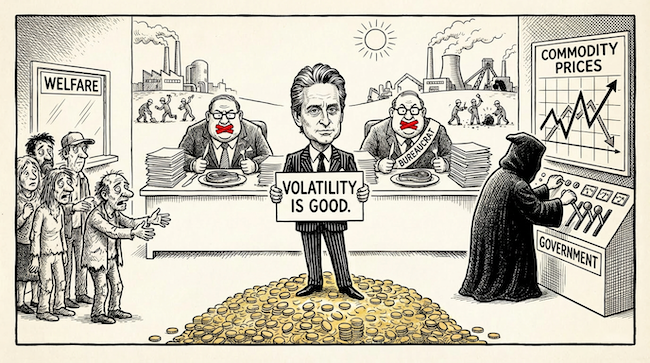

- Gordon Gekko’s second coming

- The people have had enough of entitlement and victimhood

- Volatility is good too…for investors

Gordon Gekko’s infamous “greed is good” speech has become an idiom. But have you ever listened to the Wall Street villain properly?

Not only did he have a point. In many ways, he was right. But almost nobody listened.

Instead of running our society on greed, we got environmentalism, red tape, DEI, governance, HR departments, wokeness, welfarism, bailouts and a plague of bureaucrats in far off places making decisions for us.

The psychology of victimhood and entitlement dominated how our economy functioned. And it led us right into a swamp.

The results are just what Gekko warned about.

Growth slowed. Productivity stagnated. Real living standards struggled to keep pace. The trade deficit with countries not pursuing the same agenda blew out. Government debt blew out even more. And every attempt to fix the problem is shouted down by an entire army of entitled dependents accusing the whistleblower of “greed.”

Indeed, these days, it’s greedy to want to keep your own property and virtuous to lay claim to other people’s…

Back in Gekko’s day, the same entitled psychology had infected companies like the fictional Teldar Paper. Gekko told ‘em how he saw it in the film:

Teldar Paper has 33 different vice presidents, each earning over 200 thousand dollars a year. Now, I have spent the last two months analyzing what all these guys do, and I still can’t figure it out. One thing I do know is that our paper company lost 110 million dollars last year, and I’ll bet that half of that was spent in all the paperwork going back and forth between all these vice presidents.

Doesn’t that sound familiar? Large institutions — public and private — often accumulate layers of management that add cost without adding value. It’s not like they’ve prevented pandemics, pollution, sovereign debt crises or war. But they’re still getting paid to jet around and swan around when they arrive.

Gekko proposed greed, “for lack of a better word,” as an alternative way of organising a company and country. After all, “Greed, in all of its forms – greed for life, for money, for love, knowledge — has marked the upward surge of mankind.” It’s why we get up in the morning. To satisfy the greed known as hunger, for a start.

The economist Adam Smith did provide a better word than “greed” in famous quote: “It is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from their regard to their own self-interest.”

Capitalism functions by forcing us to serve others to get ahead ourselves. And, thereby, our own self-interest forces the sort of cooperation a socialist can only presume to inherently exist.

The economist Milton Friedman pointed out that denying greed is a lie anyway: “Is there some society you know that doesn’t run on greed? You think Russia doesn’t run on greed? You think China doesn’t run on greed? … The world runs on individuals pursuing their separate interests.”

It’s just that, in Teldar Paper’s case, it was the greed of vice presidents that had taken over the company. Gekko appealed to the greed of shareholders to reassert their control:

“You are all being royally screwed over by these, these bureaucrats, with their steak lunches, their hunting and fishing trips, their corporate jets and golden parachutes.”

The same mindset has infected far greater swathes of society than during Gekko’s day. Whether it’s welfare at the top or bottom, it’s handed out without accountability or merit.

But the people have had enough

The limits of entitlement-driven policymaking are becoming increasingly visible.

In Australia, the US and UK, systemic fraud in welfare programs is topping the daily news. The rather troubling culture of elite CEOs and politicians is being exposed. Housing remains as unaffordable as it is poor quality. Immigration policy is under pressure. Wealth taxes are being debated. International institutions are facing funding scrutiny.

In Munich last week, US Secretary of State Marco Rubio gave a speech pointing out that we’ve abandoned the values that made the West great in the first place. He threatened that America’s alliances are made based on common values and not the other way around. Either Europe and Australia get their act together on things like free speech and economic dependence on geopolitical enemies, or they go it alone.

Trump’s recent speech at the World Economic Forum in Davos could’ve come straight out of the Wall Street script too. Indeed, Gekko made so many of the same points:

“America has become a second-rate power. Its trade deficit and its fiscal deficit are at nightmare proportions.”

US president Trump is demanding Europe pay for its own defence and its own drug innovation rather than riding on the US’ coat tails. And then criticising the source of their medicines and national security for greed…

Trump is also busy appealing to the greed of voters. He wants to unlock a vast horde of wealth that’s been kept under lock and key by past presidents. His decision to repeal the designation of greenhouse gases as harmful is the starting gun for a rush into resources the world hasn’t seen since the California gold rush.

Governments don’t stop instability, they cause it

Governments control natural resource supply. They permit mines and wells. As well as setting tax policy above and beyond what applies to non-natural resource companies.

This uncertainty is part of what makes commodity prices so unstable. And that’s what makes resources investing so profitable for those who understand geopolitics.

Political risk can pull vast swathes of global mine supply off-line with the swoop of a heavily armed helicopter.

Governments can flood markets with new supply by permitting more, as the US did with its shale oil and gas boom. Or they can throttle production by forming cartels like OPEC.

They can permit fracking or announce moratoriums that make them dependent on the likes of Russia and Qatar.

If the world wakes up to the power of greed, as America is calling for, and decides to produce its own resources in the name of national security, we could see a truly vast commodities boom. One that has already begun in the US. Which investors should be positioned to potentially profit from. Here’s how.

Until next time,

Nick Hubble

Editor at Large, Investor’s Daily

P.S. When governments start redrawing the rules of trade, energy, and capital flows, markets don’t respond politely. They reprice — fast.

The shifts we’re seeing right now aren’t short-term noise. They’re structural. And structural changes create the biggest, most asymmetric opportunities… for those who are positioned before the crowd catches on. Learn everything you need to know in this briefing now.