Publisher’s Note: The single best piece of investment advice I ever received was to buy gold. And yet, I can’t claim to have been early to the idea. I first bought gold in 2008, just before the world’s markets collapsed.

Ever since then, it has been the one asset where I’ve never regretted owning what I own, and only regretted not owning more. In today’s essay, Jim Rickards digs deeper into the reasons for owning gold, and where the price could be heading next…

It’s a subject we analyze continually, and we have recommended gold as part of a sound investment portfolio for years. Today the dollar price of gold is hovering near all-time highs over $3,300 per ounce.

Gold has been on a tear lately. It was $1,830 as of October 5, 2023. At today’s prices, that marks a 75% surge in just 18 months. Gold has outperformed stocks by a wide margin this year, but it has also outperformed stocks for the past twenty-five years. Gold was around $250 per ounce in 1999. The gain since then is 1,180% or almost 12 times the starting price.

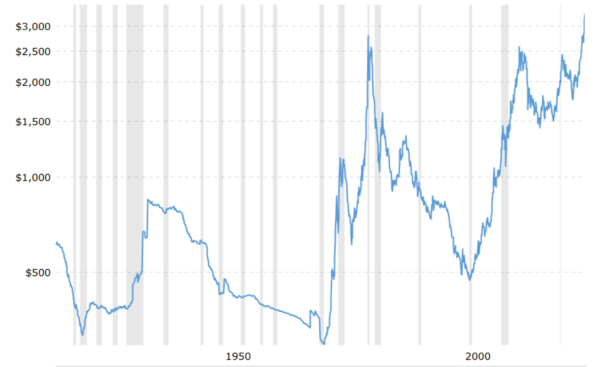

This is not the first bull market for gold. In the gold bull market of 1971 to 1980, gold rose 2,185%. In the gold bull market of 1999 to 2011, gold rose 670%. There were notable gold bear markets from 1981 to 1999 and again from 2012 to 2015. There were no bull or bear markets before 1971 because the world was on a gold standard and the price was fixed at $35.00 per ounce from 1944 to 1971. Still, the upward trend in gold prices is relentless and undeniable. Taking the entire period from 1971 until today including bull and bear markets gold has risen over 9,000%. Not bad.

Of course, that’s all in the past. What investors want to know is where do we go from here? The short answer is up significantly.

Here’s Why

The most fundamental reason for the rise in gold prices is simple supply and demand. Central banks predominantly from developing markets moved from being net sellers to net buyers of gold in 2010. Total gold reserves of central banks have risen significantly since then from just over 30,000 metric tonnes (mt) to over 35,000mt today.

The top buyers were the central banks of Russia, China, Turkey, Poland and India. Russia increased its reserves by 1,684mt to a total of 2,333mt. China increased its reserves by 1,181mt to a total of 2,235mt. Iran is also a major buyer of gold, but it is non-transparent, and its purchases and reserves are not publicly known.

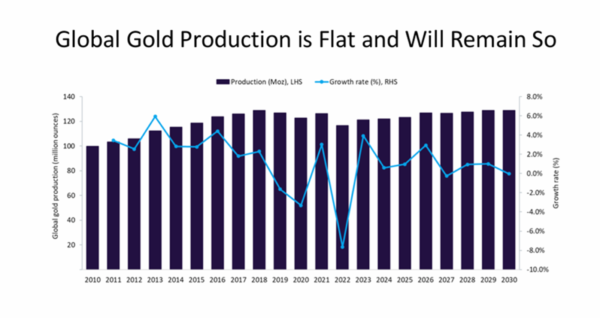

At the same time gold demand has been growing, gold output is flat. Global mining output of gold was about 130 million ounces in 2018 and was about 120 million ounces in 2024. Output declined slowly from 2018 to 2022 and then recovered slowly over the course of 2023 and 2024 but the change in both directions was slight.

Gold production is projected to grow slightly from today until 2030 but is still not projected to exceed the 2018 high. In short, gold production by miners is flat. This does not mean that we are at “peak gold” or that new discoveries are not being made. They are. What it means is that gold is becoming harder to find and costs of production (especially water and energy) are going up, so the total output trend is flat.

Continually increasing demand with flat output is a recipe for higher gold prices.

The second driver of higher prices is the role of BRICS+. From an original membership of Brazil, Russia, India and China in 2009 (South Africa joined in 2010), the group has expanded to include Egypt, Ethiopia, Indonesia, Iran and the UAE. It’s waiting list of additional members who will be added in the years ahead includes Malaysia, Nigeria, Turkey and Vietnam among others.

