Publisher’s Note: In today’s Investor’s Daily, Sam Volkering looks at the unexpected crossroads of tech (specifically, microchips) and geopolitics.

It’s something most wouldn’t have even considered until the supply-chain crisis began in 2020.

But now it’s on everyone’s mind. The key question is what’s the solution? Sam shares his take below. And keep reading for a related update from Jim Rickards.

As the tech market continues to get the rough end of Trump’s tariff stick, companies like Nvidia, AMD, Broadcom are now tumbling to prices that have erased years’ worth of performance.

And it raises the question as to whether you should be buying these stocks or sitting back waiting, poised to snaffle them up at lower prices.

Or jumping ship and avoiding them altogether.

Take a company like Nvidia. Miles in front of its nearest competitors like AMD or Intel. Even as its stock price falls on chip export bans and licence requirements to buy their chips, the market still looks at the company as having the biggest, strongest, most impenetrable technology moat in existence.

And yes, compared to American AI chip companies they are miles in front, with no clear pathway for a competitor to leapfrog them. Even the ambitious and confident Cerebras Systems and Groq are really heading down a different path (for now at least).

But what if Nvidia’s time at the top is limited? What if they’re not streets ahead as we might think.

Don’t get me wrong, I do think Nvidia is probably the best stock in the US markets right now. But I also have to consider the fact their dominance might be under threat. And if you haven’t figured it out by now, it’s a threat from China.

More specifically, from Huawei.

A fork in the geopolitical road

Over the last year, no other AI chip maker has done more to close the gap with Nvidia on AI hardware and infrastructure than Huawei. While US sanctions forced the company into a corner, necessity (and a heavy push from the state) has seen Huawei rise to the top.

Their latest developments suggest they’re not just providing a Chinese alternative anymore, they’re quite possibly ready to stand shoulder-to-shoulder with Nvidia on a global scale.

The things is, no one really knows just how far along they are (or aren’t). But it’s recognised that Huawei is effectively aiming to be the complete end-to-end solution for AI chips in China. The most significant part of this is that it includes lithography which has been a near monopoly of Dutch company, ASML.

If Huawei can do the complete supply chain for AI chips, Nvidia can kiss their Chinese market goodbye for good (thank both US political parties for that) and very likely their global dominance.

The only question from there is whether other countries outside of China have the courage to defy the US, deal with Huawei and China and run the Trump gauntlet.

I expect that the biggest most controversial trade bargaining chip will be access to, and the ability to deal in AI chips. And countries will have to side with China and Huawei, or America and Nvidia.

New chips, mass shipments, and China’s Strategic Response

News that’s only started to filter out as of the last couple of days suggests that Huawei is preparing for the mass shipment of its latest AI chip, the Ascend 910C. This is said to be two 910B’s strapped together, but importantly at the level of (or surpassing) the capabilities of Nvidia’s renowned H100 chips.

According to a report on Reuters, Huawei’s new chip is already being supplied in substantial quantities to Chinese cloud giants like Baidu and Tencent and will be the primary chip used by Chinese AI companies.

The timing isn’t coincidental. US export controls have left Chinese firms scrambling for alternatives to Nvidia’s advanced GPUs, particularly the H100 and A100. With the Ascend 910C, Huawei is stepping into that void, providing a domestically controlled and performance capable chip for AI development.

This drama also is drawing Taiwan Semiconductor into the firing line too. While they’ve made huge commitments both financially and strategically in the US, there are reports that TSMC die has been found in Huawei Ascend 910B chips. This would circumvent export restrictions and could see a $1 billion fine levied on TSMC by the Americans.

A love/hate triangle

Nvidia, TSMC, Huawei. China, Taiwan, America.

This is going to be the defining love triangle (or hate triangle, whichever way you want to look at it) of Trump’s time in office.

I don’t think it’s a great reveal that a clear AI arms race is on. To dominate the supply chain of the most important technology of the 21st century is the most strategically important chess move Trump or Xi can make.

