You may have read my prediction essay from January 2 earlier this year.

You may have read my prediction essay from January 2 earlier this year.

If not, feel free to take a refresher here.

I wrote about the immense shortages in PC hardware I was seeing in the market as a result of AI.

I even posted a picture of a message I’d sent to a mate of mine who runs a large gold mining company.

Well, I’m back to add more context, just six weeks later.

Because the way I see it, within six to 12 months, we could see black markets forming around high-performance PC parts that are great at running local AI.

GPUs trading at massive premiums. Stolen ones running a bit cheaper on the dark web. Mac Minis and Mac Studios sold out everywhere. RAM hoarded like gold bars.

Ahem, yes, I fall into that last category. Guilty as charged!

But I must say, to give you context as to how big a deal this all is, I need you to know that I’ve lived through this exact scenario before.

And if history is any guide, what comes next could be one of the most profitable periods for hardware investors in a generation.

How much bigger could the AI rollout get? How about 1,000,000% bigger?

Yep, that’s not a typo. One million percent bigger.

No GPUs here, better go look on the dark web

Cast your mind back to 2010 and 2011. Bitcoin was worth cents. Maybe a dollar on a good day. And back to cents again the next.

On every crypto forum I trawled, dark web and surface web alike, the conversation was not so much about price. It was about hardware.

Which GPU is the best for mining? Where can I get one? Who’s selling at a markup? Can I buy in bulk?

There was even a constantly updated spreadsheet ranking every GPU on the market by hash rate and cost per watt.

Early on the AMD Radeon HD 5870 became legend. Not because it was the best gaming card but because it was the most efficient bitcoin miner money could buy. It was the first major leap from CPU mining to GPU mining.

That is, if you could find one.

They sold out everywhere. Retailers imposed purchase limits. Secondary markets exploded. Yes, stolen units circulated too. People paid double, sometimes triple retail just to secure supply..

And remember, this was when bitcoin was effectively worthless by today’s standards. The mainstream media wasn’t watching. Wall Street didn’t care.

But there was a genuine hardware rush.

First AMD. Then Nvidia. Then shortages. Then the move to ASICs, purpose-built mining machines. And before long, Bitmain’s Antminers had months-long waiting lists.

Bitcoin has returned well over 1,000,000% since those early forum days and GPU rush of 2010 and 2011.

In hindsight, the catalyst wasn’t bitcoin’s price. It was too volatile, too chaotic.

The real alpha was the scramble for the underlying hardware. GPUs flying off shelves. Secondary and black markets booming. Supply vanishing for a technology most people dismissed as a joke.

Today?

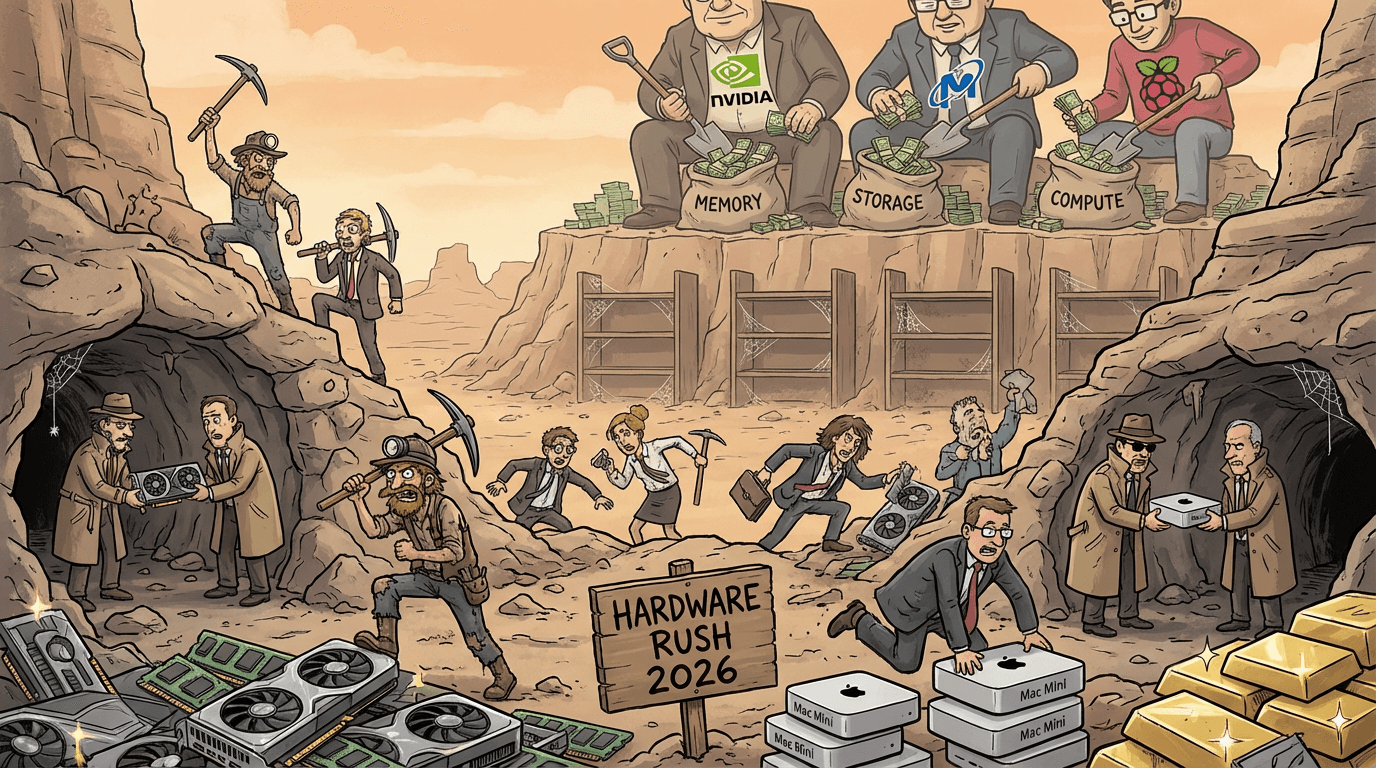

The same rush, different gold.