There was much discussion in 2023 and 2024 about a new BRICS currency that would displace the U.S. dollar in trade among members and might ultimately prove to be an acceptable reserve currency to rival the dollar. In fact, no such alternative currency is in the works. It might happen in the future but it would take ten years or longer properly to design and implement.

Instead, the BRICS are building a new payments system using proprietary cables, secure servers and highly encrypted message traffic protocols along with a blockchain-type ledger. Payments are in local currencies in the new payment channels that cannot be disrupted by western powers.

This begs the question of how trade imbalances accumulating in local currencies can be settled and converted into more liquid assets. The traditional answer was dollars. In short, the BRICS+ already have a new global currency, which is actually quite old – it’s gold. This is one reason why BRICS+ members are among the largest buyers of gold bullion.

The Everything Hedge

Importantly, gold is not just an inflation hedge, in fact it is an imperfect inflation hedge in terms of strict correlation. Gold prices have skyrocketed in recent years even as inflation has remained relatively tame (despite an inflation surge in 2022). A better model is to think of gold as the “everything hedge.”

The vectors of uncertainty are everywhere. These include tariffs, tax policy, the Department of Government Efficiency (DOGE), the War in Ukraine, the rise of China, a likely recession, left-wing violence, and even the status of Greenland and the Panama Canal among others.

It’s difficult to forecast how any one of these situations will turn out, let alone all of them and their complex interactions. Stocks and bonds can be volatile as a result. Gold is the one safe haven asset that powers through them all and offers investors some peace of mind. It is truly the everything hedge.

These drivers are sending gold prices higher and putting a floor under current price levels so that investors can enjoy potential upside with reduced concern about the downside. That’s what we call an asymmetric trade, which greatly favors investors.

Finally, there’s a simple bit of math combined with behavioral psychology that could propel gold prices to the $10,000 per ounce level in far less time than most analysts believe.

Investors naturally focus on dollar gains in the price of gold. When gold goes from $1,000 per ounce to $2,000 per ounce, investors cheer on the $1,000 gain. The same is true when gold goes from $2,000 per ounce to $3,000 per ounce. Again, investors pat themselves on the back for another $1,000 per ounce gain.

What investors don’t realize at least initially is that each $1,000 per ounce gain is easier than the one before. This phenomena involves the interaction of simple math and more complicated behavioral psychology.

The psychology is a matter of what’s called anchoring. The investor anchors on the number of $1,000 as a fixed gain and treats each such gain as the same. In pure dollars, they are the same. You make $1,000 per ounce as each benchmark is passed.

But here’s the conversion of those dollar benchmarks with each gain translated from dollars per ounce to percentages of the prior baseline:

Because each $1,000 per ounce gain begins from a higher level, the percentage gain associated with each dollar gain is less. The increase from $1,000 to $2,000 per ounce is a heavy lift. The increase from $9,000 to $10,000 per ounce is not much more than a good month. (Gold has been going up 1% to 2% daily with recent volatility).

This math is what gives rise to a gold buying frenzy. We’re not there yet. Gold buying has been limited mostly to central banks and large institutions such as sovereign wealth funds (SWFs). Retail interest in the U.S. has been slight although retail buyers have been more active in India and China. Once the frenzy kicks in those $1,000 benchmarks will be passed quickly. That’s why it’s not too late to become a gold investor. Don’t kick yourself about the gains you’ve missed. Instead, look forward to the gains that are coming.

How To Invest

The two main ways to invest in gold are what I call paper gold and physical gold bullion. Paper gold refers to securities and futures linked to the price of gold such as exchange-traded funds (GLD is the most liquid ticker), COMEX gold futures or unallocated gold purchase agreements available from large banks. Paper gold will give you price exposure and the potential for gains, but you do not own gold bullion. Many things can go wrong with a paper gold strategy including early termination of contracts, closure of futures exchanges or the failure of a dealer bank. You may find that you’re out of the gold market just when you most want to be in it.

Physical bullion is my preferred way to invest in gold. American Gold Eagle coins from the U.S. Mint in one-ounce or one-quarter ounce denominations are practical. For larger amounts you can look at 1-kilo gold bars from a reputable refiner. Do not buy “rare” or “pre-1933” gold coins unless you are a collector or numismatic expert. The premium for such coins is high and they are not worth the extra expense. Gold is gold.

Do not store your bullion in a safe deposit box. Banks are the first place the government will lock down in a crisis. Your gold could be seized. Use a private storage company like Brinks or install a home safe. If you’re using a home safe there are several techniques you can use to protect it. The best protection is not to tell anyone you have gold. That way no one will come looking.

