- Trump has unleashed animal spirits

- Mining booms pay well

- How to profit from the coming bonanza

You’ve probably heard of the South Sea Bubble. And its French counterpart, the Mississippi Bubble.

They were history’s first great stock market manias. Despite occurring 300 years ago, they’re still hung out as proof that unfettered laissez faire capitalism ends in national disaster.

What people don’t realise is that both initiatives were actually designed by the government to cut the crippling national debt. Hardly laissez faire…

In fact, the South Sea Company was launched because the government was unhappy about relying on the new Bank of England to cover its borrowing needs. That’s a clear echo from history we face again today – just ask Liz Truss about it.

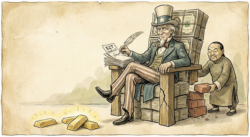

Today, the UK and French governments are back in too much debt. But they’re not the ones trying to revive the old scheme from 300 years ago. That’d be President Trump.

Before we get to that, I’d better explain how it all worked the first and second time around, back in Sir Isaac Newton’s day…

How to engineer a stock market boom big enough to repay the national debt

The 18th-century French and English schemes were simple in theory…

First, the government set up a joint stock company – a new concept that required a Royal Charter.

Then the government sold a trade monopoly to the new company. The British sold whaling and slave trading rights to the South Sea Company. And the French sold the right to trade with the colony of Mississippi to the Mississippi Company.

Investors could buy shares in these companies in the hope they’d eventually become immensely profitable from their global trading ventures. This raised vast sums of money from the public.

But the South Sea and Mississippi Company didn’t invest much of the newly raised money in trade. They used it to buy up the national debt instead…

The higher the share price of the companies went, the more the governments’ debt burden was soaked up. The governments could borrow cheaply thanks to a willing lender, and the consolidated debt became much cheaper for the government to manage. The savings to the French and British exchequers were huge. And the general improvement increased the value of the government bonds held by the new companies.

The trading ventures never really got off the ground. It’s debatable whether they ever had much of a chance. But by using this piece of financial engineering and balance sheet reshuffling, governments were able to bring their debts under control… for a while.

Unfortunately, the French and British governments spent the proceeds of their schemes on making war on each other for the next century. But that’s beside the point for our purposes today.

Why point out this ancient history? Because it’s about to rhyme…

Trump’s dirty dusty bailout

The President is stuck with a long list of challenges that would’ve been familiar to King George and Louis 300 years ago…

The national debt is too high.

The deficit is too large.

The economy is growing too slowly.

Energy prices are too high.

China has a stranglehold on key resources.

What’s noticeable about all these is how a mining bonanza would solve them all in one fell swoop.

Resources are subject to royalties and other taxes that make them a huge fiscal tailwind.

Large-scale production of resources brings down their price. This filters through to inflation. It also makes the US more cost-competitive in industry.

Mining tends to be productive and pays high wages in regional areas. That’s a golden combo for goosing GDP.

To sum it up, Trump’s best bet is to engineer some sort or resources boom.

We’ve seen all this play out in the US’s more recent history…

Shale oil and gas reversed the US’ economic fortunes

America’s rise to become a global energy superpower required a major shift in government policy. Climate change, environmental laws, and countless other barriers had to be removed to permit fracking.

Today, the US is reaping the benefits. It even managed to save Europe from major gas shortages in 2022.

Companies operating in the shale oil space went bananas as a result. In the initial phase, Wharton Business School study found that, “shale oil development is responsible for a roughly $2.5 trillion of the increase in stock market value during this [2012-2014] time period.”

Shale oil production is expected to peak in 2027. It revolutionised the US economy and thereby the world.

The US federal and state governments collected hundreds of billions of dollars in tax revenue from the boom.

Today, the US is home to the AI boom because it is the only developed economy with reasonable energy prices and supply.

We are on the cusp of another such revolution.

But, this time around, it’s not just energy that’s making a comeback under far more permissive licensing arrangements…

Prepare for a shale-esque mining boom

President Trump is busy using executive orders to roll back the regulatory barriers to mining in the US. He’s permitting vast swathes of federal land. Accelerating the approvals process. And doing deals to provide investment dollars to fund mining projects.

What unleashed all this? Last year, the Supreme Court, which Trump appointed rather a lot of justices to, reversed the Chevron Doctrine. It gave government experts from environmental agencies the ability to interpret legislation and thereby block resource projects.

But now, judges must interpret the evidence for themselves when considering whether a project should go ahead. Environmentalists no longer hold the Trump card. Resources projects are now getting a fair hearing.

But President Trump isn’t just trying to use mining to fix his many challenges indirectly. The US government is actually taking stakes in mining companies themselves. If he can engineer a surge in their value, it’ll be astonishingly similar to the tailwind of the South Sea Bubble.

The stocks that the US government has taken an interest in are already surging in value.

To sum it up, we’re talking about surging government tax and royalty revenue. The monetisation of America’s natural assets.

But it’s not just about government revenue. There will also be very real benefits more akin to the shale boom.

American industry will have access to cheaper resources. GDP will rise on mining projects. Major US companies will begin investing in domestic projects instead of searching abroad.

At a time when governments need money, they can suddenly see sense.

Some of them, anyway…

How best to profit from this bonanza?

Find out here from a former government insider who knows from experience how best to play the coming change in mining permitting.

You see, Trump hasn’t rolled back every regulation governing where miners can dig in. And one of the remaining constraints ensures three companies will be the first to capture the gains from increased mining activity.

Of course, we should keep in mind that governments have a habit of spending more than they should. So solving fiscal problems with a boost in tax revenue may only lead to even more spending.

But the point is that Trump has unleashed animal spirits and hitched up the US government’s budget to the resulting boom.

Let’s hope it ends more like the shale story than our warnings from the 18th century…

Until next time,

Nick Hubble

Editor at Large

P.S. The government may overspend, overreach, and overpromise but that doesn’t mean you can’t position yourself ahead of the boom they’ve accidentally unleashed. The upcoming event breaks down the three companies poised to benefit first from Trump’s new mining-permitting regime. Seats are limited. Grab yours now and get ahead of the boom they’ve accidentally unleashed.