- Trump will install a crony at the Fed

- Prepare for another bubble and bust cycle

- Why silver is the best way to play it

Imagine if Chancellor Rachel Reeves could print money. Do you think she would’ve been tempted to print her way out of fiscal purgatory last week?

Luckily for us, the Bank of England controls the money supply. We don’t trust politicians with it anymore.

Which begs the question why on earth we would trust Bank of England Governor Andrew Bailey instead. But never mind that. We have even bigger fish to fry…

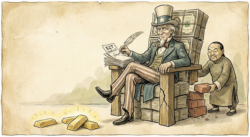

In 11 months’, time, President Trump will replace Federal Reserve Chair Jerome Powell. And then we’ll find out what happens when a politician gets his hands on the printing press once more.

You see, Trump has been giving Powell absolute hell for not cutting interest rates. Trump wants cheap monetary policy to goose the economy and financial markets. Not to mention making it cheaper to refinance the whopping national debt.

But Powell refuses to oblige. He’s worried about inflation. Or claims to be.

Trump is so desperate to give the economy a monetary shot in the arm that he’s considering announcing Powell’s replacement early. Very early – in coming months instead of next year. The idea is that financial markets will begin to price in a Trump crony at the Fed long before one arrives in May 2026.

You don’t need to cut rates to get a boom. You just need people to believe rates will be cut in the future.

A few people are already pitching for the top job by agitating for rate cuts this year. They hope Trump will notice they’re willing to do his bidding already.

Today, I’d like to explore what’ll happen if I’m right about all this.

A familiar story…

If Trump captures the Federal Reserve by installing a crony, interest rates will be markedly lower in coming years.

This will allow the government to refinance its debt at cheaper rates.

It’ll goose GDP with additional private borrowing.

Stocks will jump as debt becomes cheap and bonds return less.

And inflation will rise.

But here’s the thing: inflation doesn’t always show up in consumer prices.

Cheap money can inflate house prices instead. Or the stock market.

For some reason, we don’t consider this to be inflation worth worrying about. Heck, it looks like a good thing.

But what I’m predicting is a fake boom. A bubble very similar to the housing bubble we saw between 2003 and 2007. And the Japan bubble in the 80s.

Of course, the whole point of a bubble inflated by artificially loose monetary policy is that it eventually bursts. But not before an epic boom that lasts far longer than its critics ever expect.

A boom you should be ready to profit from.

What happens next

The 2006 housing bubble was deliberate. Don’t believe me? Here’s Paul Krugman writing in the New York Times in 2002:

To fight this recession the Fed needs more than a snapback; it needs soaring household spending to offset moribund business investment. And to do that, as Paul McCulley of Pimco put it, Alan Greenspan needs to create a housing bubble to replace the Nasdaq bubble.

That’s just what happened. Fed Chair Greenspan kept rates too low for too long.

Congress and the White House helped funnel the money into property via mortgage sponges Fannie Mae and Freddie Mac. Not to mention legislation to help sub-prime borrowers get on the housing ladder.

It worked brilliantly for almost five years, of course. It’s easy to forget how much money was made before the 2008 crash took it all back.

But an investor who understands that artificially loose monetary policy creates a fake bubble can both profit from it and dodge the bust.

The big question is where the wave of money from loose monetary policy will flow this time. Which assets will it bid up? House prices? Tech stocks? Bitcoin?

There is also a risk we’ll see another bout of consumer price inflation like 2021 and 2022.

Conveniently, there’s a way to hedge your bets…

Silver booms both ways

Silver is enough of a precious metal to soar if inflation takes off. It’s also enough of an industrial metal to harness an economic boom if cheap interest rates have the desired effect for Trump: an industrial comeback for America.

If Trump’s tariffs, cheap energy and low interest rates funnel money into a manufacturing renaissance in the US, that means a lot of silver demand.

Best of all, the silver supply can’t easily adjust.

So, whether you’re expecting Trump’s crony to trigger inflation or another boom, silver could be the way to go.

Until next time,

Nick Hubble

Editor at Large, Investor’s Daily

P.S. Imagine knowing before almost anyone else which overlooked companies could ride the next AI explosion. That’s exactly what I plan to share in an upcoming broadcast. Details are on the way—keep an eye out. This could be the most important event you’ll see all year.