I hope you like the idea of investing in crypto.

I hope you like the idea of investing in crypto.

If you don’t…well I’ve got some bad news for you.

You no longer have a choice.

I don’t mean that to be mean or force you into anything you don’t really want to do.

But at the same time, you don’t have a choice anymore.

Albeit there’s one small little caveat to this. You don’t have a choice if you want to invest in any S&P 500 ETF.

I hope you understand how index ETFs work, because every single S&P 500 ETF is about to deliver exposure to crypto investing for everyone.

Let me explain how it’s going to work…

Reflecting the index, all of it

Passive index ETFs are one of those things I like to describe as doing, “exactly what it says on the tin.”

That means something like the Vanguard S&P 500 UCITS ETF (LSE:VUSA) is going to invest in stocks so the ETF tracks the returns of the S&P 500 index.

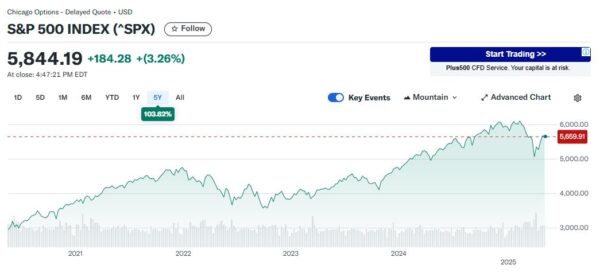

So, if you look at the ETF chart with the S&P 500 index, the returns should be roughly the same.

Source: Yahoo! Finance

Source: Yahoo! Finance

In this case, the ETF is around 20% off the index. And that’s more or less why I don’t really like ETFs. They tend to underperform, and you pay for the privilege (albeit not much), and frankly, they’re boring as hell, and barely beat out inflation.

But that’s perhaps another essay for another day, and not the focus today.

The point is that when you look at the world’s largest ETFs ranked according to assets under management (AUM) you find the top three are all S&P 500 index trackers.

In order it’s the Vanguard S&P 500 ETF ($621bn), SPDR S&P 500 ETF Trust ($576bn) and the iShares Core S&P 500 ETF ($563bn).

$1.76 trillion in just these three S&P 500 ETFs. And that $1.76 trillion is held by other funds, pension funds, individual investors just like you. Heck, you might even hold one of these ETFs directly. Or maybe you’ve got a pension fund that invests some of its capital in one of these three or the many other S&P 500 ETFs that exist in the market.

If that’s the case, then what you’re investing in is actually the 500 (usually 500 to 505) stocks that make up the S&P 500. As it’s next to impossible for most individuals to hold 503 stocks themselves, these ETFs provide easy, liquid exposure to the stocks that make up the S&P 500.

This is what’s good about ETFs.

But that also means you will be invested in some stock via the ETF that perhaps you don’t want to be. And as of the latest S&P 500 rebalance, that now includes a crypto stock.

Coinbase’s rise to the 500

Coinbase (NASDAQ:COIN) has just been added to the S&P 500. It has met all the criteria for inclusion, and it is officially the first and only crypto company in the index.

As CEO of Coinbase, Brian Armstrong quite publicly pointed out when it happened.

Even to this day, whenever I talk about crypto, bitcoin or anything to do with digital assets, I’m often greeted with scepticism and that slight look of “you idiot” on people’s faces.

But there’s a good reason why Coinbase was up 4% in trading yesterday, and then 11% in after-hours trading (after the announcement) and why it’s now up around 630% since January 2023.

Coinbase is a company central to the rollout of crypto, bitcoin, and digital assets to the world. They’re the preferred custody provider to BlackRock’s IBIT bitcoin ETF for a good reason. There’s weight behind why of all the world’s biggest exchanges, they’re the one that’s been around the longest, surviving multiple “crypto winters” and never once suffering from a major hack or irresponsible management that threatened the livelihood of the company.

I will admit, in terms of being a listed stock, it’s been a rocky road. The company still hasn’t sustained a rise through the $328 they closed at on their first day of trading on the NASDAQ back in 2021.

Maybe the inclusion in the S&P 500 is what takes it back into long term profit for good?

That’s because every single one of those S&P 500 index ETFs now has to buy Coinbase stock. No choice. And that’s a lot of passive flow of capital into Coinbase stock. Inclusion into the S&P 500 means instant demand on tap until the funds are appropriately weighted. And if Coinbase grows, and it’s rise up the S&P 500 ranks increases, the weightings tend to increase as well.

So, if you own any kind of S&P 500 ETF, congratulations, you now own a crypto stock too.

The first, and only…for now

Here’s the thing, I don’t expect it’s going to be the first, only and last either.

MicroStrategy (NASDAQ:MSTR) is also on the brink of S&P 500 inclusion. And if bitcoin’s run into and through $100,000 sustains, and goes on towards $200,000 and beyond, expect a whole slew of crypto companies to join the S&P 500.

All this is happening too off the back of a massive spate of crypto and bitcoin companies announcing mergers and takeovers and IPOs on the US markets in the last week too (more on that later this week).

Some of these stocks have been jumping 600%, 1,000% in a matter of days off the back of these announcements.

A huge amount of capital is being deployed into bitcoin and stocks on the NASDAQ and NYSE. It’s setting up for a “Crypto summer” the likes of which I don’t think anyone’s quite ready for yet. And I’m not even talking about the crypto markets; that’s just on the stock market.

Maybe Trump’s grand plans for a market bull run that destroys the bull run from his last term might come good after all…?

Either way, it’s a big deal that a crypto company like Coinbase is now in the S&P 500. From being some kind of fringe thing for “criminals and drug dealers” to “rat poison” according to Warren Buffett, this is somewhat vindication that maybe there’s something to this decentralised financial system after all.

Until next time,

Sam Volkering

Contributing Editor, Investor’s Daily

P.S. Coinbase entering the S&P 500 shows how fast the world is shifting. What was once “fringe” is now being hardwired into the global financial system. And it’s not just crypto—James Altucher believes we’re on the verge of a new wave in AI he calls AI 2.0. He’s calling it the single biggest wealth-building window since the early days of the internet. If you’ve ever felt like you were one cycle too late, don’t miss what he’s uncovered.