Publisher note: Don’t be fooled into thinking this is just an American story. If Trump takes control of the Fed—and cuts rates while markets wobble—the pound could surge, the dollar could sink, and UK inflation may rebound just as the Bank of England thinks it’s won. That could mean rate hikes here… or sterling chaos. Either way, UK investors need to prepare. What happens on Wall Street never stays there.

Recently, a rumor was unspooling on Wall Street. Donald Trump was said to be near to firing Jerome Powell.

Recently, a rumor was unspooling on Wall Street. Donald Trump was said to be near to firing Jerome Powell.

This was said to provoke more selling of US treasury bonds and more buying of gold and bitcoin.

The New York Times was on the story:

Trump Has Draft of Letter to Fire Fed Chair. He Asked Republicans if He Should Send It.

The president waved a copy of a draft letter firing Jerome H. Powell at a meeting in the Oval Office with House Republicans. It remains to be seen whether he follows through with his threat.

Just hours later, it appeared that firing Powell was “extremely unlikely.” MarketWatch:

Trump won’t fire Powell as Fed chair, says Treasury chief Bessent

“As President Trump said, he’s not looking to fire chair Powell,” Bessent said, during an interview with Bloomberg Television.

Bessent understands, perhaps better than anyone, how useful Powell can be.

But this little contretemps helps us to understand what is probably coming down the pike. In a nutshell, POTUS probably won’t fire Powell. His advisors aren’t idiots…they must fear a recession/bear market just as we do. Powell is their fall guy. They will tag Powell and his ‘high Fed interest rates’ with whatever happens.

And that is when the real trouble begins.

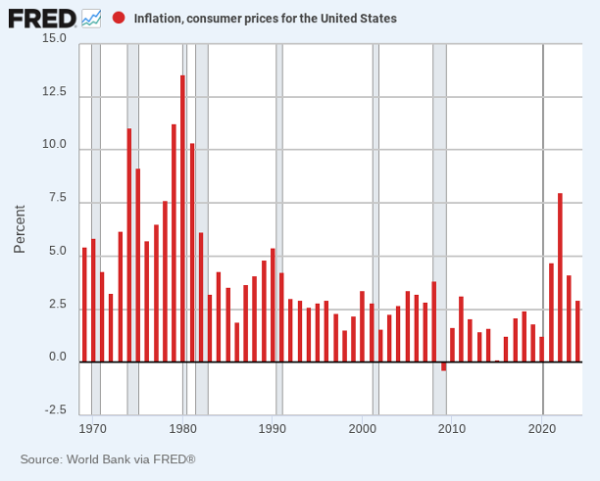

As former Fed governor Richard Fisher put it on Wednesday, “when presidents have interfered with the central bank, we’ve had hyper-inflation.”

Fisher must be recalling the early ‘70s. Back then Arthur Burns was in the Chairman’s chair at the Fed and Richard Nixon was down the street in the White House.

Burns had been a professor at Columbia. It was there that he stabbed his old friend, Murray Rothbard, in the back by rejecting the latter’s doctoral thesis on the ‘Panic of 1819.’ And it was from Columbia that he moved into government, rocking up as Fed Chairman in 1970.

The previous Fed chief, William McChesney Martin, had been unwilling to lower rates simply to placate the president. Burns was more accommodating. Although he had reservations, he backed Nixon’s infamous 1971 program, in which the dollar was cut loose from gold and wage-price controls were imposed.

The Fed’s key rate was dropped from over 9% at the close of 1969 to only 3.5% in January 1972. Inflation, which had been only 3% in 1972, rose to hit 12% two years later.

That record in mind, it’s not hard for us to imagine what might happen if Donald Trump were to have direct control of Fed policy. He’s already said the Fed should cut rates by 300 basis points.

Suppose he actually did that. How might it come about? Here’s our guess.

Trump will probably turn out to be right: the economy will run into trouble and Powell will come in handy. He will take the blame for whatever happens. Then, most likely, a crash in the stock market and/or a recession will give Trump the ‘emergency’ he needs.

The president will come to the rescue just as he did during the Covid Panic. He will take away Powell’s passkey and escort him off of the premises. In a sequel to the early ‘70s, the new Fed chairman will play Burns to Powell’s Martin; he will cut rates dramatically. And Trump will get to repeat those glory days of 2020, when the Covid raged and the president was able to hand out stimmies galore.

Too bad about what happens next.

Regards,

![]()

Bill Bonner

Contributing Editor, Investor’s Daily

P.S. If Trump’s next move is a quiet takeover of the Fed, the real story won’t be on the front pages—it’ll be buried in the bond market, the dollar, and the price of gold. Former CIA advisor Jim Rickards has seen this playbook before… and he’s revealing what it means for your money in his urgent new analysis. Don’t miss it.