Take a look at what’s happening in 2026.

Nvidia has reportedly cut RTX 50-series production by 30 to 40% because it can’t source enough memory. The RTX 50 Super lineup? Delayed.

The next-gen RTX 60 “Rubin” cards? Pushed to 2027 at the earliest.

It’s the first time in roughly 30 years that Nvidia may skip an entire consumer GPU generation. Not because it doesn’t want to ship cards. Because the memory simply doesn’t exist to put in them.

Sony now says the PlayStation 6 is going to get pushed to 2029, maybe 2030, due to hardware shortages.Nintendo is warning its next-generation console may launch at a much higher price.

And you can barely get a high-spec Mac Mini or Mac Studio with upgraded memory. Delivery windows are stretching from six days to six weeks. Apple CEO Tim Cook admitted the company is constrained by memory supply.

High-memory Mac Studios that shipped in 14 days a month ago now show 54-day wait times.

But that’s not the whole story.

A big part of this surge traces back to the “lobster” I wrote about on 28 January.

An open-source project called ClawdBot, then renamed to OpenClaw (because Anthropic sent cease and desist letters to the developer), has gone viral in the developer community. So viral it’s triggered a consumer hardware rush eerily similar to what I witnessed in 2010 and 2011 with bitcoin.

This AI runs locally. On your own hardware.

It spread so fast that it kicked off a buying frenzy. First on Macs. Now on anything that can handle the load. And the acceleration is building.

This is the GPU mining rush of 2011 all over again. Different technology. Same scramble.

Don’t focus on which new AI model launches next. Don’t obsess over the latest chatbot feature.

Look at the shelves.

Where is the RAM? Where is the storage? Where are the GPUs? Heck, where are the CPUs?

Right now it feels like everyone must already know. Like I’m late. Like the mania is obvious.

That’s exactly how it felt in 2010 and 2011.

The truth is, most people still have no idea what’s happening.

They don’t grasp what AI is already capable of. They don’t see how developers are using it. And they certainly don’t see the hardware squeeze that’s forming underneath it all — a squeeze that’s only getting tighter.

In 2011, a small tribe of early adopters realised that if you controlled the hardware that powered the network, you controlled the upside.

They bought GPUs when nobody understood why. They mined bitcoin when the rest of the world thought it was a joke.

In 2026, a growing wave of developers, tinkerers, businesses, and consumers are realising that if you control the hardware that powers AI locally, you own your own intelligence.

You don’t pay monthly cloud fees. You don’t hand your data to someone else’s server.

You run it, you own it, and the hardware to do it is getting harder to find by the week.

Really bigger than Bitcoin?

Bitcoin is up over a million percent in roughly 15 years. It began as a curiosity on obscure forums, powered by consumer GPUs that were perpetually sold out.

AI is following the same demand curve but this time it’s backed by trillions in enterprise and government capital. Not hobbyists. Not forum posts. Serious balance sheets.

And the acceleration and scale are magnitudes bigger than bitcoin’s impact.

The companies supplying the core inputs — memory, storage, compute, networking — are still early in this cycle. I can see Nvidia (NASDAQ: NVDA) becoming a $20 trillion company in time. Micron (NASDAQ: MU) scaling far beyond what most investors currently imagine. Even a minnow like Raspberry Pi (LSE: RPI) becomes interesting when you realise a tricked-up Pi could run dozens of AI agents from a garage or shed.

I said that 2026 would be the year of shortage before excess. That the smart play was to buy the companies making the hardware that there simply isn’t enough of.

Memory. Storage. Compute.

The shovels in this gold rush.

Six weeks later, the shortage is deeper, bigger, more dramatic than I expected. And it’s showing up in the consumer market now with the same urgency, FOMO, and manic energy I saw on bitcoin forums in 2011.

Dare I say, few things really get me obsessed.

But the feeling I have right now, watching where AI is heading, is uncannily similar to those early bitcoin days.

If bitcoin’s million-percent rise felt like a once-in-a-lifetime anomaly, AI may eclipse it — in scale, in global impact, and in the wealth it ultimately creates.

Until next time,

Sam Volkering

Investment Director, Southbank Investment Research

PS: In the aftermath of WWII, the global economy didn’t just recover…it exploded into what historians now call the Golden Age of Capitalism. Entire industries were born. Fortunes were made. Power shifted.

The same forces are gathering again.

President Trump’s so-called “Project Oppenheimer” isn’t just another policy announcement. It’s a structural shift that could rewire energy, technology, and capital flows for decades.

If you want to understand how this could impact your money — and how to position before the crowd catches on — you need to see the full briefing here.