61,000 bitcoin is a stash roughly worth £5.6 billion.

61,000 bitcoin is a stash roughly worth £5.6 billion.

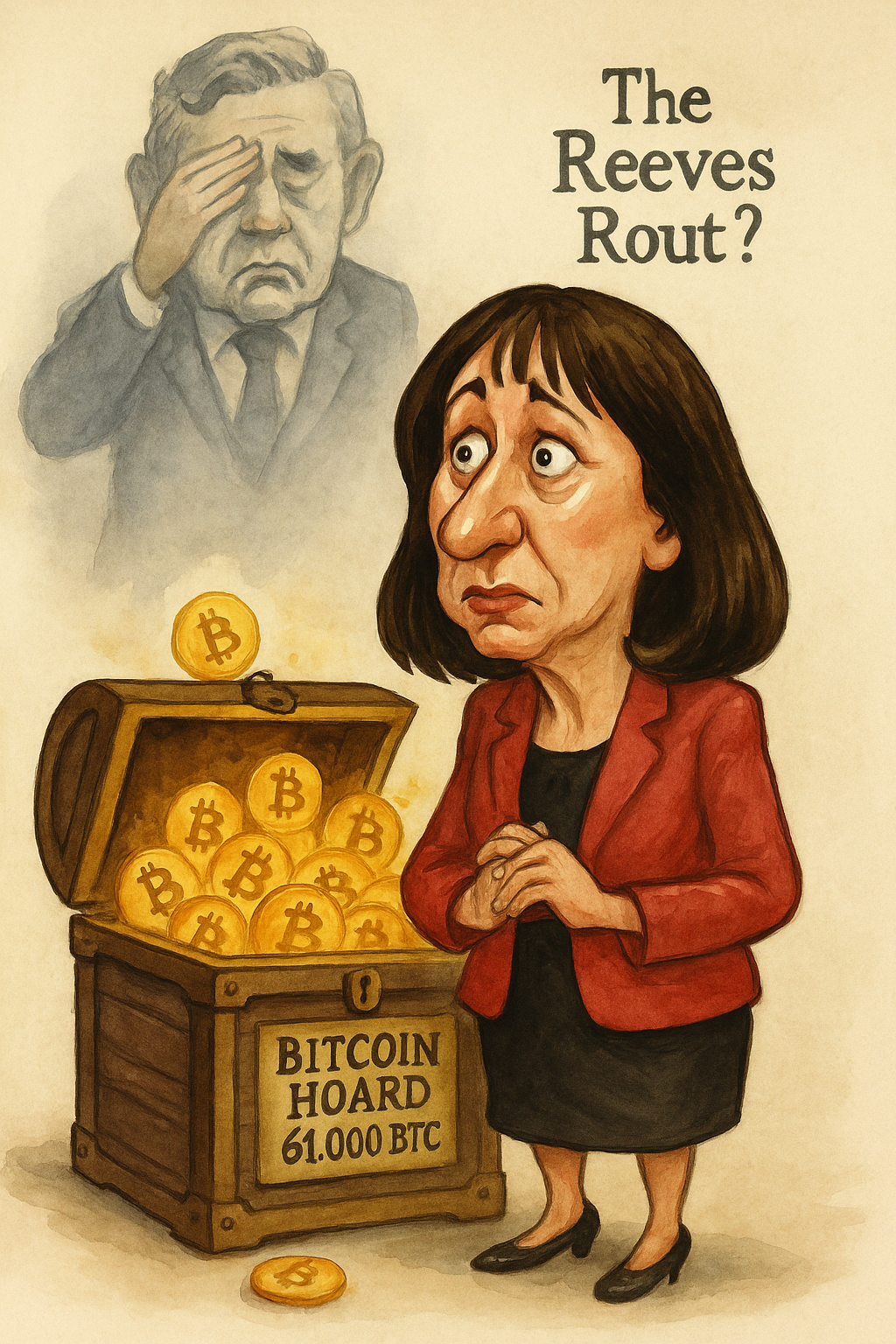

And if the whispers are true, UK Chancellor Rachael Reeves is considering selling off the government’s bitcoin holdings to help patch up the country’s financial sinkhole.

Now you might think (as I would) that we may be witnessing one of the most catastrophically short-sighted economic moves of our time.

Or have we seen this short-sighted play before?

Wind back… the year was 1999, and then-Chancellor Gordon Brown decided to sell off more than half of Britain’s gold reserves.

The price of gold back then? A bargain basement $275 an ounce.

The “Brown Bottom” sale was the literal generational bottom of the gold market.

Fast forward 25 years, and here we are again, this time it’s the “Reeves Rout” and it may seem (to her) like a good idea to offload now, but perhaps, she, too is making a generational mistake if she proceeds.

