- The US housing market is in a “deep freeze”

- US consumers are property dependent

- How to profit from the coming bubble

The US property market is having a heart attack. And we all know what that can mean for the rest of us, don’t we? But are we really on the cusp of another 2008?

Well, it took about two years for the US property bubble’s “pop” to blow up the global financial system. Prices peaked in July 2006. It was only once they’d fallen a fair way that the threat to banks emerged.

Prices haven’t fallen much yet this time around. But the latest news out of the housing sector is certainly a worry for the direction those prices could take…

US home sales have dropped to their lowest level in over 30 years. Author Robert Kiyosaki pointed out that’s despite 20% population growth in the meantime.

US house prices fell in 39 major US metro areas in July – a record share of cities.

In July, the typical US home spent 43 days on the market, which is the longest July since 2015. It’s also up from 35 days recorded a year earlier.

US 30 year fixed mortgage rates went from below 3% to over 7% in 2022. And haven’t fallen much since.

The Kobeissi Letter posted on X about the supply glut:

Monthly supply of new homes in the US surged to 9.8 months in June, the third-highest since 2008.

This indicator measures how many months it would take to sell current builder inventory at the current sales pace.

By comparison, the long-term median is 5.8 months. Since the 1960s, 5 of the 6 times builder supply reached this level, a recession followed.

The only exception was 2022, when the economy narrowly avoided a recession.

Real estate analytics company ATTOM estimates an 11% jump in foreclosure activity in July.

The list of worrying news goes on.

Who cares about US house prices?

It might seem laughable to ask that question after 2008. But a property price slowdown matters in a surprising number of different ways. If prices drop, it’ll certainly show up in your portfolio too.

The US consumer’s vast demand for goods and services is what ignites the global economy into action. But that demand is heavily influenced by US property prices. Hence the mention of recession from the Kobeissi Letter.

They call it “the wealth effect”. People buy more stuff when they feel wealthier. And homes are their biggest asset. Making house prices the defining factor for the wealth effect.

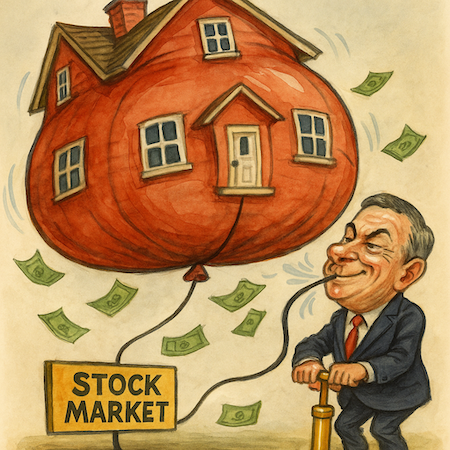

There’s another consideration. A key engine of money supply growth is US mortgage borrowing. If people stop borrowing, the money supply shrinks. That’s because banks create new money when they lend.

House price gains also allow for mobility of labour. People can sell their home and move to another location for a better job. That’s hard to do when house prices haven’t created home equity.

In property markets that are not used to an uptrend, people tend to remain stuck at home, literally. This is bad for productivity because people don’t move to better jobs.

The list of ways that US property prices matter to your stock portfolio goes on and on. But stocks don’t seem to care. Heck, housing stocks themselves don’t care. The S&P Homebuilders Select Industry Index is soaring.

How can home builder stocks jump 22% since June when the property market is “frozen” according to Yahoo Finance?

The answer should be familiar.

Mortgage fraudsters are back to blowing bubbles

It’s terrifyingly ironic that a Federal Reserve governor has been caught committing mortgage fraud. The guardian of financial stability committing the very sin that almost sank financial markets altogether in 2008.

But Fed Governor Lisa “cook the books” Cook is merely symbolic. This time around, central bankers are blowing a far bigger bubble than US property. They’ve been financing government bond markets.

Without a flighty bond market run by investors to keep governments responsible, politicians can run up absurd debts. Politics becomes about who makes the biggest promises, not who can run the country well. As Dick Cheney put it, “Deficits don’t matter.”

And I don’t think any promises in the history of the world top controlling the planet’s climate. Only in an age of central bank bailouts would any politician make that promise. Voters must first be convinced of Dick Cheney’s wisdom. Not an easy task…

The irony is that governments are now so reliant on central bank funding that it can no longer be withdrawn. The accountability mechanism is gone. The Bank of England would have to bankrupt the UK government before politicians would be willing to change tack.

They almost did, under Liz Truss.

And so this bubble will be very different to 2008. We’re going into the crisis with a complete awareness that central banks will do “whatever it takes” to keep governments cashed up.

The coming interest rate decision by the Fed will be just another round of proof for this. Cutting rates with inflation still well above target!? After the last three years? They have no shame.

The result will be a melt-up, not a melt-down. The value of money is what will plunge. That’s why even US homebuilders are rallying into the crash. Here’s one asset poised to profit.

Until next time,

Nick Hubble

Editor at Large

P.S. If you think the big moves in AI are behind us, keep your eyes on 17 September. That’s the date I believe one little-known $38 investment — what I call the AI Master Key — could start moving fast. It’s already on my radar… and you can see why right here.