- Charlie Munger was right, but we didn’t listen properly

- Why defence stocks are vulnerable in war

- How to profit from currency, trade and shooting wars

Way back in 2011, Jim Rickards first laid out his long-term prediction: currency wars are followed by trade wars and then shooting wars between major powers. This wasn’t just a forecast. It was a description of the rhythm of history, which has featured several such cycles.

Most investment professionals have a time horizon of one quarter or three months. That’s because their performance is judged based on this period. So, they didn’t really care about Jim’s long-run prediction based on cycles going back centuries. Even if he would prove to be right, it was too long-term to matter to their career.

Company CEOs only last a few years if they don’t perform well. So they’re short-sighted too.

But investors’ portfolios must perform well over a period of decades. A portfolio that does well for nine years but wipes out on the tenth is useless to everyone. And so Jim’s work found a best-selling audience among people like you and me.

Anyone who listened has profited handsomely since.

We’re obviously in phase two of Jim’s prediction now – the trade war.

Phase one occurred during the era of Quantitative Easing. Central banks and governments colluded to devalue their currencies to try and gain an export advantage for their economy. In 2013, the currency war became semi-official with Japan’s policy of devaluation. Then it was open season.

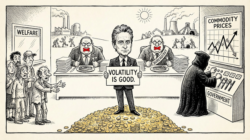

The trouble with currency wars is the same as all other wars. They are a zero-sum game in the short run. And even worse in the long run.

That’s an economist’s way of saying that currency devaluation harms your trading partners about as much as it benefits you. It triggers a tit for tat response. So, everyone ends up worse off in the end.

The IMF and G20 eventually managed to bring about a détente in the currency war game. Until President Trump escalated to phase two of Jim’s prediction: trade wars.

Trump’s first tariffs during his first term didn’t get much attention. But in the first half of 2025, they were the biggest news story in financial markets.

These days, the major powers are busy preparing for phase three of Jim’s thesis: shooting wars. But before we get to that, a quick word on how Jim got all this so right…

The patterns of history highlight the folly of logic

I first met Jim back in 2014. We have been working together to help investors through currency wars and then trade wars for almost a decade now.

Something odd has struck me on many occasions during that time. Jim often makes predictions that sound outrageous at the time without detailing why things will play out that way.

To me, it made no sense for Putin to invade Ukraine, Trump to impose tariffs, or Germany to blow up its nuclear power stations. Anyone searching for the why could find overwhelming arguments for why not to do it. And so assumed it wouldn’t happen.

But the cycles of history give us a constant stream of nonsensical surprises. They just keep happening. What makes economic or logical sense doesn’t seem to play a huge role in decision making. Other incentives must be at work.

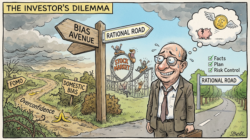

The famous investor Charlie Munger explained that, “Show me the incentive, and I’ll show you the outcome.” This is most often interpreted as explaining that people act in their own self-interest. Their legal or moral obligations don’t win out.

But perhaps the really valuable insight from the quote is different. You need to focus on figuring out what actually incentivises people, not what you might think does, let alone what should.

If you can figure out what incentives people are really responding to, you can predict how they will behave. And therefore geopolitical events and financial market trends.

The real challenge when making predictions is figuring out what motivates people. It is surprisingly difficult. People are astonishingly diverse in what they care about. When you’re married to a Japanese person, or dealing with President Putin or Trump, this becomes obvious.

Jim’s past work at the Pentagon, CIA and at the centre of Wall Street panics is perfectly suited to that type of analysis. He knows how things work behind the scenes, having made them work often enough. And he honed his analytical and predictive skills in the field rather than as an analyst on the outside looking in. He knows the incentives people face, because he’s seen them. From hostage takers to terrorists to Wall Street bailouts, Jim was there.

He also has a grasp of the historical cycles that repeat, whatever the reason might be.

But how does an investor prepare for military conflict?

If we face phase three of Jim’s rather prophetic prediction, what should investors do about it?

Currency wars benefitted gold and silver. They explain the outperformance of gold relative to stocks over the past 25 years. The value of money has fallen and the financial performance of companies has been poor due to economic disruption.

Trade wars caused commodity price spikes thanks to disruption. And markets are still sorting out who benefits in terms of onshoring.

War would be a surprisingly similar variation on the same investment themes.

In a war, industrial might and access to resources are the key. That’s why now is the right time to jump on board with the stocks Jim identifies as the beneficiaries.

But there’s an additional reason why I think you should focus on these companies.

You might think that defence stocks are the obvious option for investors if Jim is right about a “shooting war.”

They’ve been the outperformers for a few years, alongside AI stocks of course. The iShares US Aerospace & Defense ETF (ITA) has doubled since October 2023. That despite a Department of Government Efficiency (DOGE) onslaught against the industry.

Indeed, unstable government finances are one major risk to investing in defence stocks. Especially in Europe. Not many governments there have the financial capacity to spend big anymore.

But there’s nothing like a war to exempt governments from the laws of economics. Indeed, plenty of politicians have gone to war based on the prospect of their economic policies failing. They needed access to the extraordinary measures which war grants them to hide the failure of their economy.

Financial innovation also booms during a war. Politicians and their cronies can get very creative with the government’s finances.

Thus, precious metals should continue to outperform and government bonds remain dangerous.

But here’s the angle worth betting on now: domestic mining companies solve both the fiscal and commodities problem. Mining is a huge fiscal tailwind thanks to royalties. And producing your own resources makes you more geopolitically secure.

That’s why I’m expecting even Europe to turn the Titanic away from net zero in coming years. Even if hitting the iceberg is already baked in, European mining and oil projects will eventually boom under a far more friendly permitting environment, if only for the money and national security needs.

For now, though, Trump is trailblazing in the US. He’s not only shaken up permitting for resource and energy projects. He’s invested government money in the stocks doing the digging and drilling.

It’s time to follow the money. And nobody has more money to move than the US government.

Until next time,

Nick Hubble

Editor at Large