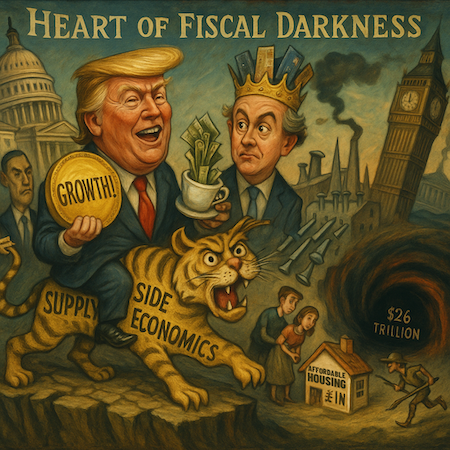

Editor’s note: While this story focuses on America’s latest economic binge, UK investors shouldn’t assume the fallout will stay stateside. The same policies—cheap money, deficit spending, and growth-at-all-costs—are alive and well in Westminster. As an investor, knowing the difference between real gains and politically manufactured illusions could be the difference between building wealth…and watching it quietly evaporate.

‘We’re gonna have growth like we’ve never seen before.’

‘We’re gonna have growth like we’ve never seen before.’

–Donald Trump

Growth! Growth! Growth!

More jobs! More income! Abundance! Joy, from coast to coast!

We know we’re on the road to joy when we see the GDP numbers. They’ll tell us when we are getting what we want — more of everything.

The two parties agree about it…and come closer together. With the advent of the new ‘abundance’ doctrine, growth is the Jehovah now worshipped by the Democrats. The Republicans regard it as their Yahweh too — ever since the virgin birth of “supply side economics” in the 1970s.

The news this morning…the Senate has just passed a version of the Big, Beautiful Budget Abomination (BBBA), with the Vice President casting the tie-breaking vote. Reuters:

US Senate passes Trump’s sweeping tax-cut and spending bill, setting up House battle

This Senate version goes even further into the heart of fiscal darkness than the House version. The numbers are fishy, but it looks like this will add $26 trillion to the nation’s debt by 2035.

‘Don’t worry about it,’ say the Republicans. ‘Growth will make the debt irrelevant.’

Today, we pause to wonder about it. Is ‘growth’ a false god? In preview, what we’ll see is that the feds can produce ‘more’ of just about everything — even more money itself. But what they can’t produce is real growth.

The statistics are misleading…or outright frauds. Falling unemployment is taken as a ‘good’ thing, for example. But it doesn’t mean that people are better off. And it doesn’t tell you whether they are doing anything worth doing, or not. The Soviets had full employment, by forcing people to dig canals — with picks and shovels. The US could have full employment too, perhaps by digging a giant canal between Mexico and the US — thus ‘solving’ two non-problems at once!

The Soviets also showed that they could produce as much ‘growth’ as they wanted simply by raising production quotas. Factory managers took their orders from bureaucrats, not from customers. They were rewarded or punished based on production targets. A factory manager might get a pat on the back depending on the the nails he turned out, measured in pounds. Easiest for him might be to produce huge, heavy spikes, which no one wanted. Then, the Gosplan geniuses could change the compensation arrangement to give bonuses based on the number of nails, rather than the weight of them. Managers could then switch to turning out millions of tiny tacks…which, again, no one wanted.

This is the core problem with all government projects. We only know if things are worth doing when and if people — of their own free will and with their own real money — pay for them. Otherwise, the transaction is likely to be a scam or a mistake.

Ultimately, citizens pay for all of the feds’ bamboozles. But the signal from voters to federal spenders passes through so many lobbyists, grifters, statistical illusions and big money political donors that it loses its ‘information content.’

And even if the voters approve of the spending program, they are only better off if it produces a real gain. This is the challenge for private industry too. If a hunter expends 2,000 calories catching a rabbit with only 1,500 calories of meat…he is worse off. If he continues with this math, he will die of starvation.

Likewise, an enterprise — public or private — that applies $100 worth of time and resources to provide a service worth only $99 has not only lost money…it has made the world $1 poorer.

On the evidence (as well as the theory), it is almost impossible for central planning hacks to keep costs down and produce a real gain for the taxpayers. Even programs that seem to make sense run over budget…and get delayed and distorted.

Thanks to the Fed’s fake interest rates…and state and federal regulations, for example, housing prices have roughly doubled in the last ten years, while wages rose only about 50%. This has put the average house out of reach for the average household. Another crisis!

What to do about it? More ‘abundance’…more supply side…more growth…more houses? California’s ‘affordable housing’ initiatives may cost as much as $1 million per unit. That’s growth! But we will all be a little poorer as a result.

More to come…

Regards,

![]()

Bill Bonner

Contributing Editor, Investor’s Daily

P.S. If you think today’s spending is unprecedented, you haven’t seen anything yet. A little-known Supreme Court decision has opened a path for Trump to seek a third term—just like FDR. If that happens, the promises of endless growth, massive stimulus, and record-breaking debt could go into overdrive. Before this becomes reality, you need to see why some believe this moment could unlock a $150 trillion economic shift. Click here for the full story.