With 2025 behind us, the temptation is to flip the calendar, declare a “new year, new theme,” and move on.

With 2025 behind us, the temptation is to flip the calendar, declare a “new year, new theme,” and move on.

Good in principle, but that’s not how markets work. Big thematic ideas don’t start on January 1 and end on December 31, they move in continuity, changing shape, sometimes direction, always fluid.

That’s why most annual predictions are a dime a dozen. What matters isn’t the date, it’s whether a trend is just emerging, or whether it’s been quietly winding up, gathering pace, about to break into the open and deliver profits.

And what matters is if you’re on board for the ride or standing aside watching it pass before your eyes.

Note: can you tell I’m not a big fan of New Year’s Resolutions…?

Looking into 2026, one theme stands out more clearly than anything else. It won’t surprise regular readers…It’s still AI. But the story is evolving, and the speed of its evolution will blow minds this year.

When we get 12 months down the track here and look back at 2026 in hindsight, I suspect we’ll describe it as the year of shortage before excess.

We’ve already had a taste of this shortage dynamic.

Precious metals have been screaming “supply constraint” for months. Gold pushed to record highs. Silver printed one of its strongest runs in decades, helped along by China tightening export controls just the other day.

Old-world scarcity is back in fashion. But as important as metals are, they’re not where the really big shortages are forming.

That comes in the machinery of intelligence itself.

The AI boom moves from software to shovels (kind of)

In 2026, the smart play for me is to buy the companies that make the necessary hardware for AI that there simply is not enough of.

It’s as good an old demand and supply story as you’ll ever get.

What makes this one for the ages, though, is that these shortages don’t then suddenly come online in a week or a month. The lead time to correct them is years. And that means for investors it’s a long-term win-win.

Memory, storage, compute, power. The physical infrastructure that makes AI possible there just isn’t enough of.

In fact, I want you to look at any AI-enabled device you have, maybe it’s your PC, or your laptop, tablet, smart watch, or phone. Now imagine that device broken down into every single individual component.

That’s what you want to buy, the individual component makers, not the phone, not the cloud it’s plugged into, not the apps you tap into, but the little bits of hardware that make it.

And you want to know why?

Because in 2026 we’ll return to “dumbphones”.

Yep, the “next generation” of “smart” phones will have less memory, less storage, less of everything the phone makers jammed into them in 2024 and 2025.

Nowhere is this clearer than in memory.

The global memory market is entering 2026 in a position it hasn’t seen in decades. Effectively sold out. SK Hynix, one of the most important suppliers of high-end memory for AI systems, has already locked in its entire 2026 output across DRAM, NAND, and high-bandwidth memory.

Customers aren’t negotiating on price anymore; they’re negotiating on access. There are reports that Microsoft, Apple, Google, and Amazon all now have supply chain managers permanently located in Taiwan just to try and outbid the others and lock down years’ worth of supply.

Good luck with that.

This isn’t an isolated case. DDR5 memory, the backbone of modern AI servers, is in acute shortage. Samsung Electronics has already pushed through multiple price hikes in a matter of months. Modules that were considered commodity products are now behaving like scarce assets.

Buyers are panic-booking supply, not because prices are attractive, but because availability is uncertain.

Micron Technology has taken an even more telling step. It has aggressively repriced memory, refused to quote certain products at all, and effectively deprioritised consumer channels to focus on AI and data-centre demand.

When a leading chipmaker chooses to turn away retail dollars and demand, that tells you everything you need to know about where the opportunities are.

What’s driving this is not just demand, but fear.

Memory suppliers remember past cycles where they overbuilt capacity, collapsed prices, and destroyed margins. This time, they’re disciplined. Capacity expansion is cautious. Supply is tight by design. The result is a classic “shortage before excess” setup. They’ll eventually catch up, but in 2028, maybe, by then they might have seen hundreds of percent in earnings growth, and stock prices taking market caps into the trillions.

Storage is following the same path. NAND flash prices have already more than doubled from their lows. NVMe SSD pricing, which consumers had come to assume would only ever fall, has started grinding higher month after month. It’s not an explosion yet. It’s something more dangerous for buyers, a slow, relentless repricing as data-centre demand absorbs supply that used to feed consumer markets.

And then there’s Nvidia…

For years, Nvidia balanced two worlds. Gaming GPUs and high-end compute.

In 2025, that balance broke. By the end of the year, roughly nine dollars in every ten Nvidia earned came from data centres, not gamers. Gaming revenue stagnated. Data-centre revenue exploded.

In 2026, Nvidia’s incentives are obvious. Every unit of memory, every advanced component, every watt of power allocated to a consumer graphics card is a unit not allocated to a hyperscaler willing to pay multiples more.

The economically smart choice is to prioritise AI compute, even if that means scaling back consumer GPU availability.

There are already strong signals this is happening. Production decisions are tilting toward high-margin AI accelerators. Consumer GPU line-ups are getting thinner. Mid-range cards are harder to find. Prices stay stubbornly high. From Nvidia’s perspective, why sell a few hundred-dollar gaming cards when the same components can underpin a five-figure AI board sold by the thousands?

Of course, all this actually leaves a huge door ajar for Advanced Micro Devices. They could do a swifty here and gobble up a tonne of Nvidia’s core customers in the retail market.

If they played a smart, decade long game here, they could become a dominant GPU provider to the gaming industry… but they probably won’t and will end up following a similar path to Nvidia.

Data-centre revenue now dwarfs its gaming business too, so it’s unlikely they’ll swoop in on the consumer market.

The entire industry is converging on the same conclusion. AI infrastructure is where growth, margins, and strategic importance live. Damned be the loyal consumer.

Which brings me to the strangest, and perhaps most exciting, opportunity of them all…

One of the best performing “assets” of the past year hasn’t been a stock, a crypto, or a commodity. It’s been physical DDR5 memory.

High-capacity RAM kits have gone from depreciating PC parts to scarce, tradable goods.

As messaged to a friend of mine who’s a CEO of a massive gold mining company…

Prices on top-end modules have risen multiple in less than a year. Some system builders are shipping machines without RAM installed, telling customers to source it themselves if they can. We’ve reached the absurd point where a large DDR5 kit can cost more than a high-end GPU.

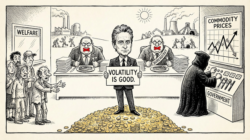

So yes, half joking but also very much serious, as you can tell from the image above, but maybe physical RAM could be the best investment of 2026.

I’ve now got 64GB of DDR5 memory and put it aside. Not to install. To sit on. To see what happens over the year. Just to prove a point, just to have something interesting to write about at the end of this year.

How high will it go? Five times? Ten times? More? I don’t know. But the logic is simple. AI cannot function without memory, and memory is scarce, so let’s see what happens.

What 2026 will really be remembered for

The AI boom is not ending. Not even close. What’s changing is who captures the next wave of value.

In 2026, it’s more about infrastructure, the unglamorous, capital-intensive, supply-constrained backbone of intelligence. It’s about what makes AI come alive.

Shortage before excess is the defining pattern. Memory, storage, compute, power, all in hot demand and virtually no supply, all at once.

And the excess that comes…well that’s a story for another day. Because it’s not the kind of excess you might think that fixes absolute shortages.

AI can be the catalyst for an age of excess, but only if we first go through a long period of shortage… but obscene profits for investors await.

Cheers,

Sam Volkering

Contributing Editor, Investor’s Daily