Last Saturday, I asked the question, “Are We Living in an AI Bubble… or Building the Roads for the Next Century?”

Last Saturday, I asked the question, “Are We Living in an AI Bubble… or Building the Roads for the Next Century?”

When I sent that piece into our publisher, China and the U.S. hadn’t yet kicked off the escalation of their on-again-off-again trade war.

In other words, when the AI market took an almighty battering last Friday, the 10th in U.S. trading hours, I hadn’t factored any of that into my Saturday essay, it was already in the process of publishing.

So, when you read it last Saturday morning, you might very well have thought to yourself, it is indeed an AI bubble, and what transpired over the weekend was the pin that burst the bubble…

Except…

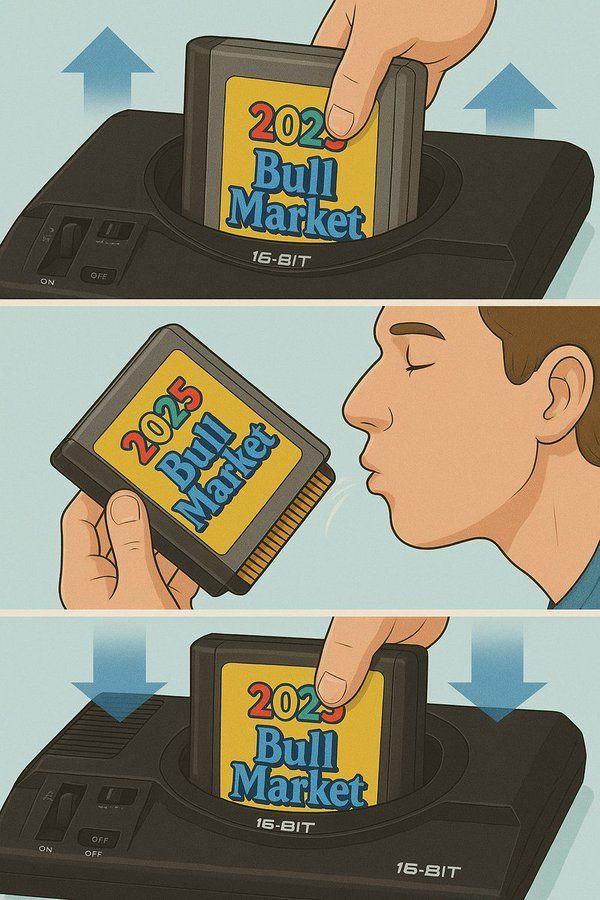

That’s a fun reference for anyone who lived on a staple diet of cartridge console games in the late 20th century…

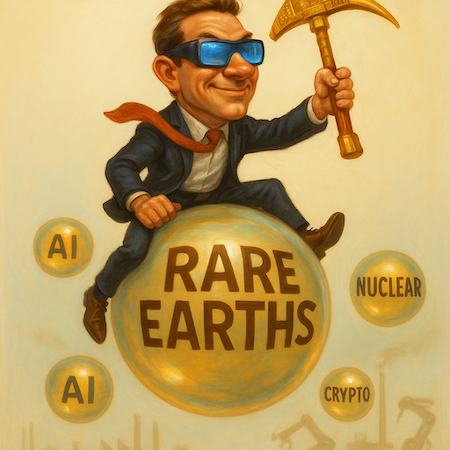

Rare earth boom and bust?

Yes, the market decided that any possible China tariffs punitively imposed by the US were going to fade away (again) and that trade deals would be struck.

That has been particularly noticeable in the rare earths market, mainly because China said they were going to restrict rare earth exports (they dominate the market), and then everyone kicked off about the national security importance of securing the rare earth supply chain for the future of technology.

Rare earths (that are not really all that rare, they’re just really hard to economically extract) companies have been on a melt-up higher.

Also, this is not the first time any of this has happened.

In fact, when it comes to rare earths, it’s déjà vu.