It will shape their countries for the next 100 years, and the geopolitical landscape of the world.

One will be dominant in AI. The US does have the lead, mainly due to Nvidia’s prowess. And I don’t see that changing. When you add up the huge investments, the capital (both financial and human) capital already deployed into the AI arena in the US, you see that it’s not all about Nvidia, but the sum of all parts that keep them ahead of China.

Sure, Huawei may become the one and only AI chip monopoly in China, but that itself becomes its own handbrake for global dominance. Nvidia doesn’t do it all, they never have, never will. ASML, TSMC, Micron, Broadcom, it’s all part of the grand plan.

Many countries will still make a choice, side with China and their AI ambitions through Huawei, or the US and their broader scope of AI dominance.

It is and will always be a two-horse race.

I expect the US will come out on top. And if they do, you’ll want to ensure you’ve got your AI portfolio locked and loaded as this transformation tech revolution rolls out in the coming decades.

Until next time,

Sam Volkering

Contributing Editor, Investor’s Daily

PS. The AI chip war might dominate the headlines but it’s not the only battleground that matters.

Behind the scenes, a far bigger financial shift is underway. One that could redraw the global power map—not just in tech, but in wealth itself.

Jim Rickards has uncovered a dormant legal mechanism, just reactivated by the Trump administration, that could unlock an estimated $150 trillion in American-held assets.

And here’s the twist: you don’t have to be American to potentially benefit.

Jim explains everything in The American Birthright.

Tranquilo

Bill Bonner, writing from Buenos Aires, Argentina

Ireland was a pleasant rest-up…a peaceful refuge…a comfortable place to hang our hats for a couple weeks.

“Tranquilo?” asked an Argentine friend.

“Yes… muy tranquilo.”

The fields are green. The cattle are fat. The spring flowers are blooming. And the traffic is calm.

“I think the biggest thing,” said a neighbor in County Cork, “is that we’re not in a battle with anyone. You don’t feel the tension that you feel in the US.”

She had a point. The American empire needs enemies – foreign and domestic. Otherwise, there would be no cause for such bare-knuckle politics. And no point to a $1 trillion military budget. And no need for tariffs either; and to ‘get even’ with other nations who are ‘ripping us off. Or 17 different spook agencies.

But after a short stay in Ireland, we’ve come to Buenos Aires to visit a daughter. In our younger, more expansive, and more reckless years, we invested heavily in Argentine farmland. It was cheap!

But a farm is not a stock. It needs to be managed. It is a business, not an investment. “It’s the eye of the owner that fattens the cattle,” say the Argentines. But who was going to keep his eyes on these animals?

Fortunately, along came a son-in-law with an interest in farming. He and our daughter have been on the job for almost two years

How is it going? We’ve come to South America to find out.

Meanwhile… CNBC:

Dow drops more than 950 points as Trump rips Fed Chair Powell…

Cryptopolitan:

Losses were led by the so-called Magnificent Seven tech stocks, especially Nvidia, which dropped 5%, and Tesla, which lost 7% by press time. Amazon fell 4%, while Meta Platforms and Advanced Micro Devices both dropped 3%. Even Caterpillar, a major equipment company, slipped 3%.

Markets fell to their lowest levels of the session right after Trump’s statement. The dollar also took a hit, falling to a three-year low. On the flip side, gold surged above $3,400 an ounce, setting a new record high. The panic was clear across every corner of Wall Street.

