Publisher’s Note: Bill’s essay today focuses on the structural forces reshaping the US dollar system.

For UK investors, the politics are secondary.

The real issue is this:

If the United States is running $2 trillion annual deficits…

If China is quietly reducing Treasury exposure…

If debt rollover requirements are approaching $10 trillion in the next 12 months…

Then the global monetary anchor is shifting.

And when the dollar shifts, nothing in the UK sits still.

Sterling does not float in isolation. Gilts do not price independently of Treasuries.

Gold does not move on UK sentiment alone.

If confidence in US fiscal discipline erodes, we will feel it here — through bond yields, currency volatility, capital flows and risk pricing.

You don’t need to agree with Bill’s political framing to recognise the underlying structural point:

Reserve currency status is built on trust. Trust is built on restraint. Restraint is in short supply.

For UK investors, the question is not whether the US system collapses.

It’s whether we are entering a period of:

- Higher structural inflation

- More volatile bond markets

- Increased geopolitical fragmentation

- Stronger long-term support for hard assets

That is where portfolio positioning becomes critical. And we’ll be there to help you along the way.

Bill’s analysis looks dramatic on the surface.

But beneath it lies a simple reality: The world’s largest debtor is asking markets for more patience.

Markets don’t grant that indefinitely.

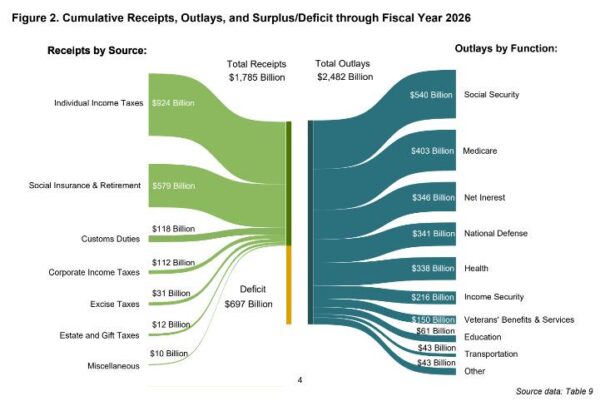

The US is on pace to run another $2 trillion annual deficit, one third of the way through the fiscal year. Source: Monthly Statement of the US Treasury

The US is on pace to run another $2 trillion annual deficit, one third of the way through the fiscal year. Source: Monthly Statement of the US Treasury

First, what’s this?

Barron’s reports:

Federal deficit shrinks for the fourth straight month

The gap between government revenue and spending has narrowed for four straight months, helped by President Donald Trump’s tariffs and major cuts in spending on education and other departments. Data disclosed Wednesday by the Treasury Department showed the federal government spent $30 billion more in January than it brought in. That compares with the gap of $82 billion notched in January 2025.

The Trump cheerleaders on Fox news this morning were positively in Rapture. The latest growth and employment numbers suggest that “this could be a very good year,” said Larry Kudlow.

“Growth,” they all agreed, will surprise everyone.

The voters may be in a gloomy mood now, the Fox finance team admits, but ‘everything will change’ as soon as Kevin Warsh opens his mouth in his confirmation hearings before the Senate Finance committee. He’ll explain that ‘growth’ changes the picture dramatically…and that he will cut interest rates to give growth a leg up.

‘Don’t worry about inflation,’ he’ll add. ‘Greater output will take care of that.’

And so, to win the mid-term elections…“All they have to do is to get the word out,” they chanted.

As always, however, ‘the word’ is more ambiguous than Fox News pretends. Next week, we’ll listen to it more carefully.

Today, let’s keep our eye on the golden ball. The South China Morning Post reports:

China wants its banks to hold fewer US Treasuries.

China is urging its biggest banks to curb their exposure to US Treasuries, a calculated intervention in the plumbing of global finance that reveals something uncomfortable about where Asia believes risk now sits. Chinese regulators have instructed large banks to stop adding to already heavy positions in US government debt and to reduce exposure where it has become excessive.

This is the problem that the new man at the Fed, Warsh, will face. Even with improving monthly deficits, he’ll have about $10 trillion in debt to finance or roll over in the next twelve months. And he’ll have fewer people who want it to roll over on them.

Gussied up in the mumbo jumbo of modern economics, Warsh can say whatever he wants. But it hardly matters. He’s playing the cards dealt him by History. US debt is rising. Confidence in the dollar is falling.

Where did these cards come from?

The post-WWII rules-based orders put rules on money too. The US broke them in two important ruptures.

To keep the chronology straight, first, the US reneged on its promise to exchange dollars for gold in August of 1971. Thereafter, dollars were still the world’s reserve currency, but nobody had any guarantee that they would remain limited and valuable.

As one might have expected, the quantity of dollars — via fractional reserve banking — did increase, relative to supply of goods and services they could buy.

As we saw yesterday, an F-150 was $1,200 in 1971. It’s $40,000 today. An average house, meanwhile, was $28,000 in 1971. Now, it’s $460,000. The average wage this year is about $33 an hour, compared to just $4 an hour 55 years ago.

It might have been worse. Even with these huge price increases at home, the US was exporting much of its inflation overseas. That was the “exorbitant privilege” that Giscard d’Estaing noticed. Foreigners took US IOUs and never cashed them in. Instead, they put them in their vaults as ‘reserves.’

But for 70 years, the world took the rip-off with good grace. What it took less well was the second breach of the rules–turning the US money system into a hammer. Beginning in the Biden Administration, the world realized that the US would use its control of the dollar system to whack foreign countries, often for what seemed like fickle or unreasonable purposes. If the US disapproved of the foreigners’ policies, it would hit them with ‘sanctions.’ Or seize their assets. Or cut them off from the international banking system. Voice of America:

Biden Slaps 500 New Sanctions on Russia Over War, Navalny Death

This was not the first time the US had used trade for foreign policy purposes. The Roosevelt Administration had cut off Japan from US exports, which — arguably — led to the bombing of Pearl Harbor.

But the Biden and Trump regimes took it to a whole new level. They removed any pretense of neutrality for the US money system. The dollar was no longer trustworthy. And thereby America gave up the exorbitant privilege of providing the world’s reserve money.

What comes next?

Stay tuned.

![]()

Bill Bonner

Contributing Editor, Investor’s Daily

PS: Bill’s warning about the dollar isn’t theoretical.

If the world slowly loses confidence in US debt if China keeps trimming Treasuries…if deficits keep compounding… then hard assets don’t just benefit — they reprice.

That’s why I’ve been looking beyond simply owning gold.

Richard Branson isn’t buying sovereigns or stacking bullion. He’s backing a little-known gold play that’s quietly outperforming traditional miners, without owning a single mine.

And in a world where reserve currencies are being questioned, that kind of asymmetric exposure becomes far more interesting.

Click here to see exactly what Branson is doing — and how you can position yourself accordingly.

Capital at risk.