In today’s issue:

- The US may already be in recession

- Trump’s policy set may make it worse

- The UK is at even greater risk

It’s becoming apparent that President Trump’s initial economic policy set, including tariffs and trade policies, are likely to push the US economy into recession.

If it isn’t already in one.

I’ve been making the case for a US recession for some time, most recently here. Today, I take an updated look at the data.

Economic data, including GDP, are subject to potentially large revisions. It is hardly uncommon for a recession to be backdated by months when final data revisions become available.

Data can also be misleading, in particular if not adjusted properly for inflation. Inflation itself is an estimate, and there are those, including myself, who believe that official measures tend to understate it.

But for our purposes today, let’s take official inflation as a given and use it to adjust some key US economic data.

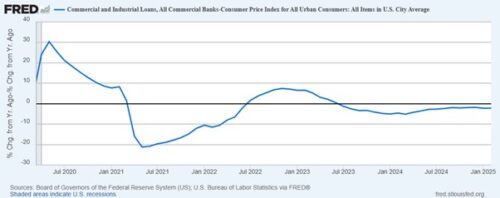

First, commercial bank lending. Businesses tend to borrow to grow and expand their operations. If they’re not borrowing, they’re likely not investing in the future and thus not contributing to economic growth. Here is a chart of US commercial bank lending, adjusted for inflation.

Inflation-adjusted business borrowing has been negative for nearly two years running, implying quite possibly outright negative net investment.

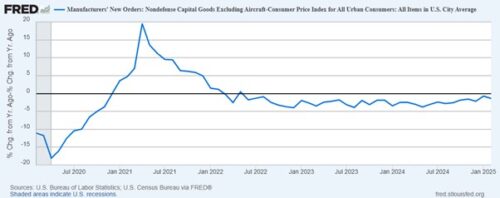

Second, business orders, specifically those for capital goods – e.g. productive assets. These can be volatile, so I look at year-over-year changes and strip out the two most volatile components, defence and aircraft. I then take the further step of subtracting inflation.

That’s a picture of a moribund economy. For three years now, when adjusted for inflation, capital goods orders have been negative.

No wonder businesses aren’t investing in expansion. Depending on how you choose to look at it, you could say the US private sector has been in recession for some time.

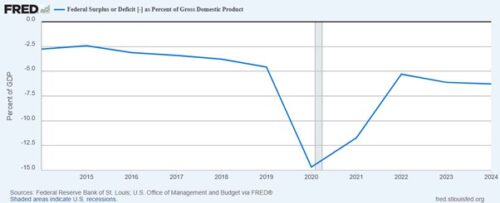

Sure, there’s been “growth” in some sectors of the economy, in particular, the public sector, which has been running a large deficit.

But as we know, cutting government waste and possible fraud is an important part of Trump’s economic programme. It is hard to imagine that the decade-long trend of a growing deficit is going to continue.

So, with the private sector stagnating and government spending on the chopping block, a recession would appear a foregone conclusion.

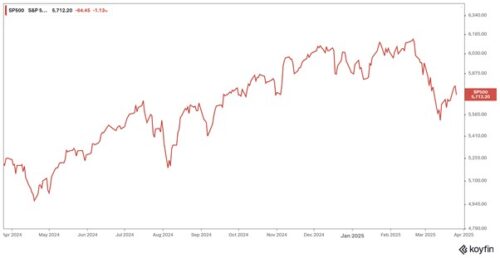

President Trump and Treasury Secretary Scott Bessent’s recent rhetoric suggests that they understand this. That they’re even willing to discuss the topic openly might have contributed to recent stock market weakness.

Source: Koyfin

Source: Koyfin

Then there are the proposed tariffs, most of which have yet to come into effect. While some sectors of the economy might benefit from tariffs, they are a net negative for growth overall, in particular, if affected countries retaliate with tariffs of their own.

Speaking of tariffs, there has been some talk that gold and silver imports into the US have recently surged in part to get ahead of any tariffs on precious metals. That may be true, although there are other possible explanations. (In my opinion Trump may in fact exempt precious metals from any tariffs.)

One quirk of how modern GDP data is calculated is that exports add to growth and imports subtract. So, the surge in precious metals imports of late will have the effect of reducing growth.

The Atlanta Fed calculates GDP estimates in real time using available economic data. As it stands, they forecast -1.8% annualised growth in Q1. Yet when they adjust for gold imports, the figure rises to 0.2%.

That’s a 2% annualised swing solely due to gold imports. Not a trivial amount.

But note that the estimate, when adjusted for gold, is basically zero.

Here in the UK, we re-entered recession last year. If the US is now slipping into one, as appears to be the case, that’s likely to be yet a further drag.

Add to that the threat of tariffs and trade wars and things could get decidedly ugly. Relative to the US, or the EU for the matter, the UK is a small, open economy, with imports and exports comprising a huge part. If global trade volumes decline the UK will be a big net loser.

That’s why I’ve suggested that the government leverage the “Special Relationship” with the US and negotiate some sort of free-trade deal:

The UK thus has a decision to make: take the initiative now and establish a good working relationship with the US on both trade and defence, or risk isolation from both the US and EU.