That, of course, is predicated on bitcoin heading higher… much higher. I think it will, $1 million and higher. But who’s right? And what do you think?

Is this the Reeves Rout?

If Reeves proceeds, this isn’t just about selling a few coins for cash; it’s a very distinct flag in the ground on this government’s approach to bitcoin, crypto and digital assets.

Unfortunately, that flag in the ground says the UK government still doesn’t get it. It says that Westminster is still treating the most valuable and best-performing asset of the 21st century like it’s just a thing for drug dealers and human traffickers.

Admittedly, the UK didn’t buy these coins. They were seized, over time, through enforcement actions, mainly in cybercrime and fraud cases.

But rather than viewing them as a national strategic asset (which the US is now doing), Reeves apparently sees them as a way out for her and the government to not look so bad.

I wonder, do you remember Brown’s sale? What did you think of that at the time?

For what it’s worth, Reeves wouldn’t be the first to fumble the bitcoin bag.

Last year Germany offloaded more than 49,858 bitcoins at an average price of $57,900.

They made about €2.3 billion from it. But if they’d kept their “diamond hands” today, they’d have €5.07 billion of it.

Short-term aim, long-term pain.

And then there’s Bulgaria…

This could be the single greatest fumble in modern European history. They seized 213,500 bitcoin in 2017 and then sold it all in 2018.

Had they held it to today, that hoard would be worth more than €21.87 billion — roughly enough to pay off the entirety of Bulgaria’s national debt.

Instead, they cashed out for pennies. Maybe Reeves is on the same track?

Granted, the UK’s national debt is around £2.8 trillion, so even at £1 million ($1.34 million) per bitcoin, the UK government would still need 2.8 million bitcoin. Still, better than nothing, right?

Will the UK be left behind?

Compare this to what’s happening in the United States.

In his first six months back in the White House, we’ve already seen the passage of a stablecoin bill (as of last week’s “Crypto Week” in the US House of Representatives), an executive order for the beginning stages of a Strategic Bitcoin Reserve and Strategic Crypto Reserve and the most pro-crypto, pro-bitcoin, pro-digital assets government in the Western World.

Why?

Well, Trump’s motives are easy to pin down. He thinks the US (and his family) will make a lot of money from it all.

Not only that, but he (and his administration and family) see it as a political tool for power, leverage, money and popularity.

I do believe there’s sufficient brains somewhere in that administration that sees it for its core ethos of a financial backstop and a hedge against sovereign decay.

Also, most likely a path to redollarisation.

But the fact that this is now a national directive says what I’ve been writing for years, this isn’t a fringe idea anymore; it’s a new monetary order.

And the US is making sure it has a big say on how dominant and open they’re going to be in extracting maximum value from the opportunity.

So, while Reeves ponders her big sale, the US is putting into place frameworks on how to make something of it. That (whether it adheres to the origins and principles of bitcoin or not) is something that takes bitcoin and crypto to global mass adoption, and its promise of a global monetary system and reserve asset.

But in the UK, so far, the only political figure who seems to grasp the opportunity (and the urgency) is Nigel Farage.

I first interviewed Nigel about bitcoin back in 2020, and then several times in the years since. Even then, he understood that bitcoin represented something bigger than finance. We spoke about sovereignty, freedom and an exit from a failing system.

Now, Farage and Reform UK are the only party proactively pushing for a Crypto and Digital Assets Bill — one that would bring clarity to investors, enable innovation, and prevent capital flight.

Even just last week, our own Nick Hubble sat down with Nigel to discuss several things including Reform’s push for this bill to ensure the UK isn’t left behind. I highly recommend checking out Nick’s interview over on the Southbank Research YouTube page via that link above.

Maybe Reeves thinks this is just clever fiscal management. A one-off windfall to ease budget pain. But history has a funny way of judging these decisions, as the “Brown Bottom” can attest.

If Reeves sells 68,000 bitcoins at today’s price, and bitcoin hits $1 million in the next decade (as many credible analysts and asset managers, not just me, believe), she will be on record as the worst Chancellor in history.

Maybe history will call it The Reeves Rout, Brown Bottom 2.0, perhaps? Or maybe call it what it really is, confirmation that the UK government has absolutely no clue about the future of money and finance.

I’d love to know what you think, too.

Should Reeves be selling off bitcoin at all?

Should governments even be allowed to hold (or dump) these assets?

Or like me, do you think this would be a short-term win masking a long-term fumble of epic proportions?

Send your views to us: feedback@southbankresearch.com

But, as you should probably know by now, I’ve been saying the same thing for over a decade.

Bitcoin is not going away. The world is moving forward. And those who fail to move with it will be left with nothing but memories of what could have been.

Until next time,

Sam Volkering

Contributing Editor, Investor’s Daily