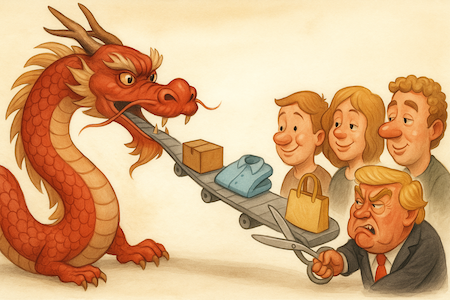

- Good luck ending our addiction to cheap goods

- China knows how to deal with economic dissidents

- Only one industry can compete with China

China has amended its divorce law. Assets are no longer split 50/50 between the feuding couple. Instead, they are divided based on who contributed financially. Housework don’t count.

Before you chuckle, or send me a nasty complaint, consider this. The West is currently trying to get a divorce from China. And it’s very clear who has been making the financial contributions in our marriage…

While Western consumers consumed, the Chinese produced. They now have the world’s factories, mills, and refineries.

Somehow, Western politicians reckon we’ll be better off without the Chinese.

But what if they’re wrong? What if China’s amended divorce law is a sign of what’s to come?

What if we are about to get fleeced?

A warning shot

Back in September, the government of the Netherlands invoked a rarely used Cold War era emergency law. They seized control of Nexperia — a Dutch-headquartered semiconductor company owned by Chinese firm Wingtech Technology.

Nexperia’s computer chips are a crucial part of the European car manufacturing supply chain. The Dutch government was worried the Chinese were stealing Nexperia’s technology and considering moving manufacturing to China. This would allow the Chinese to leave European industry high and dry for computer chips…in addition to so many other parts of the supply chain.

The Dutch Economy minister has since admitted he was stunned by the way China responded. His team hadn’t considered the possibility likely.

But the Chinese simply imposed the very constraints that the Dutch had been worried about in the first place. They stopped exports from Nexperia’s Chinese factories. It caused chaos for car manufacturing.

It’s a textbook case of China’s divorce law in action. The country that has the productive capacity wins a trade war. Jurisdiction is nine tenths of the law. And the factories are in China. Europe can legalise all it wants.

The Dutch have since surrendered. And the Chinese are letting the chips flow.

My point is…

It’s hard to break up with China

Decoupling our economy from China sounds like a good idea. But it comes with costs. Costs that may be so immense that we don’t quite pull it off.

For now, the Chinese taxpayer and slave-labourer are subsidising our consumption habit. The Chinese leaders believe this is a good idea because it keeps their population busy and increases their control over us.

We learned the hard way in Ukraine what this sort of economic dependency leads to.

So, it would seem obvious to wrestle that control back.

But has anyone done the maths on what the world would look like without China subsidising our consumption habits?

What level of consumption is sustainable if we have to produce our own goods?

If our Western companies have to make a profit, what prices would they charge us consumers?

If our Western companies have to employ us to make stuff, what could they afford to pay us?

If our Western companies must abide by environmental standards, what does that cost?

I suspect divorcing China amounts to a far lower level of overall consumption. Better known as a recession.

And that’s before you consider how China might respond to our divorce.

How many companies in your portfolio rely on Chinese manufacturing like Nexperia did?

How many could be cut off from their productive capacity during a geopolitical spat?

How many can handle cutting China out of their supply chains?

Politicians will tell you all about the benefits of cutting China out of the global economy. But what about the costs?

One industry can compete with China

The Chinese economic strategy is known as dumping. It seeks to produce vast amounts of goods at a loss in order to flood the world’s markets. This pushes its competitors into bankruptcy, leaving us reliant on Chinese manufacturing.

Part of the European Union’s initial reason for existing is to combat the practice of dumping. So, this problem is nothing new.

Perhaps a customs union of countries that agree to play by the rules will also be the outcome of this trade war.

But investors can hardly wait for that.

For now, I expect the trade war and dumping problems to accelerate. China will bite back at every attempt to wean the Western economy off its industries. We will see a thousand Nexperia type humiliations.

But not every industry is at China’s mercy. China doesn’t produce oil at scale. Instead, it demands vast quantities of it.

That’s why Trump’s economic strategy is focusing on energy first and foremost. He is unlocking vast amounts of hydrocarbons from Federal lands. An industry in which China cannot dump him, because it doesn’t have the resources.

Of course, this isn’t necessarily good news for the oil price. And so it’s not initially obvious how investors can profit.

But we have found three companies that are the linchpin of Trump’s strategy. They have a regulatory bottleneck on every new discovery Trump is trying to engineer.

I’m projecting 10x returns for each of them.

Until next time,

Nick Hubble

Editor at Large

P.S. Writing this piece reminded me how quickly the ground can shift beneath us when nations try to reorder the world. Jim Rickards has a new briefing out that examines these shifts from a perspective few analysts have — and today is the final day to watch it. If you’re trying to understand what these developments could mean for your portfolio, don’t miss this.