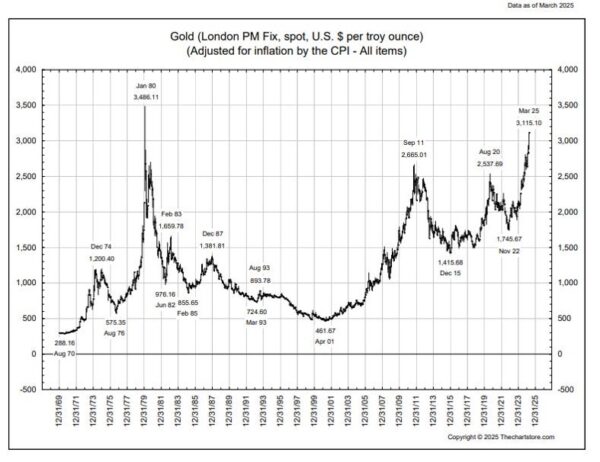

Gold has been flying. It’s up 30% so far this year. You’d have to go back to 1979 to find a similar start to the year. And when 1979 was over, gold had gained more than 120%.

That huge run-up was followed by a big ‘uh oh.’ “Gold will go to $5,000 an ounce,” predicted Howard Ruff at the New Orleans Investment Conference of 1979. He was right. But at least 46 years early!

Just when investors were sure gold was headed to the moon, it peaked out in 1980…and fell for the next twenty years. Ominously, adjusted for inflation, gold is now once again at an all-time high, even higher than it was in 1980.

The 1980 inflation-adjusted gold price high was $3,486.11, according to TheChartStore.com

Uh oh.

Could gold go into another long bear market? Of course it could. And it will. But that’s the whole point of our Dow/Gold Indicator. It recognizes that stocks and gold both go up and down. It aims to guide us to whichever one is the most bombed out, beaten up, and widely regarded as ‘hopeless.’ Then, we buy… sit tight… and wait for the world to turn.

After 1980, the seasons changed. Stocks — which had been pronounced dead by a BusinessWeek cover story in August 1979 — “The Death of Equities” — came back to life and roared ahead until January 2000. Then, it was gold’s turn again. Over the last 20 years, the gold ETF, GLD, has outperformed the S&P ETF, SPY, 622% to 571%.

Up…down…and up again.

And now, gold has gone up so much — while the stock market has come down — that our key Dow/Gold indicator has been cut in half since 2018…and dropped from 16 just a few weeks ago down to 11 today. This leaves us just 6 points above our key turnaround point — 5. That’s when we reverse our Maximum Safety position and go all-in for stocks.

It makes us nervous to think about it. Gold has been good to us. “Tranquilo.” The world of stocks, on the other hand, seems dangerous, unpredictable and unproductive. And stock prices are still hugely inflated by fake money.

Here’s something interesting. It was just a few months ago — back at the close of 2024 — that US stocks were seen as the be-all and end-all of investing. Based on their CAPE ratios, US stocks traded at prices 86% higher than those of Europe.

But then, cometh the Trump Team, and US stocks took a beating. So far this year, US stocks have the worst performance of those of any major nation — 15% lower than the global average and 23% behind the Eurozone. And the US dollar is getting hammered too.

Not surprisingly, the stocks that are taking the worst licking are those that were most highly prized. Nvidia is down 24%. Tesla has lost 40%. Amazon has dropped 21%. And so on…

The trouble is, there is still a lot of grief to come. Even with their bruises and cuts, the Magnificent Seven are still on their feet…and still expensive. Apple and Amazon are priced at 31 times their earnings. Nvidia is at 35. And Tesla sells for 118 times earnings.

The theory of our Dow/Gold trade is that by the time the ratio falls to 5, stocks ought to be cheap…with little risk of further price declines. But if gold races ahead too far, too fast…we might hit our BUY STOCKS target — at 5 ounces of gold equal to the 30 Dow stocks — while stocks still have a lot of downside left in them.

Then what? If we buy stocks, we risk taking a beating too. But if we don’t buy them, we risk taking a beating in gold. What do we do? We stick with the program. Tranquilo.

Stay tuned.

Regards,

Bill Bonner

Contributing Editor, Investor’s Daily

For more from Bill Bonner, visit www.bonnerprivateresearch.com