In 2010, the Obama administration had similar problems with China around the trade in rare earths. And then everyone kicked up a fuss about releasing that stranglehold China had on rare earth markets.

And would you believe the rare earth market did exactly what it is doing now?

Until China played nice, the “Trade War” fell away, and then through 2011, rare earth companies crashed down in value back to their true value, which wasn’t much considering many were “pre-revenue”.

Sure, the world is different now (sort of), and technology is far more advanced.

But also, it’s the same story, and the same market reaction. A decade and a half on and China still dominate rare earths, and they will for the next decade too.

In short, I see exactly why the rare earths market is pumping. We all know why. But this time is not different. And reversion to appropriate valuations will happen.

This market mania is also playing out in other pockets of the market.

Specifically, nuclear, quantum computing, space, robotics, VTOL (vertical take-off and landing), crypto stocks, and some others.

It’s all very 2021-esque.

Now that’s a good thing, because when the market is like this, you can make profit hand over fist. 100% in a month isn’t all that wild. I mean, it is wild, but not when the market has lost its sanity.

That never lasts. We all know that. And a lot of these zero-to-very-little-revenue companies will come back a lot. Make hay when the sun shines but also build a base for the long term.

When will they crash back? I don’t know.

That means you can ride some of these things higher and make some tidy profits… BUT… please ensure you’re taking profits out on the way through.

In fact, the best thing you can do if you’re playing in this high-risk volatile space, be it rare earths, robotics, quantum computing, nuclear, etc. is to make sure you de-risk positions. That means if you’re over 100% up, maybe think about taking out your original investment, and then letting the rest free ride.

That way if the stock does indeed go to zero, you’re no worse off than when you started. It’s a free swing for the fences then. Those kinds of smart strategies can make these kinds of markets so, so, so much more enjoyable.

And some of them will be absolute winners long term. But you don’t want to be caught buying your bags at the top and then waiting a decade for them to recover after they crash back.

Well… is it a bubble?

I will also add a little caveat here too; I stand by my view that we’re still witnessing a fundamental rebuilding of global infrastructure. AI factories, digital asset infrastructure, robotics, advanced compute, autonomous systems…

This will carry human progress forward for the next several hundred years. It’s taking the internet, the cloud, connectivity and scaling it up at a level hard to fathom.

The demand for compute, the capital expenditure is so large, and so much more is coming in the pipeline, that the numbers will scale up into trillions and yes, into the quadrillions in the coming decades.

And when you look at a logarithmic chart of the NASDAQ 100 index, you can see that valuations aren’t anywhere near bubble-like territory that we saw in the dot-com boom.

So, no, this isn’t a dot-com style situation.

And that’s because the big end of town, the NASDAQ 100, the likes of Meta, Amazon, Google, Microsoft, Nvidia, AMD, Broadcom, Tesla, etc, are all going to keep trucking along.

Profitable, stable, growing companies pinned to AI and the AI buildout will, over the next few decades, continue to soar higher. They might trade with price-to-earnings multiples in the 40s or 50s, but I don’t see that as an issue.

The growth they’re delivering justifies those multiples (and then some).

But, if your portfolio is stacked with companies whose earnings multiples are in the thousands or worse, don’t actually make any money, let alone profits, then you might want to rethink your life choices.

So, are we in a bubble?

Well, for some stocks, yes. For the others that are building the roads of the AI future, no.

Until next time,

Sam Volkering

Contributing Editor, Investor’s Daily

P.S. Boom… bust… repeat. If you’ve seen the rare earths cycle play out before, you know how these hype-driven rallies tend to end. But inside the noise, there’s real signal — and The Wealth Window is where we show you how to find it. James Altucher is looking past the speculative fluff and identifying the companies (and countries) best positioned to benefit from the AI infrastructure buildout ahead. If UK investors want a shot at the real wealth behind the tech revolution, this is your entry point. See what’s inside.