Publisher’s note: Empires don’t collapse overnight. They crack.

In today’s dispatch, Bill Bonner traces those fractures — from the congested autoroutes of France to the fragile façade of the American economy. His message is clear: once-mighty systems are showing their age.

And we’d be foolish to think the UK is immune.

The more central banks step in to shield markets, the more brittle they become. The more politicians meddle, the more investors are forced to the fringes — searching for real, lasting value in a world built on debt and illusion.

It’s not doom. It’s the quiet sound of something giving way.

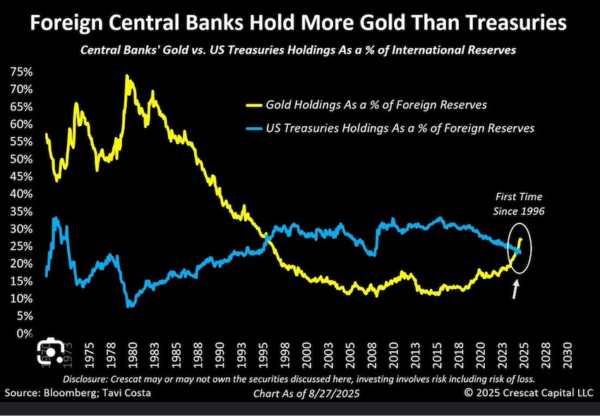

Source: Otavio Costa, Crescat Capital

Bloomberg:

Modi shores up ties with Russia and China in defiance of Trump

US News:

US-Venezuela Tensions Rise as US Warships Arrive in Southern Caribbean

Forbes:

Powerball Jackpot Hits $1.1 Billion For Labor Day Draw

Like a homeless man looking for a half-eaten sandwich, we range far and wide today. The declining empire, the magic of marriage, and the coming stock market collapse – they are in every dumpster.

“You are no longer two people,” said the priest at Saint Jean de Malte after he had completed the marriage sacrament. “That is the magic of marriage. You are now ‘one flesh.’”

The cross of Malta was on the walls and in the stained glass. It is also a favorite of America’s Secretary of Defense, either because he sees himself as protecting Christendom from the infidels…or because he got drunk on shore leave and woke up with it tattooed on his chest.

The church was built in the 13th century by the knights Hospitallers, of the Order of Malta. The knights were fierce soldiers. In 1565, a group of 500 of them held off an Ottoman force of 40,000 as Suleiman the Magnificent tried to take the island of Malta from them. After four months and huge losses, the Turks gave up and went home.

Sometimes the magic works. Sometimes it doesn’t. In a marriage it tends to work in stages. A couple faces challenges in their connubial life. As they rise to meet them, the bond goes stronger.

As our friend Nassim Taleb would say, the marriage is ‘fragile’ in the beginning, but it becomes ‘anti-fragile’ with time. We saw many of these older, anti-fragile couples among the tourists in Aix-en-Provence yesterday. They held hands. Or they simply wandered through museums together, confident that the spouse with which they entered would be the same one with whom they departed.

A young person is typically anti-fragile. He doesn’t need no stinkin’ covid shot, for example. Injuries and colds slide off of him like a baby-wipe. Later in life, as an old man, he becomes as fragile as a teacup. Even climbing out of a bathtub might do him in.

Fragility can be cyclical too. When the stock market is low, bad news is expected; it does little damage. But at the top almost anything can cause a crash…while there is almost no ‘good news’ that will send stocks higher. They’ve become fragile.

And when the feds undertake to protect a fragile market – by cutting interest rates, for example – they only make it more fragile. Markets, like marriages, and children, need challenges. They need setbacks. They need to learn from adversity. And that which doesn’t kill them, as Nietzsche put it, makes them stronger.

A stock market is healthier after the money-losing, badly managed, hopeless memes and jokes are washed away, not before.

These thoughts were on our mind as we took the road from Poitiers to Aix-en-Provence. In days gone by, the drive would have taken two days, with many stops in small towns along the route.

Those were the days of ‘motoring’ through France, the days before the construction of the network of ‘autoroutes’ that now race traffic throughout the country.

The autoroutes cut through mostly empty countryside. You may drive at 70mph for hours and not really see a house, a hotel, or a real restaurant. Even driving through cities, you see little but roofs or concrete abutments. And in the rest areas, much like those along the New Jersey Turnpike, you can get a cup of coffee, snacks and fast food. Not much more.

Our friend, Warren Trabant, had been a photographer for LIFE magazine. He lived in France in the 50s and 60s and enjoyed it when it was probably at its best – before it became over-taxed, over-regulated, and over auto-routed. Back then, France reached some kind of post-war peak. It had some of the world’s best cars – notably the Citroen DS. It also had the best restaurants (such as Maxim’s in Paris…in which Brigitte Bardot caused a scandal when entered with bare feet.) France even had a version of the internet – the minitel – fifteen years before it was built out in the US.

But in 1981, Francois Mitterand was elected. He introduced many of the labor rules, subsidies and regulations that that make doing business in France difficult and expensive. Since then, (though not necessarily because of him) many of France’s talented, well-educated and ambitious innovators have left the country. And today, the French buy their cars from Germany, Japan or China. And McDonald’s and KFC franchises are hither and yon.

The highway system is sleek and modern. But on the last weekend of the summer vacation, the centralizing traffic backs up. On the road between Clermont Ferrand and Aix, cars were backed up for what seemed like fifty miles.

France, perhaps like America, seems to have become old and fragile.

More to come…

Best,

![]()

Bill Bonner

Contributing Editor, Investor’s Daily

P.S. At Southbank, we’re paying close attention to what comes after the cracks — and where the strongest opportunities lie in a fragile financial world.

One of those, according to Nick Hubble, is what he calls the “AI Master Key” — a little-known asset tied to every major AI development, yet overlooked by the mainstream. It’s not a stock, ETF, or crypto. And it could move sharply as soon as 17 September.