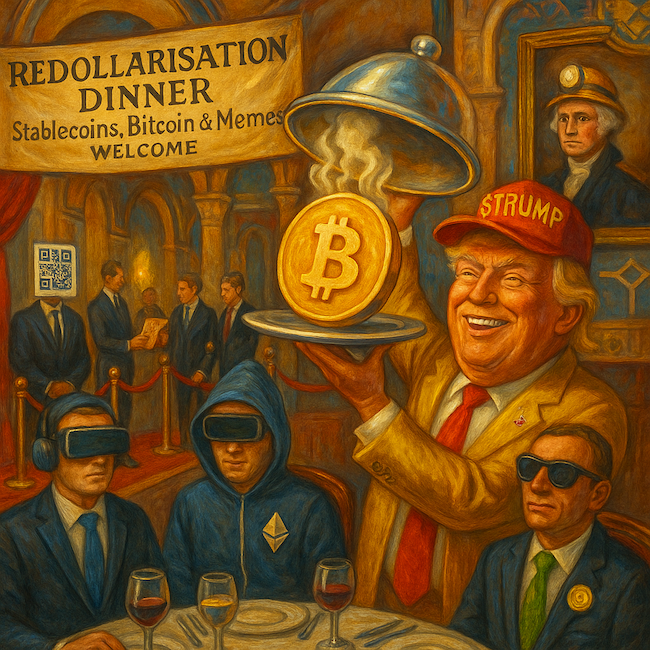

This week, something frankly absurd (on the face of it) is taking place in Washington.

This week, something frankly absurd (on the face of it) is taking place in Washington.

The top 220 holders of the $TRUMP token (a crypto memecoin based on Donald Trump) will be dining with the President at his golf club in D.C.

The top 25 holders will enjoy even greater access including a VIP reception and a private tour.

On the surface, it looks like a PR stunt, a bizarre blend of crypto speculation and political theatre. I’ve even seen mainstream news reports calling it “grotesque”

That’s a bit much, I think.

But if you’ve been around crypto a minute or two as I have, and you peel back the layers there’s a bigger story at play here. And it’s nothing to do with a memecoin, but the redollarisation of the US dollar.

The memecoin hook and stablecoin strategy

This isn’t about $TRUMP. It’s about what it opens the door to. And that’s a sweeping crypto-centric vision that could shape U.S. economic power for the next decade.

I don’t think it’s any surprise to you that the US dollar is probably the weakest in terms of geopolitical power that it’s ever been.

Trump is aware of that. Everyone is aware of that. And in order for the US to remain a global superpower, it can’t remain like that.

Hence, he needs to fix it. But it is no quick fix. And you can’t just apply traditional financial thinking in order to reverse course.

You need to think and act outside the box. And I believe that’s exactly what’s taking place, with President Trump as the face of it, but very much driven by Howard Lutnick, David Sacks and Scott Bessent.

It involves memecoins, stablecoins, and strategic bitcoin alignment adding together as a deliberate redollarisation strategy, powered by crypto rails and secured by bitcoin.

Dismiss the dinner if you must. But if you’re a serious investor this is the moment to pay attention.

The $TRUMP token isn’t the strategy. It’s the bait.

It’s the cultural front-end that draws in big money, powerful allies, builds visibility, and sends legacy media and financial elites into an utter headspin of disbelief.

As we’re seeing right before our eyes, Trump isn’t the old-guard Republican waving a red hat (at least not the public facing side of him). He’s the only presidential contender actively engaging the digital economy in a language it understands (and has the right people nudging him to the right positions to make it happen).

But the question remains, how does a coordinated plan to re-establish the U.S. dollar as the dominant trade currency for the next digital age play out off the back of a memecoin power dinner?

Here’s how I see the plan taking shape…

1. AI alignment with the Middle East to bypass China

Trump’s pivot towards the Gulf States is about more than military or energy. It’s about AI supply chains, it’s about information, and energy – AI energy.

As U.S. chip firms like Nvidia and AMD face export limitations to China, Trump’s camp is redirecting AI hardware and software flows to Middle Eastern allies.

Why? Because in Trump’s world, you don’t beat China through tariffs and a “who’s economy is bigger” contest, you beat them by building an alternate stack. AI infrastructure, plus trade, plus data, exported to friendly regimes.

It’s initially a soft-power play that pulls in Middle East capital (as I wrote about last week) but also opens them up to a friendly digital asset system too, which we already know the Middle East is very progressive with.

