He just hosted a dinner for “investors” in the $TRUMP memecoin. And the mainstream media absolutely had a field day with how poor taste it was, how corrupt it was and how this President is just a vile grifter who’d do anything for a buck.

He just hosted a dinner for “investors” in the $TRUMP memecoin. And the mainstream media absolutely had a field day with how poor taste it was, how corrupt it was and how this President is just a vile grifter who’d do anything for a buck.

Let alone the fact reports say the dinner was rubbish, the speech confusing at best and perhaps a McDonald’s would have been a better idea.

So enraged was Democrat Senator Elizabeth Warren she labelled the whole shebang an “orgy of corruption”.

So much of that idea dares never to be imagined…

But if you thought the President was done there… think again.

Because a mere dinner with 220-or-so $TRUMP holders is nothing compared to the $3 billion he’s got earmarked for bitcoin.

DJT goes big on bitcoin

The Trump Media & Technology Group (NASDAQ: DJT), has lived a tumultuous existence. It announced a reverse merger with a SPAC (special purpose acquisition company) the Digital World Acquisition Corp in 2021.

But legal problems, strange ties to China, SEC investigations and delayed shareholder vote after delayed shareholder vote meant the merger didn’t actually complete until March 2024.

Its stock price then exploded to almost $80 per share, and as recently as September 2024 hit a low of around $12.

It’s effectively the company that holds his Truth Social company (the alleged competitor to X.com) and Truth Media (alleged competitors to Disney, Netflix, Hulu, HBO, etc.).

But now it seems the Trumps are taking a “strategic pivot” and DJT is now lining up $3 billion to add crypto to its balance sheet.

The Financial Times reports that the company is raising $3 billion to spend on cryptocurrencies such as bitcoin. Now, you may or may not take this with a pinch of salt.

On one hand the FT loves to take aim at the President. And this may be a source of a source of a source kind of story. Or it may be 100% accurate. It’s no surprise the Trumps, in particular Donald Jnr, and Eric (and Barron to a lesser extent) are betting big on bitcoin and crypto.

They sit on a range of boards and have a piece of action with several crypto and bitcoin related companies ranging from:

- American Bitcoin (which used to be American Data Centre, which is using bitcoin mining rigs from Hut 8 (NASDAQ:HUT) and merging with Gryphon Digital Mining (NASDAQ:GRYP) to be listed on the NASDAQ soon). Tied in with this, Don and Eric also sit on the board of Dominari Holdings (NASDAQ:DOMH), an investor in American datacentres, and therefore an investor in American Bitcoin.

- World Liberty Financial the DeFi project spearheaded by the Trumps and the Witkoffs (Steve Witkoff being Trump’s special envoy to the Middle East, Zach Witkoff running the show) which has launched a US dollar stablecoin, USD1.

- Metaplanet, the “Strategy of Japan”, which Eric Trump now sits on the strategic board of advisers. Note: Strategy, for reference is the company formerly known as MicroStrategy (NASDAQ:MSTR).

That’s a snapshot of what they’re doing so far…

But the DJT move is a big one. $3 billion is a lot of money for an unprofitable company that has dubious growth across their media channels.

Maybe this is the Trumps deciding that media isn’t the game, but adopting a bitcoin strategy is.

You see, all of this does sound a little wild, and no doubt sceptics will say this is indeed an “orgy of corruption”, but there’s a bigger picture in play here. And it’s not really anything to do with the Trumps. They’re just latching onto a bigger theme playing out here.

And it’s exactly what I think takes bitcoin’s price to $1 million and beyond.

The Bitcoin Treasury Club Just Got a Whole Lot Bigger

DJT isn’t alone. The number companies adopting bitcoin as part of their corporate strategy is accelerating — not just as a hedge, but as a way to grow value.

Let’s look at a sample of companies doing this:

- Strategy (MSTR): Formerly MicroStrategy, Michael Saylor’s business software company is now a bitcoin development company. And it’s currently sitting on more than 580,000 bitcoin, with no plans on slowing down their bitcoin buying spree.

- GameStop (GME): After years of meme stock infamy, they’ve finally taken the plunge, allocating $1.3 billion from a debt issuance to bitcoin. Rumour is something even bigger is on the cards for them.

- Genius Group (GNS): Just added more bitcoin to its treasury now holding 85.5 bitcoin, with plans to get to 1,000 bitcoin to underpin their balance sheet.

- Semler Scientific (SMLR): A medical tech firm that recently announced another round of bitcoin buys, from a stock offering taking their tally to 4,264 bitcoin.

- Asset Entities (ASST): This is a small cap that’s now merging with Vivek Ramaswamy’s Strive asset management, plans there are to buy billions in bitcoin and become a bitcoin treasury company too.