Best,

Jim Rickards

Contributing Editor, Investor’s Daily

P.S. I’ve spent years studying the hidden levers of our financial system—what I call the “invisible gears” behind the economy. And I believe gold is more than just a hedge today. It may be the clearest path to reclaiming what I’ve called your American Birthright. Most people won’t see it. They’ll miss the signals. But those who understand the opportunity tied to a $150 trillion endowment hidden in plain sight… they could be in for a very different future. I explain everything here.

Unfinished Business

Bill Bonner, from Buenos Aires, Argentina

Many times in the past, Donald Trump was reportedly ‘finished.’ His many gaffes, faux pas and foibles would have destroyed a lesser figure.

But he survived…and grew stronger than ever.

And now…once again, the press is running hopeful obituaries. The Washington Post leads with a “It might be falling apart for Trump” headline:

Multiple polls this week showed Trump hitting new lows. His approval rating has been double-digits underwater in surveys from the Pew Research Center (minus-19), Economist-YouGov (-13), Reuters-Ipsos (-11) and now Fox News (-11).

Trump was already more unpopular at this point in his presidency than any modern president not named Trump; he’s now flirting with falling below where he was at this point in his first term.

Perhaps more troublingly for Trump, most of his major policies are even more unpopular than he is.

On Tuesday, the Trade War, the signature policy of the Trump II administration, came to what appeared to be a whimpering end.

First, Trump’s Secretary of the Treasury admitted to the whole world that his proposed Liberation Day tariff proposals were “unsustainable.” The trade war was sending Wall Street into a tizzy; the Wall Street Journal ran damning editorials; Republicans were threatening to revolt. Trump had no choice. He had to flip flop.

Since then, the Dow has recovered more than 2,000 points. But with no further risk from the Trade War, the foreigners have little incentive to make dramatic changes to their export policies. The Independent:

Trump keeps claiming he’s working on a deal with China. Beijing says that it is all in his mind

“There are no negotiations going on with the Trump Administration regarding lowering tariffs between the two countries,” adds the South China Morning Post.

Whatever the state of play, the effect will probably enrich the insiders close to the Trump administration and otherwise leave trade much as it was. Mediaite:

Fox Reporter Says the Trump White House Is Giving Wall Street Executives Inside Info on Tariff Negotiations

Then, on Wednesday, as expected, another key Trump program — the Department of Government Efficiency — bit the dust. Politico:

DOGE loses its biggest advocate as Musk exits Washington

Elon Musk’s claim that his job in Washington is “mostly done” may calm Tesla shareholders — but his departure could sap the Department of Government Efficiency of its disruptive energy even as it continues to make major cuts to the federal workforce.

In an effort to reassure rattled Tesla shareholders after a bruising first-quarter earnings call, Musk told investors this week that his around-the-clock involvement in DOGE will soon be scaled back to just a day or two per week.

The DOGE campaign made no more headway than the trade war. The problem was spending…not how the money was spent. And spending levels are determined by Congress, not by an independent, quasi-governmental agency led by a billionaire. Is there waste and inefficiency that should be cut?

Of course, there is. But every penny goes into someone’s pocket, though not always the pocket Congress intended for it to go into. And that pocket almost surely has political connections. Trying to cut the ‘waste’ without the support of Congress was always a fool’s errand.

Musk initially said he would cut $2 trillion from the budget — thereby eliminating the deficit. Then, he said the $2 trillion figure was ‘aspirational;’ it would be more like $1 trillion in savings. Finally, the DOGE website claims $160 billion in savings…most of which is probably illusory.

Poor Elon, he didn’t seem to understand what a nasty business he had gotten himself into. And now his cars are scratched. His showrooms are picketed. Tesla’s profits are down 71% and his own fortune diminished almost as much as DOGE claimed to save.

For most of us, even a loss of $1 billion would be troubling. Elon has lost $148 billion since January 17th.

The Trump collapse, however, is not limited to Trade Policy and DOGE. A former insider at the Pentagon told Politico that the military had become largely dysfunctional:

The last month has been a full-blown meltdown at the Pentagon — and it’s becoming a real problem for the administration.

Returning to the budget, the aforementioned Secretary of the Treasury, Scott Bessent, claimed that the Trump administration was trying to wean the economy off government spending so that it would return to the private sector.

Bad news for him!

During the first six months of the current fiscal year, deficits already total $1.3 trillion — a figure worse than any since FY 2021, a Covid year with DJT fingerprints all over it.

No reciprocal tariffs. No Liberation Day. No DOGE dividend checks. Chaos in the military. And we’re still going broke. A normal mortal would probably resign and retire. But is The Donald really finished? Probably not. His real mission remains unaccomplished.

Stay tuned.

Regards,

Bill Bonner

Contributing Editor, Investor’s Daily

For more from Bill Bonner, visit www.bonnerprivateresearch.com