Many books and articles claim to reveal the habits of millionaires. Most rely on studies that compare groups of people over decades and draw tidy conclusions from messy lives. I don’t find that approach useful.

Many books and articles claim to reveal the habits of millionaires. Most rely on studies that compare groups of people over decades and draw tidy conclusions from messy lives. I don’t find that approach useful.

I trust experience more than aggregation.

I’ve made and lost millions multiple times. Luck may explain one success. It cannot explain four. Each time, I started from zero. Each time, I rebuilt. I can trace exactly how it happened, what worked, and what failed.

What follows reflects that experience. Some of these points describe habits. Others describe context. All of them mattered.

A note before we begin

This is not a formula. Markets change. Technology changes. People do not. These principles hold because they rely on behaviour, not trends.

1. Develop a Clear Vision

Early in my career, I believed that every company would eventually need a website. At the time, very few people agreed.

I had no formal business experience. I had read biographies of entrepreneurs, but books only point the way. Experience teaches direction.

Vision mattered more than experience at the start. A strong view of the near and medium-term future gave me something to act on, even before I understood how to execute well.

To develop vision, I did one thing consistently. Every day, I wrote down ten ideas about what I thought would happen next. I questioned each idea. I tested it against reality. I asked why it might fail.

Vision requires discipline. Without it, you risk falling in love with your own ideas.

2. Communicate Relentlessly

Once I formed that view, I shared it constantly.

I told restaurants, artists, schools, small shops, and large companies that they needed a website. I talked about it because I believed it and because belief spreads through repetition.

I built my own website and posted a short story. When someone from Sweden emailed to say he had read it, I understood the scale of what was coming. The internet connected people in ways no previous medium had.

Eventually, people asked me to build websites for them. First a diamond dealer. Then a shoe company. Then larger firms. That led to major contracts with companies like American Express and film studios.

Opportunity followed communication.

3. Learn the Entire Stack

At the time, no manuals explained how to build websites. I learned by doing.

I studied HTML, ran my own servers, learned programming languages, and understood how networks worked. I read the original code written by Tim Berners-Lee. I learned how files compressed, how payments processed, how media moved across systems.

Today, tools abstract much of that complexity. Back then, understanding fundamentals created leverage.

Learning deeply gave me confidence and independence. It also made me harder to replace.

4. Participate in the Ecosystem

I knew every other company working in our space. There were only a few in New York.

I met competitors for lunch. We shared ideas. We collaborated when it made sense. We respected each other because we were building something new together.

When an industry expands fast enough, cooperation matters more than rivalry. Strong ecosystems lift all participants.

Many of those relationships still matter decades later.

Build your scene. It will carry you further than any single transaction.

5. Minimise Risk

I did not quit my job immediately. I waited eighteen months. By then, the company had employees and revenue. I wanted stability before commitment.

I reduced risk by diversifying clients and services. We avoided dependence on any single source of income. We tested new ideas constantly.

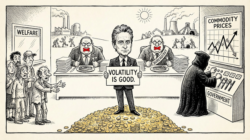

People associate wealth with risk-taking. My experience taught the opposite lesson. Millionaires manage risk. Non-millionaires gamble.

6. Prioritise Profitability

I ran a service business. We did work. Clients paid. Each project made money.

Investors approached us. We declined. Profitability gave us control.

In hindsight, I recognise that better capital strategy might have produced greater scale. At the time, profitability gave peace of mind.

In most cases, steady profit beats rapid growth funded by leverage.

7. Choose People Carefully

My business partner was my sister. I trusted her completely.

I hired people I liked and respected. We worked hard, but we enjoyed the work. Many of those relationships remain close decades later.

When partnerships felt wrong, stress increased and performance suffered. We exited those relationships quickly.

Business consists largely of conversations about people. Choose well.

8. Follow Up Consistently

I missed opportunities by failing to follow up. One major bank expressed strong interest. I never called back. The deal died.

A competitor once told me how a single returned call led to a major contract. His lesson stuck with me.

Good business requires responsiveness. Relationships decay without attention.

9. Set High Expectations and Deliver More

I set ambitious expectations for clients and myself. I aimed to exceed them.

That approach demands belief in your work and willingness to endure discomfort. It works best when you care deeply about what you do.

Clients remember effort. They return when trust forms.

10. Price for the Long Term

I often charged less than competitors. I valued relationships over margins early on.

Certain projects attracted talent and future clients. They paid dividends later.

Money follows vision when vision stays consistent.

11. Keep Employees Engaged

I wanted employees to enjoy their work and grow.

I encouraged creativity and autonomy. I discussed long-term paths openly. Many former employees went on to build successful careers and businesses.

Helping others succeed compounds over time.

12. Always Create Value

Selling does not mean extracting. It means helping.

The strongest business relationships persist because both sides benefit. Years later, many of the people I worked with still reach out. That continuity defines success more than any single exit.

What I Learned the Hard Way

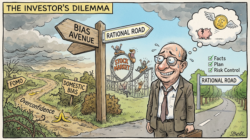

I learned too late that wealth involves three skills: making money, keeping it, and growing it. I initially focused on only one.

Burnout followed. Business demands constant engagement. I underestimated the psychological toll.

I also learned that passion matters. I shifted industries quickly and gained knowledge, but I lost joy. In hindsight, I would have stayed longer where curiosity pulled me naturally.

Final Thought

Money rewards applied passion guided by discipline.

Experience teaches faster than theory. Relationships outlast strategies. Risk management matters more than bravado.

The first million taught me these lessons. The next ones built on them.

Maybe I’ll write about those another time.

Best,

James Altucher

Contributing Editor, Investor’s Daily

P.S. Experience has taught me this: the real advantage comes before the moment everyone else starts paying attention. That’s why I put together a short briefing to go alongside this piece. It explains how I think about positioning early, managing risk, and recognising inflection points while they still look uncomfortable or unclear. If you’re serious about applying these lessons — not just reading them — watch the briefing before you make your next move.