- Cantor Fitzgerald Equity Partners (CEP): This is a SPAC from Howard Lutnick’s company (the current Secretary of Commerce) that’s going to merge with 21 Capital a new company headed by Jack Mallers of Strike bitcoin to buy (again) billions of bitcoin and become a direct competitor to Strategy.

- Metaplanet (3350): This Tokyo Stock Exchange listed former real estate company is the “Strategy of Japan” and is aggressively buying bitcoin like Michael Saylor. It’s so volatile and so shorted, that it even appears a GameStop-style short squeeze is on, triggering the TSE’s circuit breakers day after day.

These are just a few of the many companies around the world now buying bitcoin like there’s a finite supply… oh hang on a minute…

A “Strategy of the UK”?

Now you might think this is all wild developments overseas, but as of a month ago, it also became a British thing.

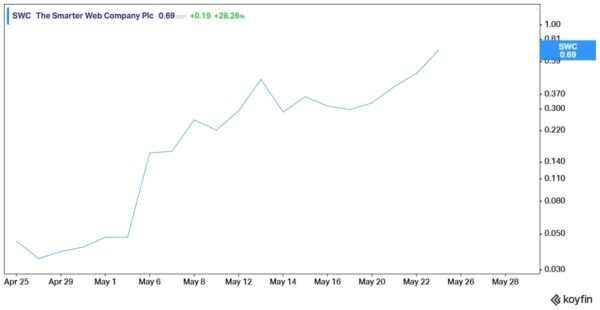

On 25 April 2025, The Smarter Web Company, listed on the Aquis Stock Exchange via a retail offer, placing and subscription and name change from Uranium Energy Exploration.

In the admission announcement, CEO, Andrew Webley said,

“…we are … pioneering the adoption of a Digital Asset Treasury Policy, including Bitcoin, into our strategy. We are confident that this business model will return substantial returns to shareholders.”

Their “10-year plan” outlines, “The Smarter Web Company offers web design, web development and online marketing services and is focused on growth to create shareholder value.”

But let’s call this for what it is, a listed vehicle to raise capital to buy bitcoin and drive shareholder value that way. If Metaplanet is the “Strategy of Japan” then SWC looking like the “Strategy of the UK”.

To the best of my knowledge there’s no other UK company on either the LSE, AIM or Aquis doing this. You can bet your backside that plenty more will though as SWC fires up in price.

I say this because value has already been delivered to SWC shareholders in the most explosive way.

A 2,660% return in a month from their 2.5GBp issuance price to the current price of 72GBp. This is all off the back of the market going bonkers for bitcoin treasury adoption stocks.

Webley is currently in Las Vegas attending The Bitcoin Conference — the biggest bitcoin gathering of the year — rubbing shoulders with the likes of Michael Saylor, the Trump kids, bitcoin billionaires, and other CEOs adopting a similar strategy outside the UK.

He’s no doubt also looking to raise the profile of SWC in America.

It does raise the question, I’m thinking it, so no doubt you are, is this a bubble that’s going to end badly?

Billions say more than haters ever could

Sceptics will be frothing at the mouth over this.

They’ll say this is all hype. That these companies are just trying to chase the next meme cycle. That bitcoin could crash 40% tomorrow and wipe out these paper gains.

They’re technically not wrong, volatility is still part of the game. And this stuff is not for the fainthearted.

But what the haters struggle with is that this isn’t just a name change and a pitch deck saying they’re going to adopt blockchain.

They’re buying bitcoin. It’s not an if or a maybe. There is real bitcoin now sitting on a balance sheet. It’s an asset of value. Of rising value. Even if the stock price is volatile, the entire financial make up is now backed by an asset that’s on track to become a global reserve asset and if all this continues, I think worth $1 million per bitcoin.

As companies buy up more and more bitcoin, we inch closer and closer to a bitcoin standard. Even reporting for companies (at least in the US for now) that hold bitcoin is changing to accommodate all this.

The world is changing on how it considers and adopts bitcoin.

How companies look at value creation, and value protection is changing. Bitcoin is now an asset that can underpin growth and generate significant value.

It can also be leveraged against to accrue more value, be it through acquisitions or investment into growth, all underpinned by its rise in value.

The world is changing, the “bitcoinisation” of the world is accelerating. Those who are slow to move, or refuse to move, or look at all this and scoff, will be left in the dust (again).

So, I say, let them scoff. They’ve been wrong for sixteen years straight.

Bitcoin is the reserve asset of the next era.

Until next time,

Sam Volkering

Contributing Editor, Investor’s Daily