Notwithstanding Trump’s support for the “Special Relationship”, some Labour members might be inclined towards the latter course. Regardless, let us hope that they choose wisely.

Well, time is now running out. The US and by extension the global economy is slipping into recession. Tariffs are on the way and likely to make any recession even worse. The UK is disproportionately exposed.

For investors, there is nothing good about any of that. It is a time to focus on wealth preservation, not generation.

As I wrote last week, if you don’t yet own any gold, I strongly recommend that you acquire some. And although they have performed very well in recent months, many precious metals miners and royalty firms still trade at reasonable valuations, offering outperformance potential.

Until next time,

John Butler

Investment Director, Investor’s Daily

Dollar Cage Match

Bill Bonner, writing from Baltimore, Maryland

Another day. Another sucker punch. And another guess about the dumbest investment you can make. USA Today:

President Donald Trump on Wednesday imposed 25% tariffs on imported automobiles, barreling forward with a whiplash economic strategy that has rattled markets and ignited a global trade war. Trump detailed the tariffs, which will start at 2.5% and rise to 25% on all foreign cars and light trucks, in front of reporters in the Oval Office.

Why the feds would want to make autos more expensive is hard to figure. Inscrutable. Implausible. Incomprehensible.

But not inconceivable.

Mr. Trump believes in tariffs the way prize fighters put their faith in their left jabs or right hooks. Everything is a fight. And the goal is to win.

He’s ready to duke it out with one and all. And now, Ontario, Canada, arguably our closest and dearest neighbor, has its fists up too. Reuters:

Ontario Premier vows to ‘inflict as much pain as possible’ on US over tariffs

Ontario Premier Doug Ford said on Wednesday (March 26) he aims to “inflict as much pain as possible” on American citizens as the U.S. and Canada engage in a trade dispute over tariffs.

But since we’re wondering what will turn out to be the dumbest investment you can make, let’s consider what the real causes and consequences of a trade war may be. America’s last trade war, led by Misters Smoot and Hawley, led to the Great Depression.

This time could be different. Mr. Trump is no average, run-of-the-mill protectionist. He’s a brawler, not an economist… nor a diplomat. He throws tariffs around like a prizefighter, not a statesman. Fortune:

Trump warns EU and Canada not to team up to resist tariffs—they must take the beating or worse will follow

President Trump is warning the EU and Canada not to get any ideas about joining forces to outmaneuver his upcoming tariff announcements, saying if they team up against the U.S. they will face consequences.

Next Wednesday is a day of reckoning for the Trump administration—and indeed for economies across the world. ‘Liberation Day’, as Trump has called it, will confirm further tariff action against a raft of countries.

The greatest country in the world conducts its affairs as if it were a Mixed Martial Arts cage combat. But is there a method to the madness? Probably not. But let us imagine that there is.

Perhaps the chaos is intended to drive investors out of the US… reduce the value of the dollar and thereby make US exports more competitive?

Would that make sense? Maybe.

In the long run, a weaker dollar could help US export industries. But in the near term, the combination of declining dollar purchasing power and tariffs on imports would surely pinch consumer spending, hard. MoneyTalksNews:

Economic Pessimism Hits 12-Year Low As Americans Brace for Uncertainty

The Conference Board reports consumer confidence has plummeted below recession warning levels for the second straight month. With 15.5% of Americans expecting lower incomes and inflation expectations rising to 6.2%, financial anxiety is growing nationwide.

Combined with already sinking consumer confidence – the result would likely be a slowdown in GDP, along with rising unemployment and a recession. A lower dollar would also make it harder to fund America’s expected $60 trillion worth of new and refinanced debt over the next 15 years.

How would all of that shake out? We don’t know. But a declining dollar would also mean a decline in the value of dollar assets. And the biggest dollar asset is also America’s biggest dollar liability.

It may be that some forward-thinking person on Team Trump believes he can score a two-fer… or a three-fer. Lowering the value of the dollar, in an imagined Mar-a-Lago Accord, would reduce imports, improve exports… and one other thing – lower the real value of US debt.

Bingo! A 20% cut in the dollar would lighten America’s debt load by nearly $8 trillion. Another 20% loss to inflation would bring the savings to $16 trillion.

There is a precedent for this sort of manipulation too. The Plaza Accord of 1985 – 30 years ago this September. Then, as now, the dollar was judged too high. The leading financial powers got together at the Plaza Hotel in New York and agreed to knock it down.

The effect was to put a rocket under Japanese asset prices… leading to the famous Japan Inc. bubble of the late ‘80s… thence to the crash in Japan of 1990… and to the 35-year bear market that followed.

But no matter. If the feds were to achieve the objective – a lower dollar – consumer prices would rise. Wage earners would lose jobs (at least in the short-run). Investors would lose money in stocks. But the biggest losers would probably be those who held US Treasurys.

Either way – because lack of spending control brings inflation… or because the feds want to lower the value of the dollar, intentionally – US Treasurys would come down. If both were to happen, which seems likely, 30-year Treasury bonds, now offering a paltry 4.68% yield, might turn out to be the dumbest investment you could make.

Regards,

Bill Bonner

Contributing Editor, Investor’s Daily

For more from Bill Bonner, visit www.bonnerprivateresearch.com