2. Stablecoins as programmable trade dollars

Once those AI deals and capital are flowing, you need a settlement layer. That’s where stablecoins come in.

Expect the Trump administration to push regulatory clarity around U.S. dollar-backed stablecoins, and not just for domestic use. The goal is to embed stablecoins into real-world trade, particularly through AI-driven supply contracts and digital commerce agreements. They’re building frameworks for an entire digital economy, with digital assets as the primary settlement layer.

Programmable stablecoins (not CBDCs – albeit pretty close to it) sanctioned by Washington, flowing through API-enabled contracts tied to global trade. This is how you redollarise the world without tanks, without SWIFT, and without asking permission.

You simply use the already thriving crypto ecosystem.

And once the U.S. establishes those digital corridors with the Middle East? The EU, the UK, and Asia will have no choice but to integrate. You can’t deny the huge wave of capital that involves. Just as the petrodollar became the global default in the 1970s, this new “smartdollar” could do the same in the 2020s and 2030s.

3. Bitcoin as the strategic collateral base

What’s also key here is to understand that behind it all will be the Strategic Bitcoin Reserve.

No, not on the Fed’s balance sheet. Not as a formal currency. But as a sovereign-grade asset held like gold in Fort Knox (has anyone checked yet to see if it’s all there?_

Neutral, auditable, on-chain and outside the reach of political gamesmanship.

Bitcoin, a million bitcoin (or more) becomes the backstop to the stablecoin ecosystem. U.S. stablecoins, widely exported, find their ultimate assurance not in Treasury bonds, but in bitcoin and bitcoin backed securities as a reserve anchor — the digital gold standard for a stablecoin, programmable US dollar empire.

This isn’t hypothetical. Trump’s allies have already begun whispering about a budget-neutral way to accumulate strategic BTC reserves. And we know that stablecoin legislation is working its way through the legislative system.

Expect to see a lot of this play out this year.

Why this matters for UK investors

You might think this is all a uniquely American phenomenon, a populist crypto sideshow unlikely to cross the Atlantic.

Think again.

If the U.S. locks in this trifecta,

- Digital trade corridors with the Middle East with AI as the headline,

- US dollar stablecoins in global supply chains to solidify digital trade,

- Bitcoin as the strategic backing behind it all

It creates a monetary pressure the UK and Europe cannot ignore.

I think there’s a geopolitical reshuffle happening, and crypto is the tool enabling it.

In this context, bitcoin is no longer a speculative asset. It’s a base layer, the incoming idea of a “bitcoin standard” is not fringe, it’s a serious investment thesis that cannot be ignored any longer by doubters.

So, I ask plainly and simply, if you still have zero exposure to bitcoin, or crypto in your portfolio, what exactly are you waiting for?

We now have:

- Bitcoin in ETF wrappers run by the world’s largest traditional financial institutes

- Stablecoin networks transacting billions daily, instantly, borderless and low cost

- Sovereign states aligning crypto with trade strategy and taking this seriously

- Corporations around the world adopting bitcoin as a treasury and defensive asset

- And a potential U.S. president making it part of his economic doctrine

Yet many still think this is all going to zero?

If you’re in that camp, I’d love to hear your rationale for it. I’m not saying I’m right and you’re wrong…actually maybe I am. But still, I would love to hear a rational reason as to why someone wouldn’t include bitcoin at a minimum as part of their long-term wealth strategy.

I do concede, that it’s still confusing and scary for some people, which is why I’m willing to help you understand the best I can. But some people hate gold, some hate stocks, some hate bonds, some hate my essays…you can’t win over everyone.

But let’s have a discussion if you think I’m WAY off the mark. Send any comments and feedback to me at

I do think it’s inevitable the U.S. adopts stablecoins, backed by bitcoin and bitcoin securities as their path to redollarisation.

And if I’m right, and they execute on this strategy, the question won’t be whether it’s adopted in the UK too, merely a question of how quickly Number 10 follows.

And if that happens, there’s no good reason I can conclude as to why you still wouldn’t want bitcoin in your portfolio.

Until next time,

Sam Volkering

Contributing Editor, Investor’s Daily

P.S. This isn’t just about a token. It’s about control. As the legacy system breaks under its own weight, a new one is being built in parallel—faster, leaner, and increasingly sovereign. Jim Rickards believes this shift is just beginning. He calls it American Birthright—a £150 trillion realignment of resources, capital, and power. His latest briefing shows what’s unfolding and how investors can position before the transition becomes irreversible.