- Gold is a safe bet on political shenanigans

- When even Buffett bought silver

- A similar setup to today?

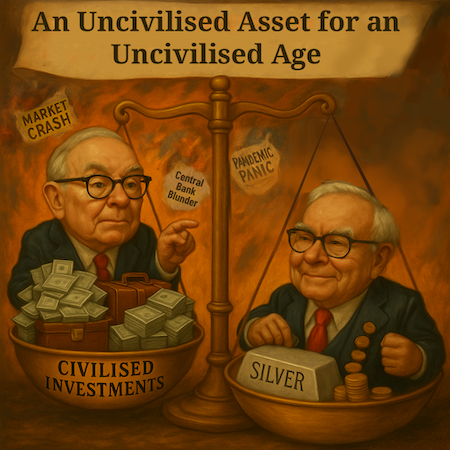

“Civilised people don’t buy gold.” So said Warren Buffett’s right hand man Charlie Munger back in 2012.

“Gold is a great thing to sew into your garments if you’re a Jewish family in Vienna in 1939,” he explained at the Berkshire Hathaway annual meeting.

I don’t know about you, but I’d say those Jewish families weren’t just civilised, but rather clever to buy gold when they did…

And I can think of several other periods when owning gold was a good idea too. As the uncivilised hedge fund guru Ray Dalio put it, “If you don’t own gold, you know neither history nor economics.”

I’ve owned gold for more than a decade now. And gold was the top performing asset class rather often during that time…

But let’s be fair. Munger’s claim was that you’re better off investing in “productive businesses” than a lump of inert metal. Businesses can grow their value and pay out profits to owners. Gold just sits there doing nothing.

The trouble is, sometimes productive businesses get hammered. Politicians get big ideas, central bankers make a boo-boo, or a pandemic comes along. In which case gold begins to look rather nice and shiny.

The real question investors should ask themselves is what sort of age they’re living in. It’s no good being civilised if you’re living in an uncivilised age.

Gold and Berkshire Hathaway shares have performed equally well over the last 27 years!

Initially, Berkshire’s performance left gold for dead. But gold came back big time in the end.

When an inert lump of metal is outperforming the world’s greatest investors, we must be living in a very uncivilised age indeed…

The thing is, Munger’s insults weren’t the first time precious metals featured in Berkshire Hathaway’s history…

When even Warren Buffett bought silver

In a 2006 meeting for Berkshire Hathaway shareholders, one attendee noted that Warren Buffett had once owned one of the largest stores of physical silver in the world.

“Could you please help us to understand,” he asked, “how you determine the value of a non-interest-bearing precious metal?”

Buffett explained that his decision to buy 130 million ounces of silver in the late 1990s was a trade, not an investment. It was a way to profit from the vast supply/demand imbalance he saw in the market at the time. Demand was outstripping new supply by around 100 million ounces.

Over time, this would hoover up the above ground supply of silver, eventually forcing up prices.

You see, the silver and gold markets are a bit odd. You never run out of either. There’s simply too much silver and gold sitting in investor’s vaults.

Instead of shortages, it’s just a question of how high the price has to go out to convince enough investors to sell their holdings to meet demand.

And that’s what Buffett was punting would happen.

But there was another reason Buffett was bullish on silver

“Added to that,” Buffett said, “was the fact that there were relatively few silver mines— pure silver mines. Silver is largely produced as a byproduct of copper, lead, and zinc, so it was not easy to bring on added production.”

“So all of that added up to the fact that I thought silver would get very tight at some point. And… I was early in that conclusion and I was early in selling, and we did not make much money on it.”

Characteristically, Buffett was being a bit hard on himself – he made $97 million in profit from his silver trade, after all. Back when that was serious money.

But as he acknowledged, he left some serious money on the table by cashing out when a silver rally was just beginning… He sold his silver ounces at $7.50/oz, before silver prices went on to nearly double within a few years.

A similar setup for silver today

It’s speculation on my part, but I would be surprised if Warren Buffett isn’t taking a hard look at buying physical silver again. Perhaps he retired from Berkshire Hathaway because he didn’t want to be haunted by Charlie Munger’s ghost calling him “uncivilised” for buying a precious metal…

After all, there are some strong parallels between the setup for silver in the late 1990s and today.

First, there’s a similar deficit between new supply and demand. We’re in the fifth year of it.

This means the world is steadily depleting its above-ground stockpile of investors’ silver, causing the price to rise to bring out more supply.

And new supply from mines won’t close the deficit for at least a few years because the dynamic Buffett pointed to in 2006 is still true today – supply of silver can’t simply be turned on like a tap, because most silver comes from mines that focus primarily on copper, lead, zinc, or gold.

Because silver is normally produced as a byproduct metal the supply-demand gap can’t be answered by opening new silver mines. There are precious few exceptions to this rule.

More on those, next week.

Until next time,

Nick Hubble

Editor at Large, Investor’s Daily

P.S. If history shows us anything, it’s that wealth windows don’t announce themselves. Whether it was Buffett quietly loading up on silver or investors pivoting to gold when everything else collapsed, the biggest gains often come when you bet against the consensus. Today, a new wealth window may be opening—not just in precious metals, but in the technology reshaping the financial system itself. Make sure you’re positioned before the crowd catches on.