This week, Kevin Rudd, Australia’s outspoken ambassador to the United States – and former Australian Prime Minister known for his deep ties (and love) to China – suddenly announced he is stepping down from one of the most sought-after ambassadorial roles a full year ahead of schedule.

This week, Kevin Rudd, Australia’s outspoken ambassador to the United States – and former Australian Prime Minister known for his deep ties (and love) to China – suddenly announced he is stepping down from one of the most sought-after ambassadorial roles a full year ahead of schedule.

Officially, it’s his choice, and it’s said he will return to the Asia Society think tank so he can speak more freely about the current US administration.

But dig a little deeper, and you start to see the real reason K.Rudd (as he’s popularly referred to in Australia) is weaselling out of his post early.

Rudd’s past barbs at President Trump, calling him “the most destructive president in history” and a “traitor to the West,” have long been a thorn in Australian and US relations.

Those comments, hastily deleted after Trump’s 2024 re-election, didn’t vanish from memory. Trump himself took a swipe at Rudd during a White House meeting last October, saying he “didn’t like” the ambassador and “probably never will.”

But that wasn’t why Rudd is leaving.

In fact, I suggest he is abandoning ship because he’s seen the iceberg that’s coming and that weirdly leaves investors in a very exciting and strong position…

The weasel is spooked out of the coop

Rudd’s exit I believe is a symptom of something bigger, escalating US pressure on allies like Australia to deliver on critical metals and rare earths.

These are the building blocks of modern defence, AI, and energy systems.

All three are areas where the US aims to maintain global dominance.

The US is unabashedly ramping up its demands for these metals amid soaring national security needs, whereas Australia (as home to the world’s largest deposits of many of these materials) is caught somewhat flat-footed.

Exploration, mining and production of these metals isn’t scaling fast enough, thanks to years of underinvestment in capital expenditure needed to scale the industry.

China has dominated rare earths processing forever, and Australia has long known it holds these deposits, but they’ve refused to invest in a meaningful way to wrestle control away from China.

The US also knows this and is the only one that is prepared to do something about it.

Flash back to October 2025, when Trump and current Australian Prime Minister Anthony Albanese signed the U.S.-Australia Framework for Securing Supply in Mining and Processing of Critical Minerals and Rare Earths.

This non-binding (but let’s be honest, it’s pretty binding) pact aims to build resilient chains by pooling industrial demand, stockpiling, and investments – at least $1 billion in financing for projects in both countries within six months.

It includes streamlining permits, protecting against “non-market policies” (read: China’s unfair practices), and even tools to block asset sales on security grounds.

The goal? Diversify away from China’s dominance, which controls 87% of rare earth processing globally.

But here’s the issue: we are now roughly three months in, and I say Rudd saw the writing on the wall. A coming showdown over resources that aren’t getting delivered and investment that’s not being made, and he wanted no part of.

His resignation clears the deck for another diplomatic patsy to take the fall, and he keeps face and cushy US based think tank roles.

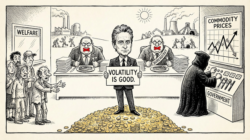

For all the political weaselling going on, it also spotlights a market poised for a melt-up in critical metals stocks through 2026.

Just days ago, on 12 January Australia unveiled details of its $1.2 billion Critical Minerals Strategic Reserve, designed to safeguard “Australia’s future prosperity”.

Prioritizing antimony, gallium, and rare earths, it focuses on securing offtake rights from domestic producers and selective stockpiling.

It’s a half-hearted attempt to counter China’s grip and support allies like the US by ensuring reliable flows for defence and clean tech.

But it may be too late. The US is pressing for immediate delivery.

On Wednesday this week, President Trump issued a new Presidential action, “Adjusting imports of processed critical minerals and their derivative products into the United States.”

It directs urgent negotiations with trading partners to secure supplies through agreements like price floors or trade restrictions.

The U.S. is 100% import-reliant on 12 critical minerals and over 50% on 29 more, leaving it vulnerable to disruptions.

These materials that are needed for rare earth permanent magnets for electronics and vehicles, lithium for batteries, gallium for communications are essential for national defence (weapons, aircraft, naval systems) and 16 critical infrastructure sectors, including energy and AI.

