- Who started a crisis doesn’t determine who gets taken out

- UK government bonds are now a speculative asset

- We saw this crisis coming a month ago

Financial crises are funny things. They rarely cause a panic where they begin. Instead, someone else entirely goes belly up. Usually they’re in another hemisphere altogether.

If you want to understand where the next crisis will really do damage, you have to stop watching where it starts and start watching where fragility is building.

The bankruptcy of a small Thai property developer can trigger the default of entire governments in bond markets.

US sub-prime mortgage fraud can cause European banks to go bust.

A European energy crisis can leave Pakistan without enough gas.

The Shanghai commodity exchange buying up silver can cause chaos at JP Morgan’s trading desk.

The principle we can derive from this is that instability is part of financial markets. What makes a crisis is vulnerability.

Put these two insights together and you reach the important conclusion: financial crises don’t usually start with the most vulnerable. But wherever they begin, the most vulnerable get hit hardest in the end.

There are plenty of things going wrong each day. What matters is where fragility is accumulating.

All this will be mighty familiar to parents. Who started it doesn’t matter to us. It’s the most vulnerable that can’t handle the volatility.

Lately, my youngest has been growing stronger than the mischievous middle child. Crises have been escalating faster and growing more common as a result.

The solution is not to prevent chaos. That’s impossible. The solution is for everyone to be more robust.

This is achieved by avoiding bailouts when small failures can be absorbed. Letting children fall and bump into each other. Letting banks and funds fail before they become system-critical.

For decades, our governments and regulators have been busy avoiding such minor instability. This is breeding vulnerability.

The question is not where a crisis begins. It is where the vulnerability is accumulating.

Don’t keep more than one eye on Japan

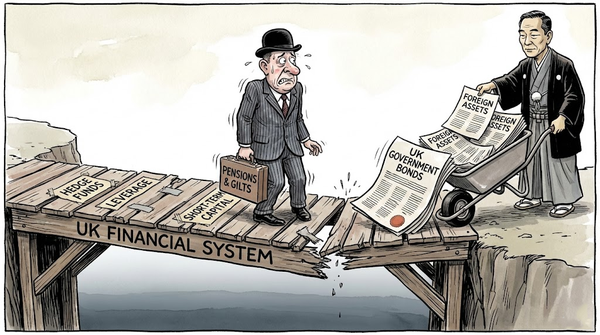

Right now, investors are obsessing about instability in Japan’s bond and currency market. Somewhere, someone is sitting on vast losses from a huge position in Japanese bonds.

So a crisis may well be beginning in Japan. But is Japan the vulnerable one?

Nope. It has vast foreign assets accumulated thanks to trade surpluses over the years. It owns many investments all around the world.

Before Japan gets into financial trouble, it will sell those foreign assets and bring the money home. This would both bid up their currency and their bond market in the process.

Japan can afford to bail itself out with its own money. It just needs to sell its investments.

Investments you also own…

Investments your pension fund owns…

Investments which fund the company you work for…

Investments which fund the infrastructure you use each day…

Investments which finance your government…

The question investors should be asking themselves is not whether Japan is vulnerable, but who is. Which assets will Japan be selling that cannot survive such a selloff?

The answer won’t surprise you. Even the Bank of England knows.

UK government bonds are a speculative asset

In financial markets, vulnerability can be measured in liquidity. That is, how many willing buyers are there for your assets?

If one buyer turns into a seller, will this trigger a crash? Or are there lots of long-term investors willing to buy?

Here’s what Bank of England Governor Andrew Bailey told the Treasury Select Committee a few weeks ago:

There has been a huge change in, frankly, the structure and nature of intermediation of Government bond markets in the past five [to] 10 years. They are now dominated by non-bank institutions, and hedge funds are a very big part of that.

A relatively small number of hedge funds are taking very big positions in what I call the cash market. They have the gilts.

This market development, I’ll be quite frank, has enabled a lot more debt issuance. It is supporting a much bigger market in that sense. It is not UK-specific, but all governments are therefore benefiting from the ability to issue more debt.

The question we have to face is, is that a robust structure from the point of view of financial stability?

It isn’t robust. This is flighty capital.

Our next sovereign debt crisis may begin in Japan. But it’s hedge funds’ panic selling in response that will get us into trouble first.

We’re the vulnerable ones. And we’re in the right hemisphere.

By the way, I recorded a video about all this with my old friend Jasmine Birtles of MoneyMagpie.

It’s a follow up to our video which predicted Japan’s current crisis a month ago.

Until next time,

Nick Hubble

Editor at Large, Investor’s Daily