rise over time, unless the world goes through several decades of contraction… and that’s not happening any time soon, is it?

That said, indexes are nice and boring if you want nice and boring.

And if you want nice and boring, I’d suggest you stop reading now, go make a cup of tea and come back for someone else’s essay tomorrow.

But if you like your investing with a healthy dash of flare, risk and ridiculous returns, then have I got something for you!

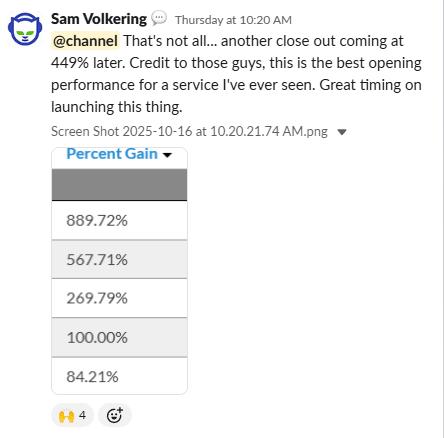

Ridiculous scenes from “those guys”

A week ago, I posted the following in one of our Southbank Research Slack channels,

“Those guys” I was talking about are James Altucher and Zach Scheidt. Now you might already know them because you’re a subscriber to True Alpha, or maybe you have no idea who they are.

If you’re in the latter camp, then keep an eye out in the next week because you’ll get a chance to learn about them and get a lot more context to that screen shot of our Slack channel above.

Part of why things have been going so great and screenshots like above have been taken is largely in part to the single biggest market driving technology the world has ever seen…

AI.

And most people now have the basic understanding that AI needs a few things to work very well… compute, power, infrastructure and data to name a few.

Therefore, when you think about opportunities in the market, you’ll naturally start looking at companies that provide… computer, power, infrastructure and data.

Congratulations, you’ve unlocked the secret sauce to making returns in this market.

Yep, it’s that simple. Job done.

Sort of.

Thing is, that’s one step of a very detailed, time-consuming, all-encompassing process of then finding out what’s good, what’s not good, where there’s returns to be made, and what to avoid.

Take, for instance, the quantum computing market.

Now, all things considered, if commercial quantum computing were a present reality that the biggest companies in the world were rolling out completely replacing hardware like Nvidia GPUs, the market would be a very different beast.

Except useful quantum computing, while very close, is still not at a scale that something like Nvidia is reaching with their AI superchips like the GB200 systems.

Hence on balance, quantum computing is highly speculative. And even Rigetti Computing CEO, Subodh Kulkarni has said commercial use of quantum computing is still years away.

So, while we have quantum computing, it’s still very developmental, experimental and in some cases theoretical. But that hasn’t stopped the wild speculation in quantum computing companies.

As such, they’ve been absolutely skyrocketing in value. Year to date, Rigetti is now up 183%.

IonQ (IONQ) another leading quantum player is only up 43% year to date but is up around 3x since March lows.

And D-Wave (QBTS) another of the “Big 3” listed quantum players has also risen over 309% since the start of the year as speculative money has been on the move.

Owning these stocks has been rewarding enough. But the real thrill and the really wild action is in the options.

Because those numbers from the screen shot earlier, some of those (the big ones) are from D-Wave.

All through True Alpha. And what makes it even more crazy is all inside a few short weeks.

Quantum is still early. It’s volatile. But when markets are trending like this, volatility is a gift, not a risk. You don’t need to own quantum stocks long term to reap the rewards. You can make bank using options, then use some profits maybe for a more long-term view, and some other to make more “moonshot” plays in the options market.

Keep feeding your own cycle

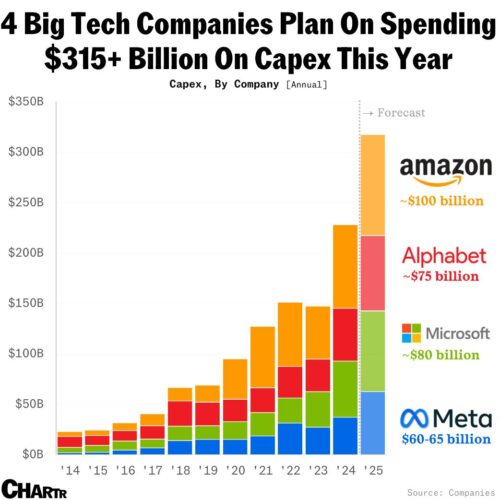

Despite the chatter about bubbles, the backdrop for investing in the in AI boom is pressing on without pause.

It’s a global capital-spending supercycle that’s now touching every sector from semiconductors to cloud infrastructure to automation to quantum computing.

Those obscene levels of spending predominately on AI might seem wild, but they will pay off. And that capital flows south and boosts the smaller players across the various AI boom industries.

Sure, there will be wild days and flash crashes along the way. And a bunch of frothy stocks are likely going to rip lower.

But as long as the market keeps rewarding innovation, and capex keeps flowing, dips are opportunities, not emergency exit signs.

And you also don’t need to own a stock long term to benefit from momentum, speculative money and a bull market.

You can use strategies like options, to make money, to fund your more stable, boring index investing. Use speculative capital to make smart long term wealth decisions.

This is what makes the current setup so exciting for both investors and traders. The long-term story of AI and quantum is still unfolding, but the short-term swings inside it are electrifying.

And with something like options, you can use one to feed the other and then keep feeding that cycle.

Knowing when to cash out, and take profits is equally as important, but that’s again why guys like Zach and James come into the picture. Bear in mind, high risk, high returns, also exposes the outcome for high failure… and one position I will say just expired worthless for a 100% loss. But if you had already seen 10x your original investment, and you lose one, I think you’d still be pretty chuffed with the outcome.

The AI boom. Relentless innovation. Massive capital spending. Rivers of money chasing the next big thing. In markets like this, the real challenge isn’t spotting opportunity — it’s channelling all that energy and finding your lane.

But if you can get your focus right, lean on the expertise of “those guys” who know more about certain sections of the market than you, you’ve got a chance to set the foundations for a long-term wealth strategy with a large dose of fun and action mixed in.

We’re standing at the start of a technological super-cycle — the kind that reshapes economies, rewrites wealth, and leaves a trail of millionaires in its wake.

AI is the spark, but the explosion is much bigger. Data, chips, energy, robotics…they’re all part of the same story. And money is flooding in faster than ever.

The question is: will you be a spectator, or will you know where to stand when the next surge hits?

That’s why we’ve been preparing something brand new — a project designed to help you turn this chaos into clarity, and this momentum into opportunity.

We can’t say more just yet. But it’s close. Very close.

So, stay sharp, keep your inbox open… and be ready when the signal arrives.

Until next time,

Sam Volkering

Contributing Editor, Investor’s Daily

P.S. We’ve seen markets like this before…when new technology reshapes entire industries and rewrites the rules of wealth. The trick is spotting the moment before the world catches on. That moment is now. Keep an eye on your inbox — we’re about to show you where the next wave begins.