All this is off the back of a massive ramp up in the US defence budget too from around $1 trillion to $1.5 trillion.

The proclamation highlights skyrocketing demand from military buildup, AI data centers, nuclear energy, and renewables.

US production meets only a fraction of needs, especially in processing, where raw minerals are often shipped abroad (mostly to China) and reimported as finished products.

Frankly they can’t come to dominate military tech, AI and energy when they’re so heavily reliant on China.

Which brings us back to the importance of Australia.

Australia boasts massive deposits, it’s the top non-Chinese producer of rare earths, yet output is pitiful.

Australia (and arguably the world’s) most prominent rare earth producing company outside China is Lynas Rare Earths (ASX:LYC).

There’s been murmurs and even a half-baked attempt at a merger between Lynas and US-based MP Materials (NYSE:MP) in 2024 and 2025.

But it all broke down and petered away. Lynas CEO Amanda Lacaze (who’s now retiring from her post) always wanted the deal to get done, but the official line it failed was around timing and valuations.

MP’s stock had been in a multi-year down trend, and there were questions about who was getting the better deal and that MP’s valuation was a point of contention.

But my take is the real powers in the US government wanted MP to stay fully American-owned and operated, and that would be their proxy to have their own Lynas running at full steam on domestic shores.

Lynas is bigger and more advanced, with a strong customer base, but consolidating under foreign control risked diluting US security interests. And you can’t Make America Great Again when your rare earth golden child is mainly Australian owned and controlled.

Instead, the Pentagon took an equity stake in MP, plus a $400 million investment, $150 million loan, and 10-year offtake at premium prices. This kept domestic control and in the time since the US government has pumped the heck out of critical metals and MP along the way.

Oh, that’s why they want Greenland so bad

But MP alone is not enough for the US demands.

They need Australia to get its act together now.

But Australia isn’t ready.

And I believe that if you’re positioned right, this coming tension could translate into outsized gains. The fact Rudd bailed on it all, is really a catalyst for you to line up your rare earth and critical metals plays right now.

Demand for rare earths and critical minerals is exploding. The US is driving it hard, with big spending on defence and tech ambitions. But supply chains remain fragile and dominated by China. And Australia isn’t and can’t move fast enough for the time being.

This creates an imbalance of demand massively outstripping supply.

We’ve seen this already in 2025 with semiconductor memory and storage prices melting up amid constrained supply. Also worth noting a lot of the critical metals the US needs so badly are also the ones needed for these kinds of advanced AI technologies.

This melt-up in critical metals is coming.

Note: all this is also why the US wants to buy Greenland so bad.

So, how do you play it?

Well for one, don’t sit on the sidelines. 2026 could be a banner year for critical metals plays.

You can play this with the stocks that are major players in critical and rare earth exploration, mining and production.

You can also use the options market to great effect both from the commodities themselves and from the stocks that are trying to deliver the supply.

And of course, there’s a growing number of ETFs that give exposure to metals and mining in this space, as well as defence applications that a lot of these metals go into.

In short, Rudd’s resignation is more than diplomatic drama as the mainstream media may portray.

His ability to dodge a bullet is true to form and also exposes the weak link in any kind of agreement that Australia and the US have in the pipeline.

And while that might be some concern geopolitically, and will definitely bring some headlines, the real story is it puts the critical and rare earths industry at a melt-up inflection point where investors may be positioned to benefit in 2026.

Until next time,

Sam Volkering

Contributing Editor, Investor’s Daily

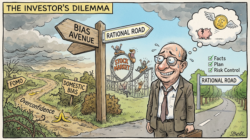

P.S. One thing worth stressing.

This isn’t about guessing which headline comes next or trying to time a short-term spike.

The real opportunity sits in a small group of companies positioned behind the politics — the ones that control supply, processing, or access to critical and rare earth metals the US simply cannot afford to be without.

We’ve put together a focused briefing that walks through where that leverage sits today, and how investors can position themselves before the supply squeeze becomes impossible to ignore.

If you want to see how to play this properly — without chasing headlines — you’ll want to review that analysis next.